Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 28-3 Performance measures The following table gives abbreviated balance sheets and income statements for Walmart. At the end of fiscal 2017 , Walmart had

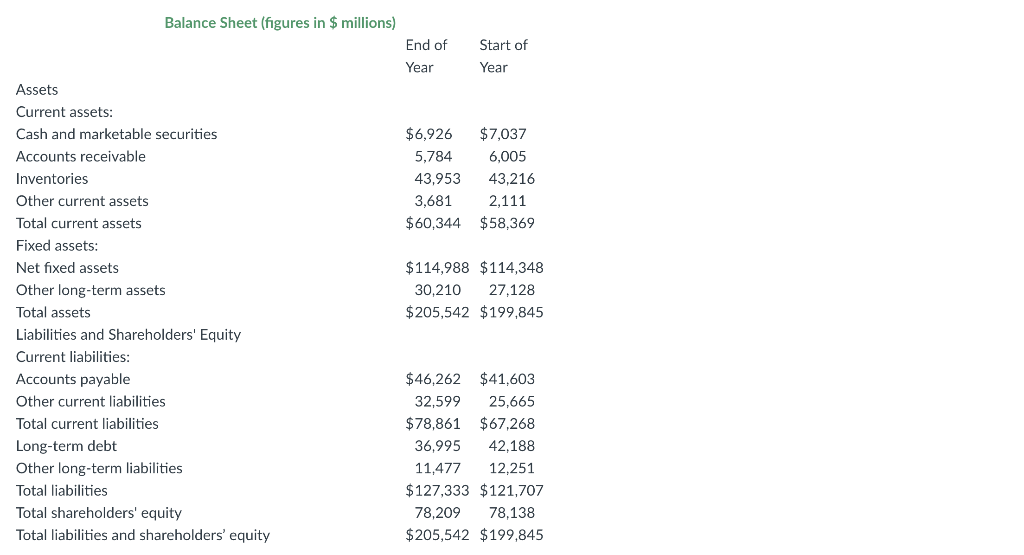

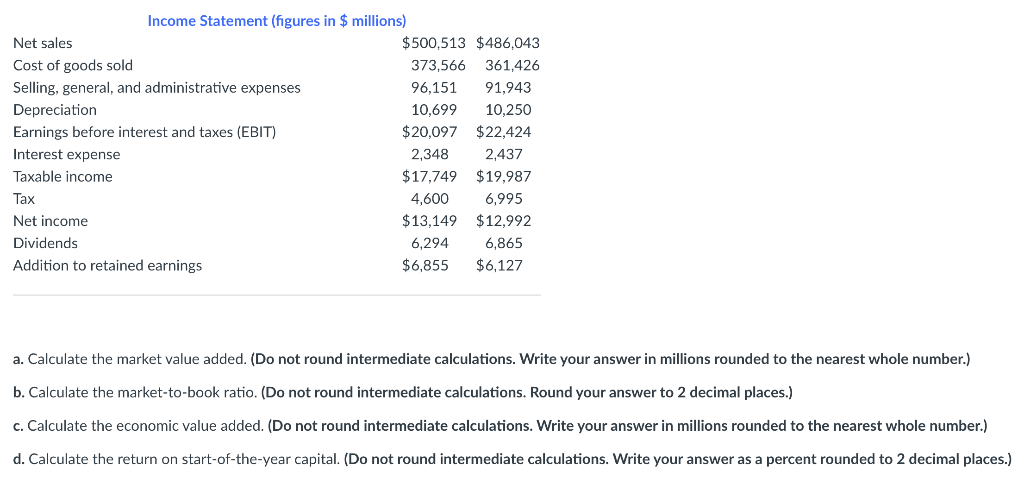

Problem 28-3 Performance measures The following table gives abbreviated balance sheets and income statements for Walmart. At the end of fiscal 2017 , Walmart had 3,045 million shares outstanding with a share price of $140. The company's weighted-average cost of capital was about 5%. Assume a tax rate of 35%. Balance Sheet (figures in \$ millions) End of Start of Year Year Assets Current assets: Cash and marketable securities Accounts receivable Inventories Other current assets Total current assets Fixed assets: Net fixed assets $114,988$114,348 Other long-term assets 30,21027,128 Total assets $205,542$199,845 Liabilities and Shareholders' Equity Current liabilities: Accounts payable Other current liabilities 32,59925,665 Totalcurrentliabilities$78,861$67,268 Long-term debt Other long-term liabilities Total liabilities Total shareholders' equity 36,99511,47742,18812,251 Total liabilities and shareholders' equity $205,542$199,845 a. Calculate the market value added. (Do not round intermediate calculations. Write your answer in millions rounded to the nearest whole number.) b. Calculate the market-to-book ratio. (Do not round intermediate calculations. Round your answer to 2 decimal places.) c. Calculate the economic value added. (Do not round intermediate calculations. Write your answer in millions rounded to the nearest whole number.) d. Calculate the return on start-of-the-year capital. (Do not round intermediate calculations. Write your answer as a percent rounded to 2 decimal places

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started