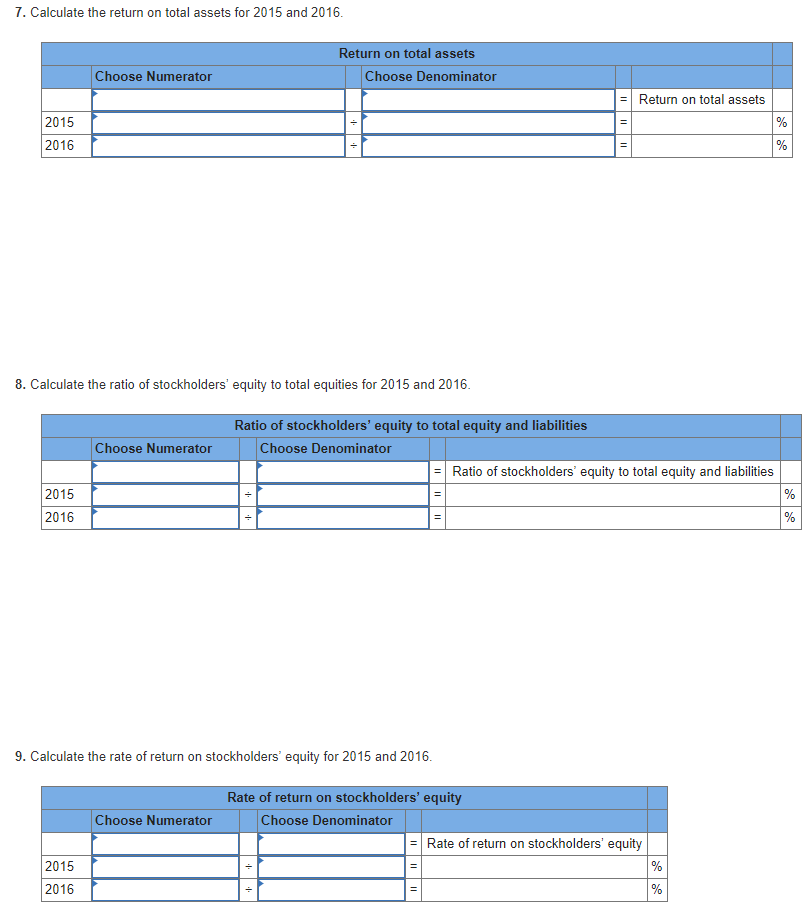

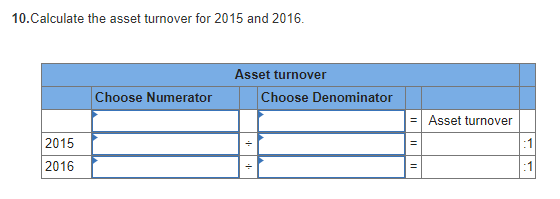

Problem 23.2A Computing financial ratios. LO 23-5, 23-6, 23-7

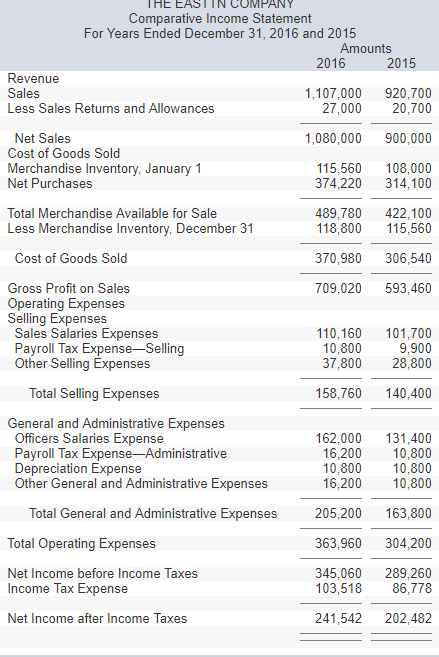

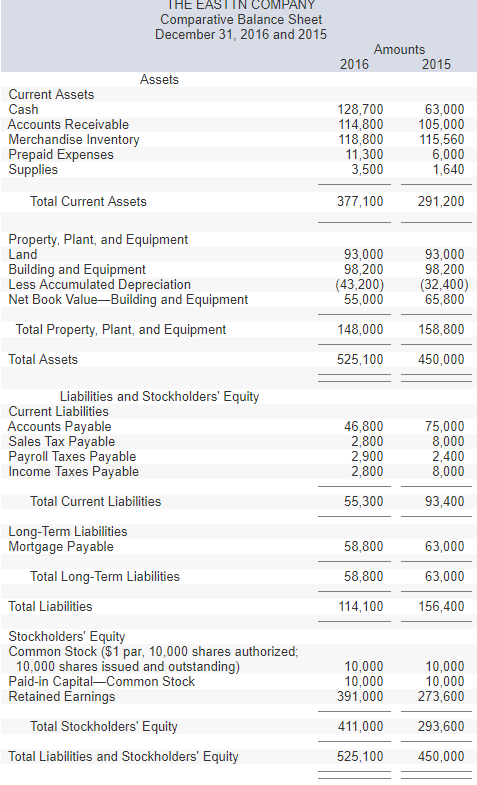

