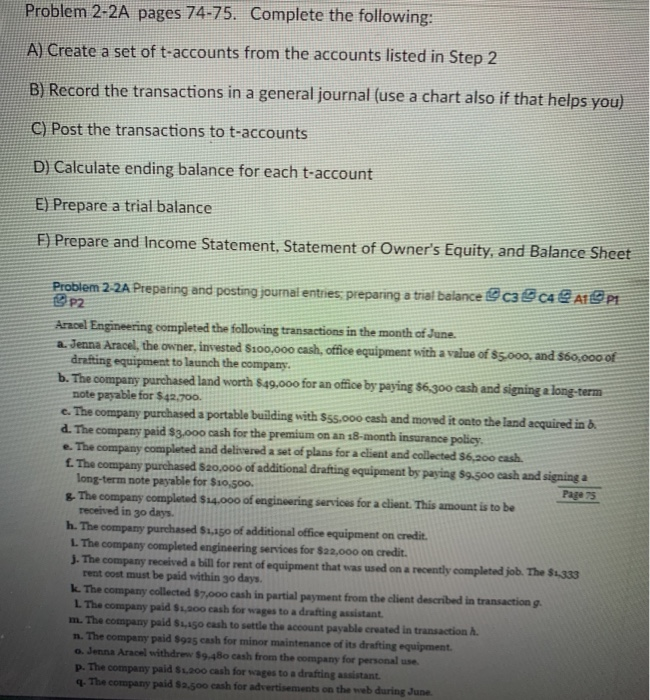

Problem 2-2A pages 74-75. Complete the following: A) Create a set of t-accounts from the accounts listed in Step 2 B) Record the transactions in a general journal (use a chart also if that helps you) C) Post the transactions to t-accounts D) Calculate ending balance for each t-account E) Prepare a trial balance F) Prepare and Income Statement, Statement of Owner's Equity, and Balance Sheet Problem 2-2A Preparing and posting journal entries, preparing a trial balance c39c42491 P2 Aracel Engineering completed the following transactions in the month of June. a. Jenna Aracel, the owner, invested $100.000 cash, office equipment with a value of $5.000, and $60,000 of drafting equipment to launch the company. b. The company purchased land worth $49,000 for an office by paying $6,300 cash and signing a long-term note pasable for $42.700. e. The company purchased a portable building with $55.000 cash and moved it onto the land acquired in b. d. The company paid $3.000 cash for the premium on an 18-month insurance policy, e. The company completed and delivered a set of plans for a client and collected 56,200 cash f. The company purchased $20,000 of additional drafting equipment by paying $9.500 cash and signing a long-term note payable for $10,500. Page 7 & The company completed $14,000 of engineering services for a client. This amount is to be received in 30 days. h. The company purchased $1,150 of additional office equipment on credit. 1. The company completed engineering services for $22,000 on credit. J. The company received a bill for rent of equipment that was used on a recently completed job. The $1.333 rent cost must be paid within 30 days. k. The company collected $7,000 cash in partial payment from the client described in transaction g. 1 The company paid $.00 cash for wages to a drafting assistant m. The company paid $1,150 cash to settle the account payable created in transaction h. n. The company paid $995 cash for minor maintenance of its drafting equipment. ..Jenna Aracel withdrew $9.480 cash from the company for personal use. p. The company paid $1.200 cash for wages to a drafting assistant 4. The company paid $2.500 cash for advertisements on the web during June Problem 2-2A pages 74-75. Complete the following: A) Create a set of t-accounts from the accounts listed in Step 2 B) Record the transactions in a general journal (use a chart also if that helps you) C) Post the transactions to t-accounts D) Calculate ending balance for each t-account E) Prepare a trial balance F) Prepare and Income Statement, Statement of Owner's Equity, and Balance Sheet Problem 2-2A Preparing and posting journal entries, preparing a trial balance c39c42491 P2 Aracel Engineering completed the following transactions in the month of June. a. Jenna Aracel, the owner, invested $100.000 cash, office equipment with a value of $5.000, and $60,000 of drafting equipment to launch the company. b. The company purchased land worth $49,000 for an office by paying $6,300 cash and signing a long-term note pasable for $42.700. e. The company purchased a portable building with $55.000 cash and moved it onto the land acquired in b. d. The company paid $3.000 cash for the premium on an 18-month insurance policy, e. The company completed and delivered a set of plans for a client and collected 56,200 cash f. The company purchased $20,000 of additional drafting equipment by paying $9.500 cash and signing a long-term note payable for $10,500. Page 7 & The company completed $14,000 of engineering services for a client. This amount is to be received in 30 days. h. The company purchased $1,150 of additional office equipment on credit. 1. The company completed engineering services for $22,000 on credit. J. The company received a bill for rent of equipment that was used on a recently completed job. The $1.333 rent cost must be paid within 30 days. k. The company collected $7,000 cash in partial payment from the client described in transaction g. 1 The company paid $.00 cash for wages to a drafting assistant m. The company paid $1,150 cash to settle the account payable created in transaction h. n. The company paid $995 cash for minor maintenance of its drafting equipment. ..Jenna Aracel withdrew $9.480 cash from the company for personal use. p. The company paid $1.200 cash for wages to a drafting assistant 4. The company paid $2.500 cash for advertisements on the web during June