Answered step by step

Verified Expert Solution

Question

1 Approved Answer

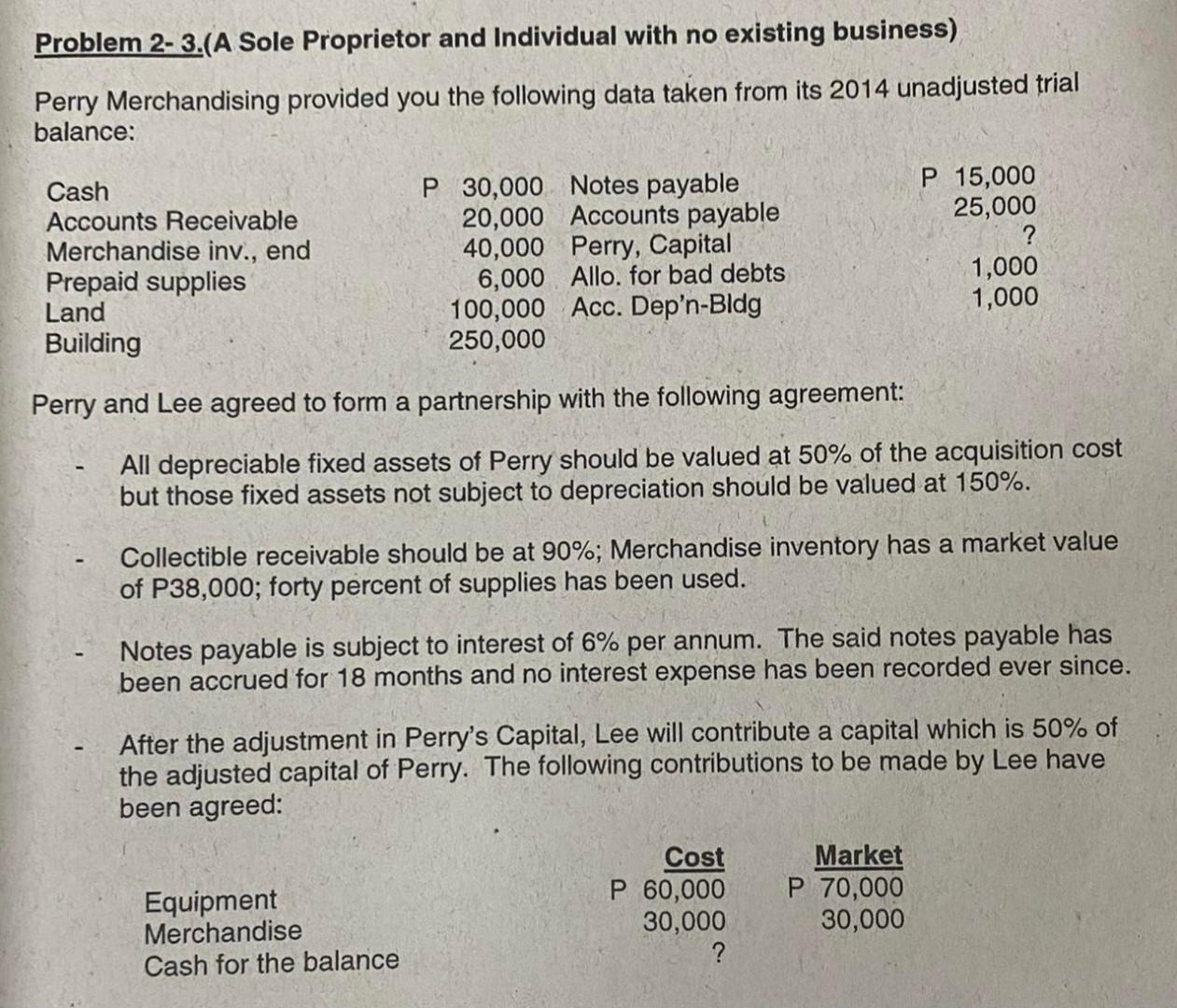

Problem 2-3.(A Sole Proprietor and Individual with no existing business) Perry Merchandising provided you the following data taken from its 2014 unadjusted trial balance: Perry

Problem 2-3.(A Sole Proprietor and Individual with no existing business) Perry Merchandising provided you the following data taken from its 2014 unadjusted trial balance: Perry and Lee agreed to form a partnership with the following agreement: - All depreciable fixed assets of Perry should be valued at 50% of the acquisition cost but those fixed assets not subject to depreciation should be valued at 150%. - Collectible receivable should be at 90%; Merchandise inventory has a market value of P38,000; forty percent of supplies has been used. - Notes payable is subject to interest of 6% per annum. The said notes payable has been accrued for 18 months and no interest expense has been recorded ever since. - After the adjustment in Perry's Capital, Lee will contribute a capital which is 50% of the adjusted capital of Perry. The following contributions to be made by Lee have been agreed: Required: 1. Compute for the unadjusted capital of Perry. 2. Adjusting entries in the proprietor's books. (Use simple entries) 3. Closing entries in the proprietor's books. 4. Opening entries in the books of partnership using two simple entries

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started