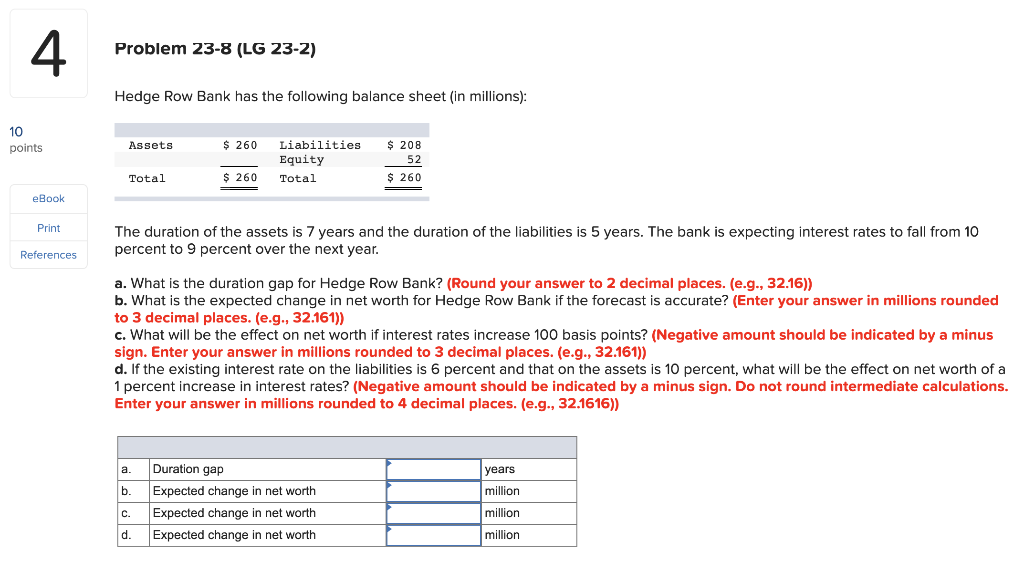

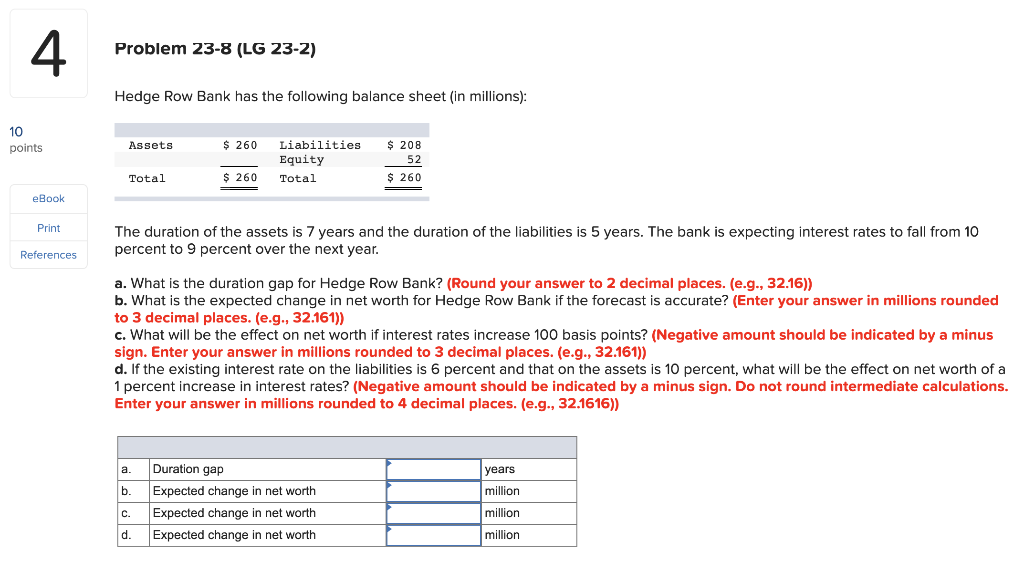

Problem 23-8 (LG 23-2) Hedge Row Bank has the following balance sheet (in millions): 10 points Assets $ 260 $ 208 Liabilities Equity Total 52 Total $ 260 $ 260 eBook Print The duration of the assets is 7 years and the duration of the liabilities is 5 years. The bank is expecting interest rates to fall from 10 percent to 9 percent over the next year. References a. What is the duration gap for Hedge Row Bank? (Round your answer to 2 decimal places. (e.g., 32.16)) b. What is the expected change in net worth for Hedge Row Bank if the forecast is accurate? (Enter your answer in millions rounded to 3 decimal places. (e.g., 32.161)) c. What will be the effect on net worth if interest rates increase 100 basis points? (Negative amount should be indicated by a minus sign. Enter your answer in millions rounded to 3 decimal places. (e.g., 32.161)) d. If the existing interest rate on the liabilities is 6 percent and that on the assets is 10 percent, what will be the effect on net worth of a 1 percent increase in interest rates? (Negative amount should be indicated by a minus sign. Do not round intermediate calculations. Enter your answer in millions rounded to 4 decimal places. (e.g., 32.1616)) a. years million Duration gap Expected change in net worth Expected change in net worth Expected change in net worth million million Problem 23-8 (LG 23-2) Hedge Row Bank has the following balance sheet (in millions): 10 points Assets $ 260 $ 208 Liabilities Equity Total 52 Total $ 260 $ 260 eBook Print The duration of the assets is 7 years and the duration of the liabilities is 5 years. The bank is expecting interest rates to fall from 10 percent to 9 percent over the next year. References a. What is the duration gap for Hedge Row Bank? (Round your answer to 2 decimal places. (e.g., 32.16)) b. What is the expected change in net worth for Hedge Row Bank if the forecast is accurate? (Enter your answer in millions rounded to 3 decimal places. (e.g., 32.161)) c. What will be the effect on net worth if interest rates increase 100 basis points? (Negative amount should be indicated by a minus sign. Enter your answer in millions rounded to 3 decimal places. (e.g., 32.161)) d. If the existing interest rate on the liabilities is 6 percent and that on the assets is 10 percent, what will be the effect on net worth of a 1 percent increase in interest rates? (Negative amount should be indicated by a minus sign. Do not round intermediate calculations. Enter your answer in millions rounded to 4 decimal places. (e.g., 32.1616)) a. years million Duration gap Expected change in net worth Expected change in net worth Expected change in net worth million million