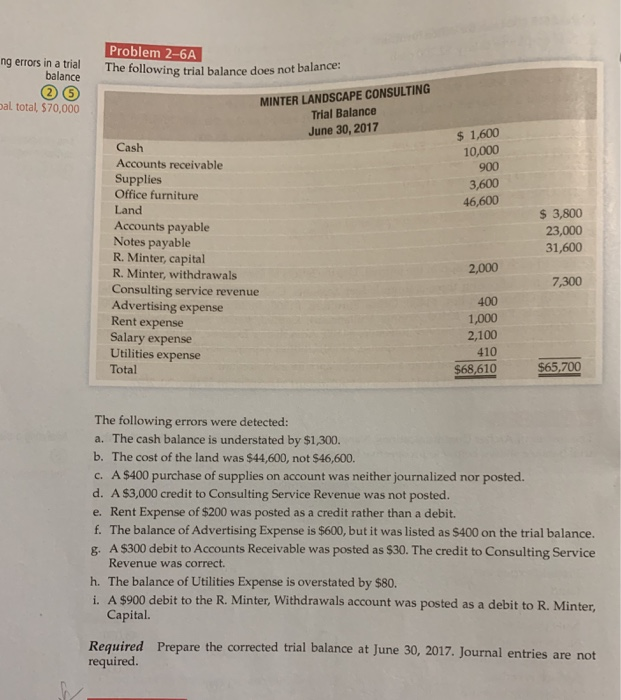

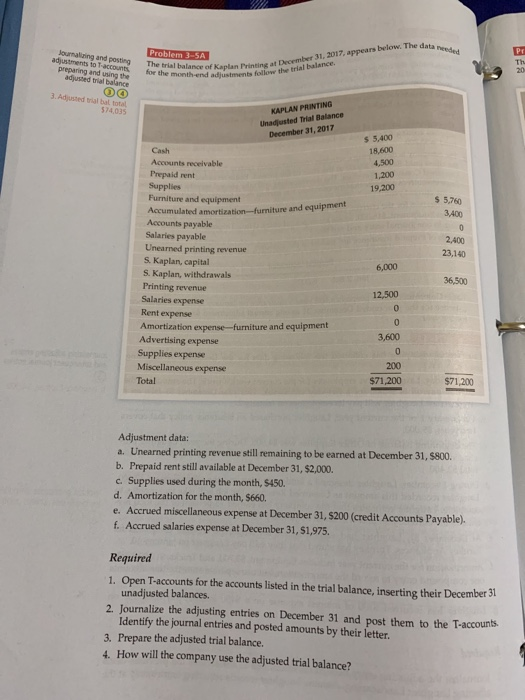

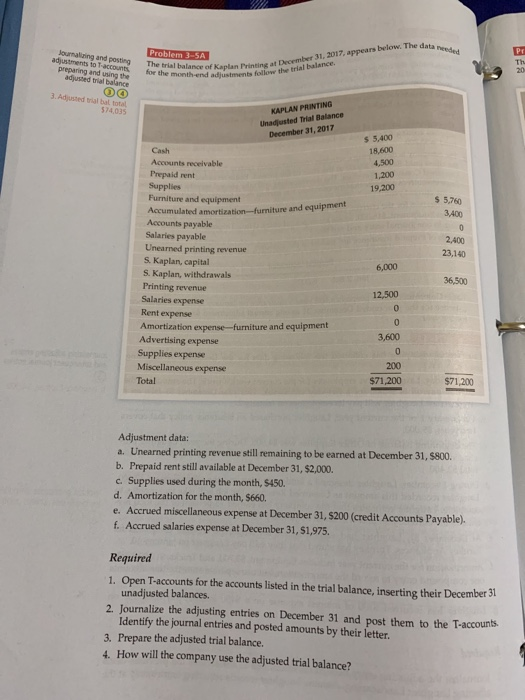

Problem 2-6A ng erros in a tial hellowingtrilbalance does not balance balance MINTER LANDSCAPE CONSULTING Trial Balance al total, $70,000 1,600 10,000 900 3,600 46,600 June 30, 2017 Cash Accounts receivable Supplies Office furniture Land Accounts payable Notes payable R. Minter, capital R. Minter, withdrawals Consulting service revenue Advertising expense Rent expense Salary expense Utilities expense Total 3,800 23,000 31,600 2,000 7,300 400 1,000 2,100 410 $68,610 $65,700 The following errors were detected: a. The cash balance is understated by $1,300. b. The cost of the land was $44,600, not $46,600. c. A $400 purchase of supplies on account was neither journalized nor posted. d. A $3,000 credit to Consulting Service Revenue was not posted e. Rent Expense of $200 was posted as a credit rather than a debit. f. The balance of Advertising Expense is $600, but it was listed as $400 on the trial balance. g. A $300 debit to Accounts Receivable was posted as $30. The credit to Consulting Service Revenue was correct. h. The balance of Utilities Expense is overstated by $80. i. A $900 debit to the R. Minter, Withdrawals account was posted as a debit to R. Minter Capital. Required Prepare the corrected required trial balance at June 30, 2017. Journal entries are not below. The data ournalizing and 1. 2017, appears below. The da Th The trial for the mont at December 31, 2017, a preparing and using the adjustments follow the trial balance 3. Adjusted trial bal total 74,035 KAPLAN PRINTING Unadjusted Trial Balance December 31, 2017 s 5,400 18,600 Accounts receivable Prepaid rent 1,200 Supplies 19,200 Furniture and equipment $ 5,760 Accumulated amortization-furniture and equipment Accounts payable Salaries payable Unearned printing revenue S. Kaplan, capital S. Kaplan, withdrawals Printing revenue Salaries expense Rent expense Amortization expense-furniture and equipment Advertising expense Supplies expense 2,400 23,140 6,000 36,500 12,500 3,600 200 Miscellaneous expense Total $71,200 $71,200 Adjustment data a. Unearned printing revenue still remaining to be earned at December 31, $800 b. Prepaid rent still available at December 31, $2,000. c. Supplies used during the month, S450. d. Amortization for the month, $660. e. Accrued miscellaneous expense at December 31, s200 (credit Accounts Payable). f. Accrued salaries expense at December 31, $1,975. Required 1. Open T-accounts for the accounts listed in the trial balance, inserting their December 31 unadjusted balances. 2. Journalize the adjusting entries on December 31 and post them to the T-accounts Identify the journal entries and posted amounts by their letter. 3. Prepare the adjusted trial balance. 4. How will the company use the adjusted trial balance