Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 2-2A Posting journal entries to T-accounts LO5 Tobias Eaden started a sole proprietorship named Sky High Ads. A customer's message can be displayed on

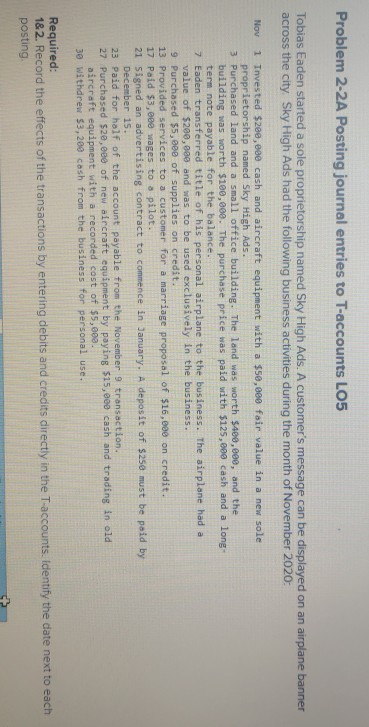

Problem 2-2A Posting journal entries to T-accounts LO5 Tobias Eaden started a sole proprietorship named Sky High Ads. A customer's message can be displayed on an airplane banner across the city, Sky High Ads had the following business activities during the month of November 2020: Nov 1 Invested $200,000 cash and aircraft equipment with a $50,000 fair value in a new sole proprietorship named Sky High Ads 3 Purchased land and a small office building. The land was worth $400,000, and the building was worth $100,000. The purchase price was paid with $125,000 cash and a long term note payable for the balance. 7 Eaden transferred title of his personal airplane to the business. The airplane had a value of $200,000 and was to be used exclusively in the business. 9. Purchased $5,000 of supplies on credit. 13 Provided services to a customer for a marriage proposal of $16,000 on credit. 17 Paid $3,000 wages to a pilot. 21 Signed an advertising contract to commence in January. A deposit of $250 must be paid by December 15. 23 Paid for half of the account payable from the November 9 transaction. 27 Purchased $20,000 of new aircraft equipment by paying $15,000 cash and trading in old aircraft equipment with a recorded cost of $5,000. 30 Withdrew $3,200 cash from the business for personal use. Required: 1&2. Record the effects of the transactions by entering debits and credits directly in the T-accounts. Identify the date next to each posting Problem 2-2A Posting journal entries to T-accounts LO5 Tobias Eaden started a sole proprietorship named Sky High Ads. A customer's message can be displayed on an airplane banner across the city, Sky High Ads had the following business activities during the month of November 2020: Nov 1 Invested $200,000 cash and aircraft equipment with a $50,000 fair value in a new sole proprietorship named Sky High Ads 3 Purchased land and a small office building. The land was worth $400,000, and the building was worth $100,000. The purchase price was paid with $125,000 cash and a long term note payable for the balance. 7 Eaden transferred title of his personal airplane to the business. The airplane had a value of $200,000 and was to be used exclusively in the business. 9. Purchased $5,000 of supplies on credit. 13 Provided services to a customer for a marriage proposal of $16,000 on credit. 17 Paid $3,000 wages to a pilot. 21 Signed an advertising contract to commence in January. A deposit of $250 must be paid by December 15. 23 Paid for half of the account payable from the November 9 transaction. 27 Purchased $20,000 of new aircraft equipment by paying $15,000 cash and trading in old aircraft equipment with a recorded cost of $5,000. 30 Withdrew $3,200 cash from the business for personal use. Required: 1&2. Record the effects of the transactions by entering debits and credits directly in the T-accounts. Identify the date next to each posting

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started