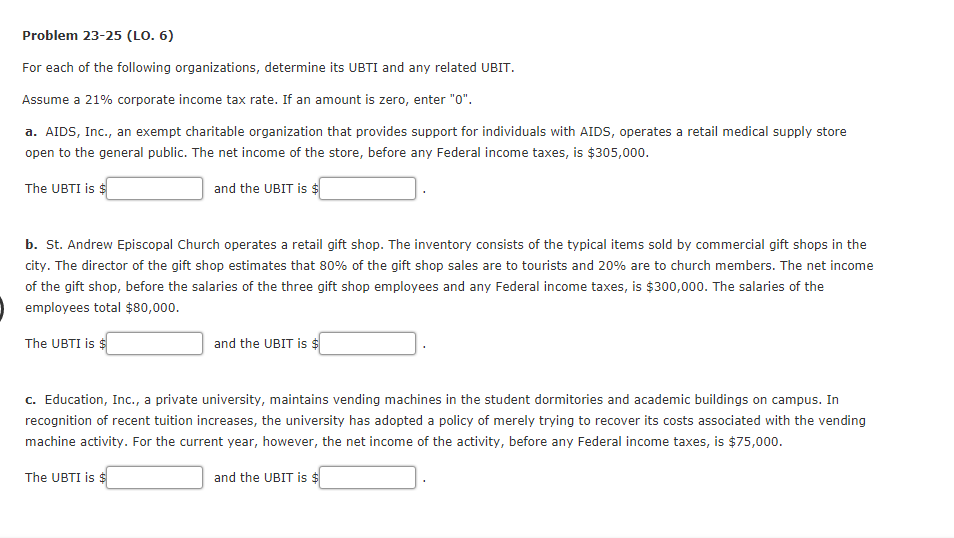

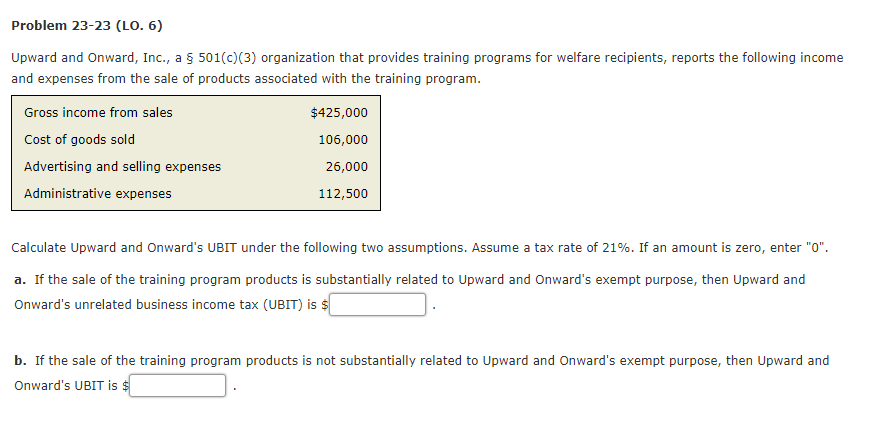

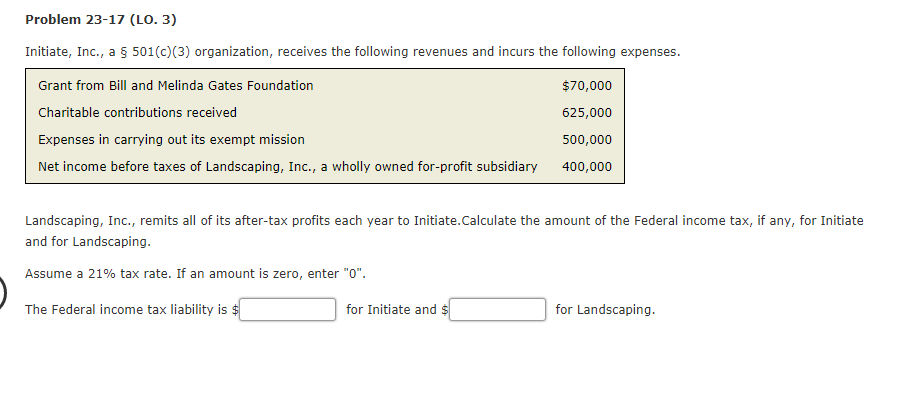

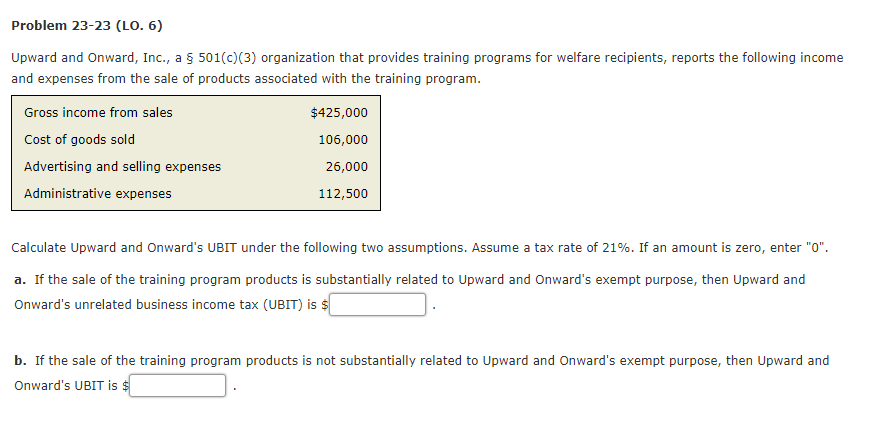

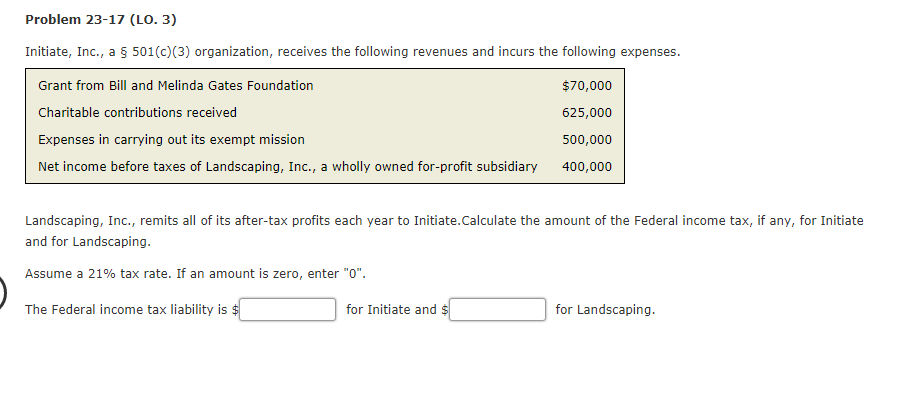

Problem 23-25 (LO. 6) For each of the following organizations, determine its UBTI and any related UBIT. Assume a 21% corporate income tax rate. If an amount is zero, enter "0" a. AIDS, Inc., an exempt charitable organization that provides support for individuals with AIDS, operates a retail medical supply store open to the general public. The net income of the store, before any Federal income taxes, is $305,000. and the UBIT is $ The UBTI is $ b. St. Andrew Episcopal Church operates a retail gift shop. The inventory consists of the typical items sold by commercial gift shops in the city. The director of the gift shop estimates that 80% of the gift shop sales are to tourists and 20% are to church members. The net income of the gift shop, before the salaries of the three gift shop employees and any Federal income taxes, is $300,000. The salaries of the employees total $80,000. and the UBIT is $ The UBTI is $ Education, Inc., a private university, maintains vending machines in the student dormitories and academic buildings on campus. In C. recognition of recent tuition increases, the university has adopted a policy of merely trying to recover its costs associated with the vending machine activity. For the current year, however, the net income of the activity, before any Federal income taxes, is $75,000 and the UBIT is $ The UBTI is $ Problem 23-23 (LO. 6) Upward and Onward, Inc., a 501(c)(3) organization that provides training programs for welfare recipients, reports the following income and expenses from the sale of products associated with the training program. Gross income from sales $425,000 Cost of goods sold 106,000 Advertising and selling expenses 26,000 Administrative expenses 112,500 Calculate Upward and Onward's UBIT under the following two assumptions. Assume a tax rate of 21%. If an amount is zero, enter "0" a. If the sale of the training program products is substantially related to Upward and Onward's exempt purpose, then Upward and Onward's unrelated business income tax (UBIT) is $ b. If the sale of the training program products is not substantially related to Upward and Onward's exempt purpose, then Upward and Onward's UBIT is $ Problem 23-17 (LO. 3) Initiate, Inc., a 501(c)(3) organization, receives the following revenues and incurs the following expenses. Grant from Bill and Melinda Gates Foundation $70,000 Charitable contributions received 625,000 Expenses in carrying out its exempt mission 500,000 Net income before taxes of Landscaping, Inc., wholly owned for-profit subsidiary 400,000 a Landscaping, Inc., remits all of its after-tax profits each year to Initiate.Calculate the amount of the Federal income tax, if any, for Initiate and for Landscaping. Assume a 21 % tax rate. If an amount is zero, enter "0" The Federal income tax liability is $ for Landscaping. for Initiate and