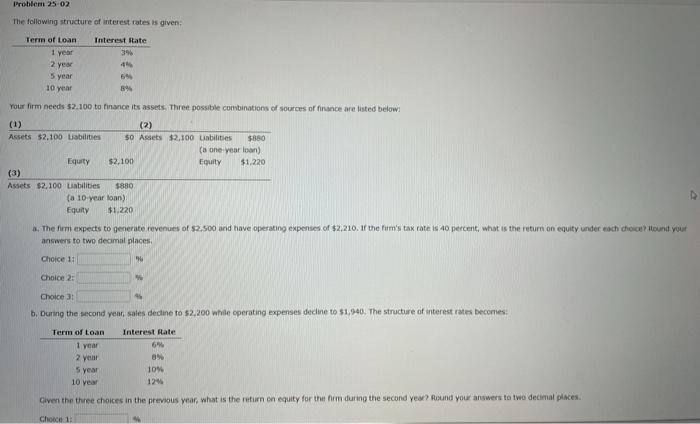

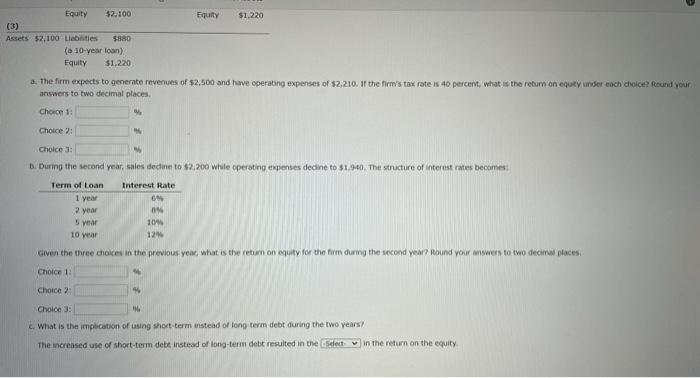

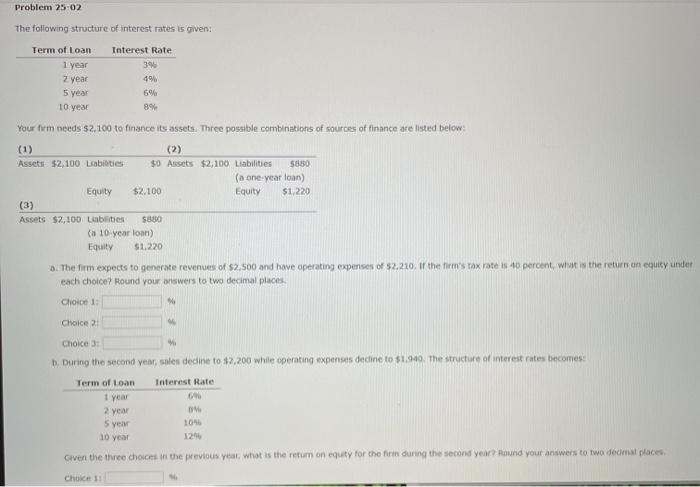

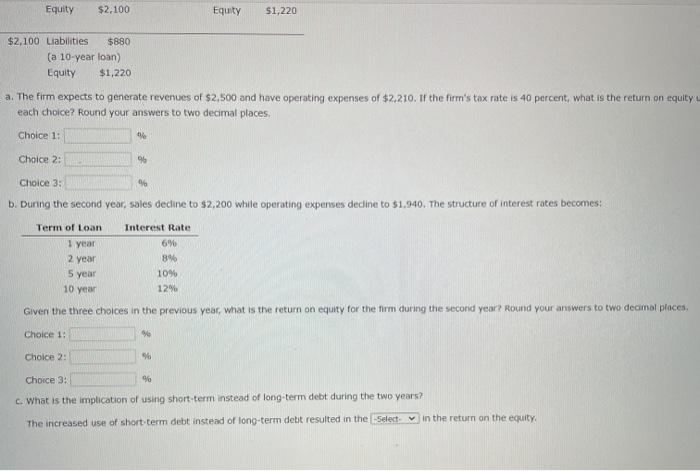

Problem 25-02 The following structure of interest rates is given Term of Loan Interest Rate 1 year 39 45 5 year 69 10 year 8% 2 year Your firm needs 52.100 to finance its assets. Three possible combinations of sources of finance are listed below (1) (2) Assets $2,100 abilities $0 Assets $2,100 Liabilities $850 (a one year loan) Equity $2.100 Equity $1.220 (3) Assets $2.100 Labilities $880 (a 10-year loan) Equity $1,220 . The firm expects to generate revenues of $2.500 and have operating expenses of $2,210. If the firm's tax rate is 40 percent, what is the return on equity under each choice?itound your answers to two decimal places Choice 11 HU Choice 2: 4 Choice3 b. During the second yes sales decline to $2,200 while operating expenses decline to $1,940. The structure of interest rates becomes Interest Rate Term of loan 1 year 2 year 5 year 8 10 12 10 Year Given the three choices in the previous year, what is the return on equity for the firm during the second yea? Round your answers to two decimal places Choice 1: Equity $2.100 Equity $1.220 (3) Assets 52.100 liabilities 5880 (10-year loan) Equity $1,220 2. The firm expects to generate revenues of $2,500 and have operating expenses of $2,210. If the firm's tax rate is 40 percent, what is the return on equty under each choice found your answers to two decimal places Choice 1: Choice 2: Choice 3 B. During the second year, sales decline to $2,200 while operating expenses dedine to $1.940. The structure of interest rates becomes Term of Loan Interest Rate 1 year 2 year 5 year 104 10 Year 12 cliven the three choices in the previous you what is the return on equity for the firm during the second year? Round your swers to two decimal places Choice1 Choice 2 Choice 3: What is the implication of using short-term instead of long-term debt during the two years The increased use of short-term