Answered step by step

Verified Expert Solution

Question

1 Approved Answer

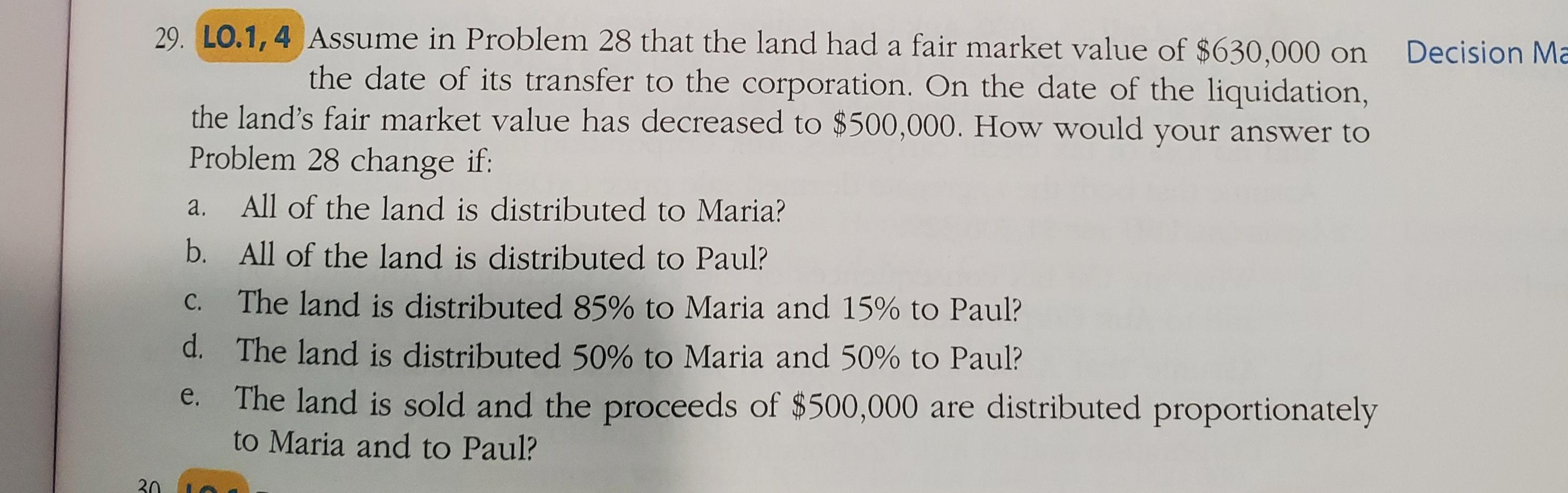

Problem 28 is only included for reference. Decision Ma a. 29. LO.1, 4 Assume in Problem 28 that the land had a fair market value

Problem 28 is only included for reference.

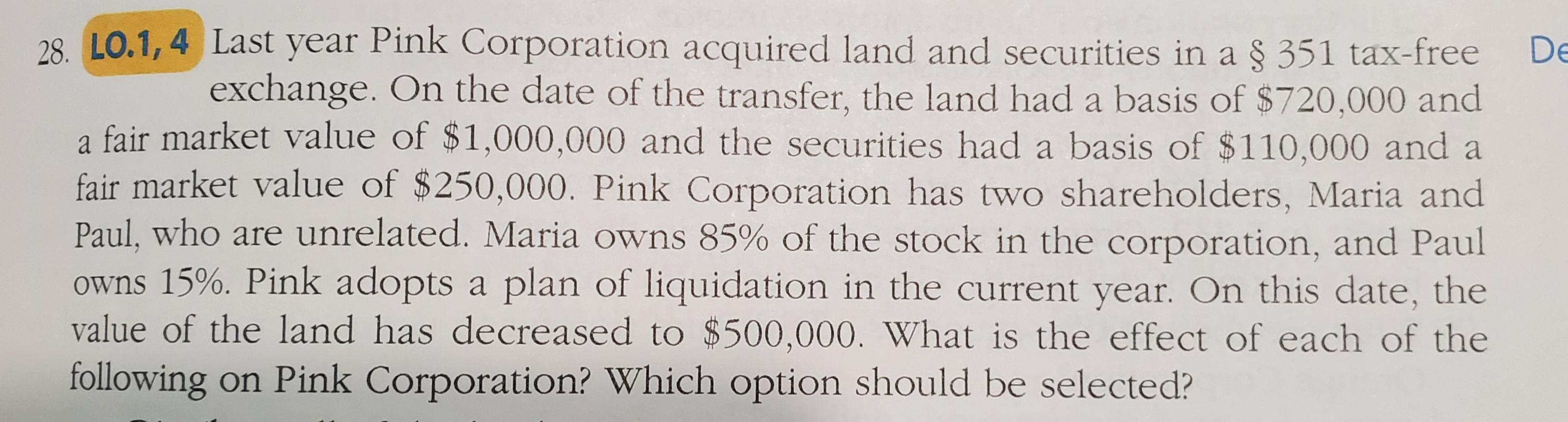

Decision Ma a. 29. LO.1, 4 Assume in Problem 28 that the land had a fair market value of $630,000 on the date of its transfer to the corporation. On the date of the liquidation, the land's fair market value has decreased to $500,000. How would your answer to Problem 28 change if: All of the land is distributed to Maria? b. All of the land is distributed to Paul? C. The land is distributed 85% to Maria and 15% to Paul? d. The land is distributed 50% to Maria and 50% to Paul? The land is sold and the proceeds of $500,000 are distributed proportionately to Maria and to Paul? e. 30 DE 28. LO.1,4 Last year Pink Corporation acquired land and securities in a $ 351 tax-free exchange. On the date of the transfer, the land had a basis of $720,000 and a fair market value of $1,000,000 and the securities had a basis of $110,000 and a fair market value of $250,000. Pink Corporation has two shareholders, Maria and Paul, who are unrelated. Maria owns 85% of the stock in the corporation, and Paul owns 15%. Pink adopts a plan of liquidation in the current year. On this date, the value of the land has decreased to $500,000. What is the effect of each of the following on Pink Corporation? Which option should be selected

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started