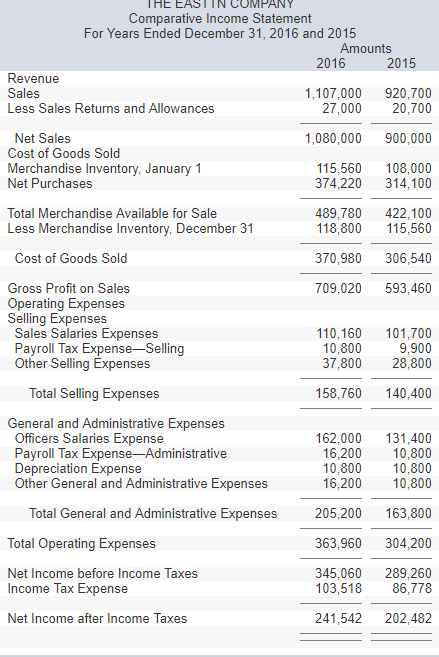

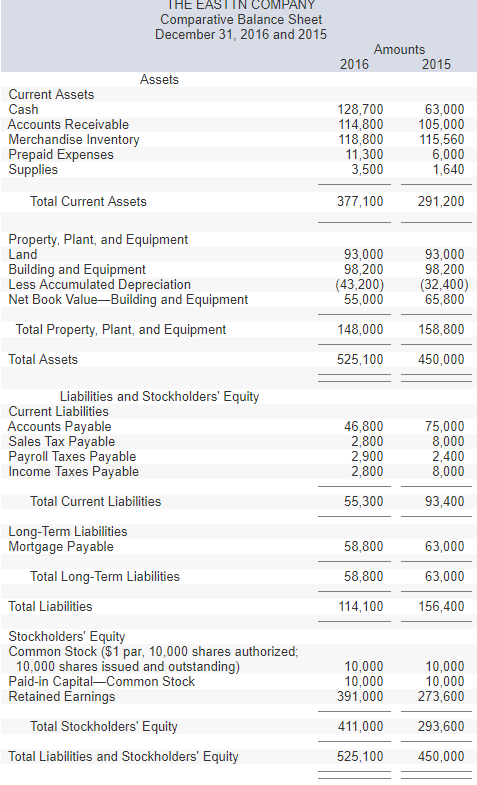

| The EastTN Company sells computer parts through a retail store that it operates. The firm's comparative income statement and balance sheet for the years 2016 and 2015 are shown below. |

