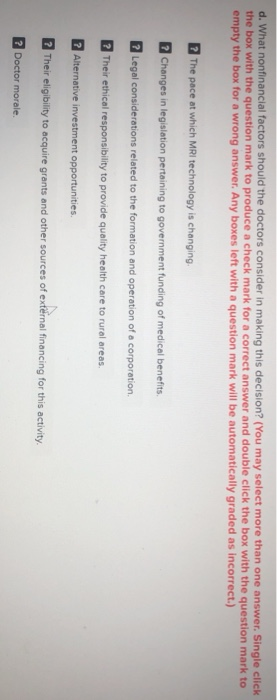

Problem 26.7A Considering Financial and Nonfinancial Factors (LO26-1, LO26-2, LO26-3, LO26-4) Doctors Hanson, Dominick, and Borchard are radiologists living in Fargo, North Dakota. They realize that many of the state's small rural hospitals cannot afford to purchase their own magnetic resonance imaging devices (MRIs). Thus, the doctors are considering whether it would be feasible for them to form a corporation and invest in their own mobile MRI unit. The unit would be transported on a scheduled basis to more than 100 rural hospitals using an 18-wheel tractor-trailer. The cost of a tractor-trailer equipped with MRI equipment is approximately $1,250,000. The estimated life of the investment is eight years, after which time its salvage value is expected to be no more than $100,000, The doctors anticipate that the investment will generate incremental revenue of $800,000 per year. Incremental expenses (which include depreciation, insurance, fuel, maintenance, their salaries, and income taxes) will average $700,000 per year. Net incremental cash flows will be reinvested back into the corporatidh. The only difference between incremental cash flows and incremental income is attributable to depreciation expense. The doctors require a minimum return on their investment of 12 percent. Required: a. Compute the payback period of the mobile MRI proposal. (Round your answer to 2 decimal places.) Payback period years b. Compute the return on average investment of the proposal (Round your percentage answer to 2 decimal places (i.e., 0.1234 should be considered as 12.34.)) Rotum on average investment % c. Compute the net present value of the proposal using the tables in Exhibits 26-3 and 26 4. (Round "PV Factor" to 3 decimal places, Intermediate and final answers to the nearest dollar amount.) Not present value d. What nonfinancial factors should the doctors consider in making this decision? (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect.) d. What nonfinancial factors should the doctors consider in making this decision? (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect.) The pace at which MRI technology is changing. Changes in legislation pertaining to government funding of medical benefits. Legal considerations related to the formation and operation of a corporation Their ethical responsibility to provide quality health care to rural areas. 7 Alternative investment opportunities. | Their eligibility to acquire grants and other sources of external financing for this activity. ? Doctor morale