debt instead of long-term debt resulted in the set in the return on the equity Problem 25-02 The following structure of interest rates is given Term of Loan Interest Rate 1 year 39 2 year 49 5 year 6% 10 year 89 Your firm needs $2,100 to finance its assets. Three possible combinations of sources of finance are listed below: (1) (2) Assets $2,100 Lisabilities $0 Assets $2,100 Liabilities $880 (a one year loon) Equity $2.100 Equity $1,220 (3) Assets $2,100 Labrities S880 (a 10-year lon) Equity $1,220 a. The firm expects to generate revenues of $2,500 and have operating expenses of $2,210, if the firm's tax rate : 40 percent, what is the return on equity under each choice Round your answers to two decimal places Choice1 Choice 21 Choice3 D. During the second year, sales dedine to $2,200 while operating expenses decline to $1.940. The structure of interest rates becomes Interest Rate Term of loan 1 year 2 year 5 ye 10 year 105 1296 Given the three choices in the previous yeat, what is the return on equity for the firm during the second year round your answers to two decimal places Choices Equity $2,100 Equity $1,220 $2,100 Liabilities $880 (a 10-year loan) Equity $1,220 a. The firm expects to generate revenues of $2.500 and have operating expenses of $2,210. If the firm's tax rate is 40 percent, what is the return on equity each choice? Round your answers to two decimal places Choice 1: Choice 2: 96 Choice 3: % b. During the second year, sales decline to $2,200 while operating expenses dedine to $1.940. The structure of interest rates becomes! Term of Loan 1 year 2 year 5 year 10 year Interest Rate 6% 8% 1096 1296 Given the three choices in the previous year, what is the return on equity for the firm during the second year Round your answers to two decimal places Choice 1: Choice 2: 90 Choice 3: 46 c. What is the implication of using short-term instead of long-term debt during the two years? The increased use of short-term debt instead of long-term debt resulted in the Select in the return on the equity