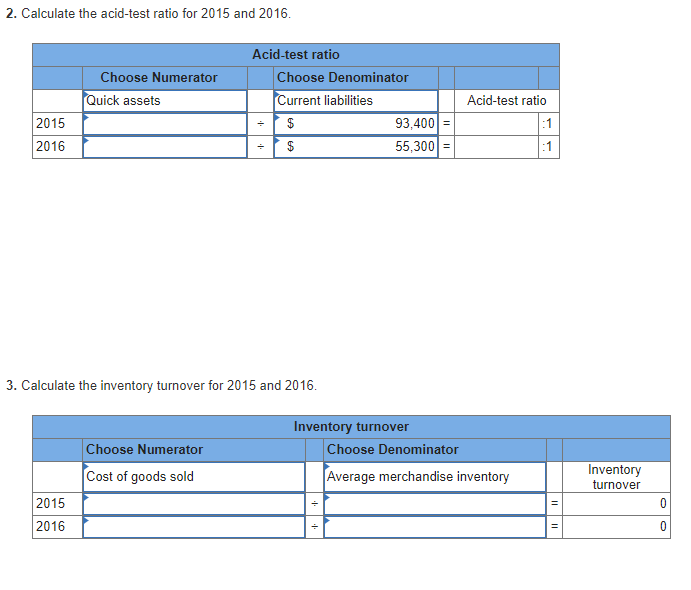

| Assume all sales are credit sales. |

| 1. | Calculate the current ratio for 2015 and 2016. |

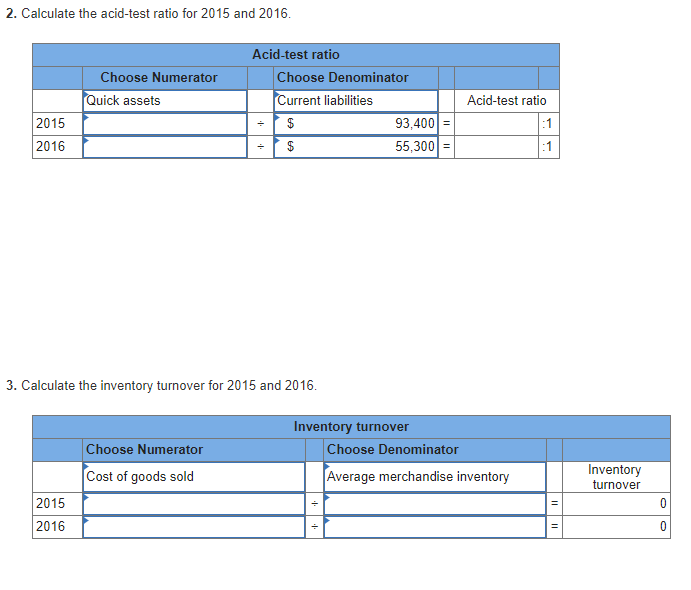

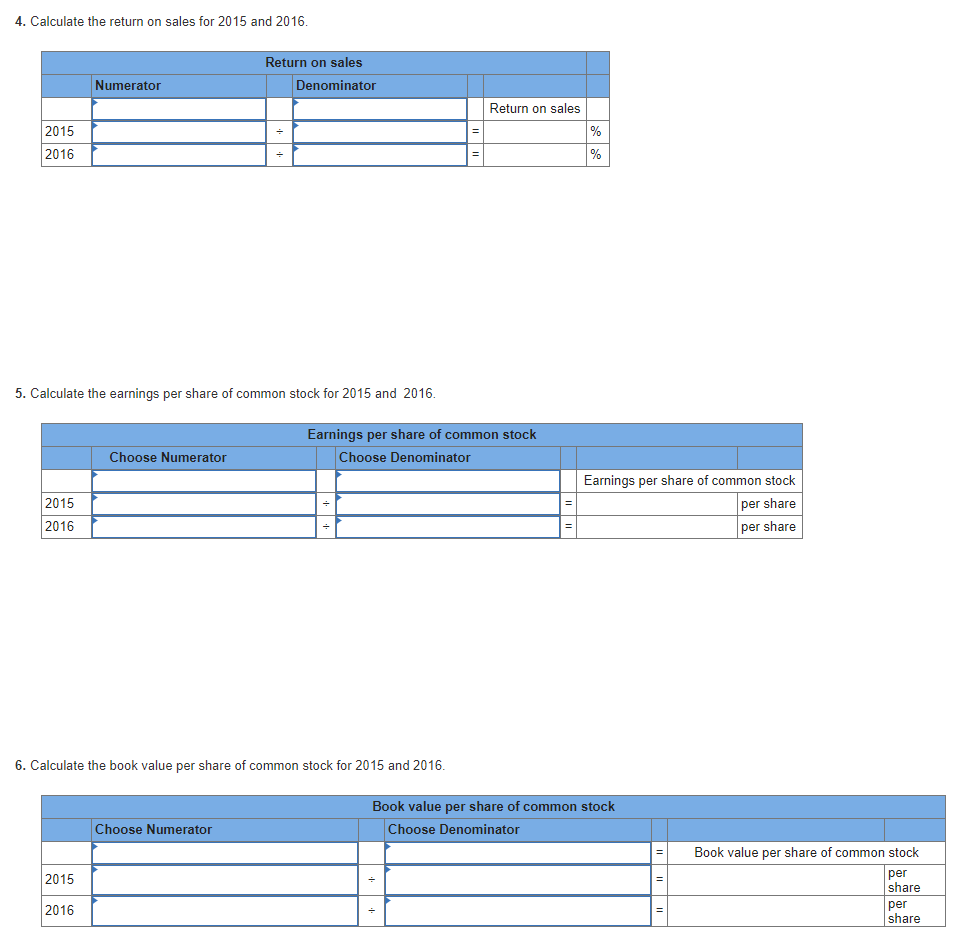

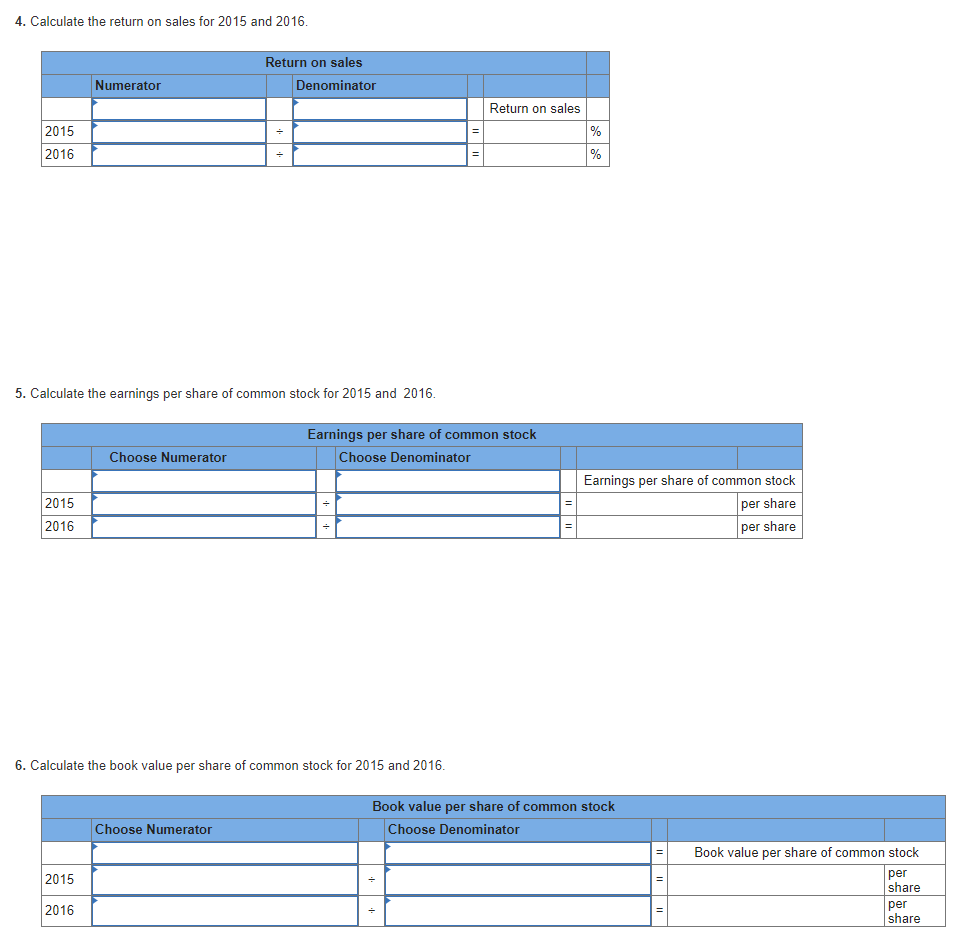

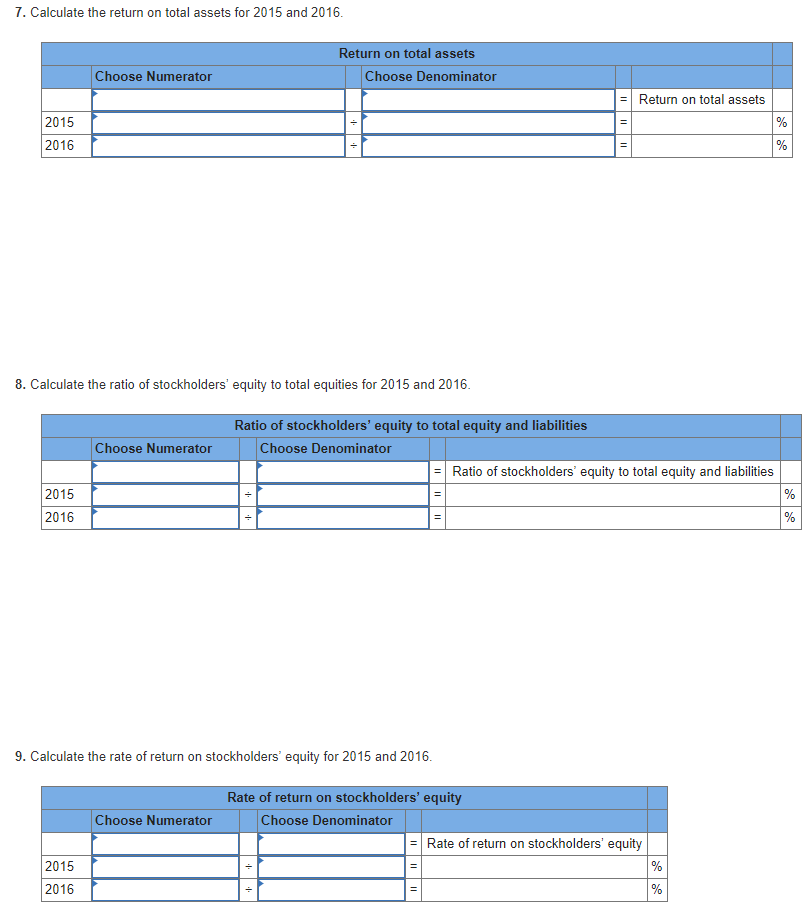

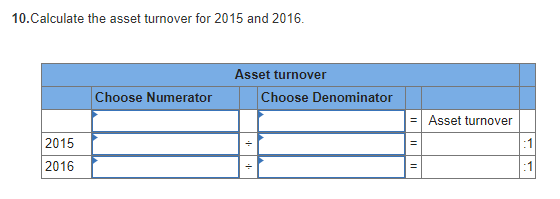

HE EASTIN COMPANY Comparative Income Statement For Years Ended December 31, 2016 and 2015 Amounts 2016 2015 Revenue Sales Less Sales Returns and Allowances 1,107,000 920,700 Net Sales Cost of Goods Sold Merchandise Inventory, January 1 Net Purchases 27,000 20,700 1,080,000 900,000 115.560 108,000 374,220 314,100 Total Merchandise Available for Sale Less Merchandise Inventory, December 31 489,780 422.100 118,800 115,560 370,980 306,540 709,020 593,460 Cost of Goods Sold Gross Profit on Sales Operating Expenses ling Expenses Sales Salaries Expenses Payroll Tax Expense-Selling Other Selling Expenses 110,160 101,700 9,900 37,800 28,800 10,800 Total Selling Expenses 158,760 140,400 General and Administrative Expenses Officers