Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 3 - 20 Marks Garage purchased a specialized machine on April 1, 2021 for a total cost of $ 254,000 from Scissor Manufactory. This

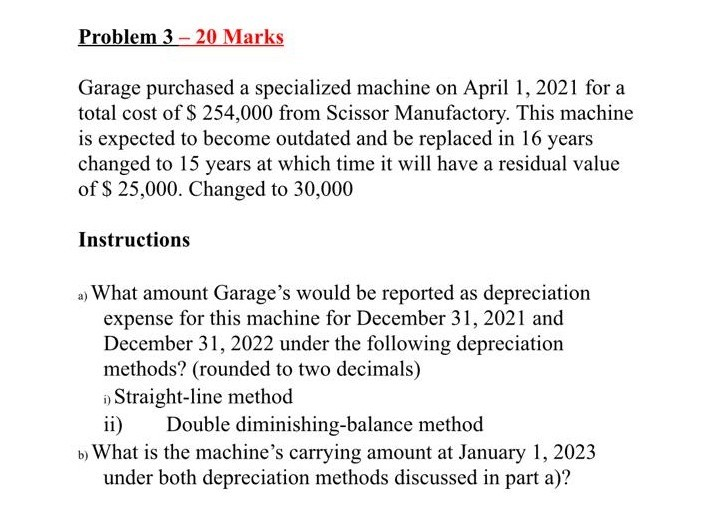

Problem 3 - 20 Marks Garage purchased a specialized machine on April 1, 2021 for a total cost of $ 254,000 from Scissor Manufactory. This machine is expected to become outdated and be replaced in 16 years changed to 15 years at which time it will have a residual value of $ 25,000. Changed to 30,000 Instructions a) What amount Garage's would be reported as depreciation expense for this machine for December 31, 2021 and December 31, 2022 under the following depreciation methods? (rounded to two decimals) Straight-line method ii) Double diminishing-balance method b) What is the machine's carrying amount at January 1, 2023 under both depreciation methods discussed in part a)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started