Salaries Expense Payroll Tax Expense-Administrative Depreciation Expense Other General and Administrative Expenses 162,000 131.400 16,200 10,800 10,800 16,200 10,800 10,800 Total General and Administrative Expenses Total Operating Expenses Net Income before Income Taxes 205,200 163,800 363,960 304,200 345,060 289,260 103,518 86,778 Income Tax Expense Net Income after Income Taxes 241,542 202,482 THE EASTIN COMPANY Comparative Balance Sheet December 31, 2016 and 2015 Amounts 2015 Assets Current Assets Cash Accounts Receivable Merchandise Inventory Prepaid Expenses Supplies 128,700 114,800 118,800 11,300 3,500 63,000 105,000 115,560 6,000 1,640 Total Current Assets 377,100 291,200 Property, Plant, and Equipment Land Building and Equipment Less Accumulated Depreciation Net Book Value-Building and Equipment 93,000 93,000 98,200 55,000 148,000 525,100 98,200 65,800 158,800 450,000 (43,200) (32,400) Total Property, Plant, and Equipment Total Assets Liabilities and Stockholders' Equity Currnt Liabilities Accounts Payable Sales Tax Payable Pavroll Taxes Pavable Income Taxes Pavable 46,800 2,800 2,900 2,800 75,000 8,000 2,400 8,000 55,300 58,800 58,800 114,100 Total Current Liabilities 93,400 Long-Term Liabilities Mortgage Payable Total Long-Term Liabilities otal Liabilities Stockholders' Equity 63,000 63,000 156,400 Common Stock ($1 par, 10,000 shares authorized; 10,000 shares issued and outstanding) Paid-in Capital-Common Stock Retained Earnings 10,000 10,000 391,000 273,600 10,000 10,000 Total Stockholders' Equity 411,000 293,600 Total Liabilities and Stockholders' Equity 525,100 450,000 2. Calculate the acid-test ratio for 2015 and 2016 Acid-test ratio Choose Numerator Choose Denominator Quick assets Current liabilities Acid-test ratio 93,400- 55,300- 2015 2016 3. Calculate the inventory turnover for 2015 and 2016. Inventory turnover Choose Numerator Choose Denominator Cost of goods sold Inventory turnover Average merchandise inventory 2015 2016 4. Calculate the return on sales for 2015 and 2016 Return on sales Numerator Denominator Return on sales 2015 2016 5. Calculate the earnings per share of common stock for 2015 and 2016 Earnings per share of common stock Choose Numerator Choose Denominator 2015 2016 Earnings per share of common stock per share per share 6. Calculate the book value per share of common stock for 2015 and 2016 Book value per share of common stock Choose Numerator Choose Denominator Book value per share of common stock per share 2015 per share 2016 .Calculate the return on total assets for 2015 and Return on total assets Choose Numerator Choose Denominator Return on total assets 2015 2016 8. Calculate the ratio of stockholders' equity to total equities for 2015 and 2016. Ratio of stockholders' equity to total equity and liabilities Choose Numerator Choose Denominator Ratio of stockholders' equity to total equity and liabilities 2015 2016 9. Calculate the rate of return on stockholders' equity for 2015 and 2016. Rate of return on stockholders' equity Choose Numerator Choose Denominator Rate of return on stockholders' equity 2015 2016 10.Calculate the asset turnover for 2015 and 2016 Asset turnover Choose Numerator Choose Denominator Asset turnover 2015 2016