Answered step by step

Verified Expert Solution

Question

1 Approved Answer

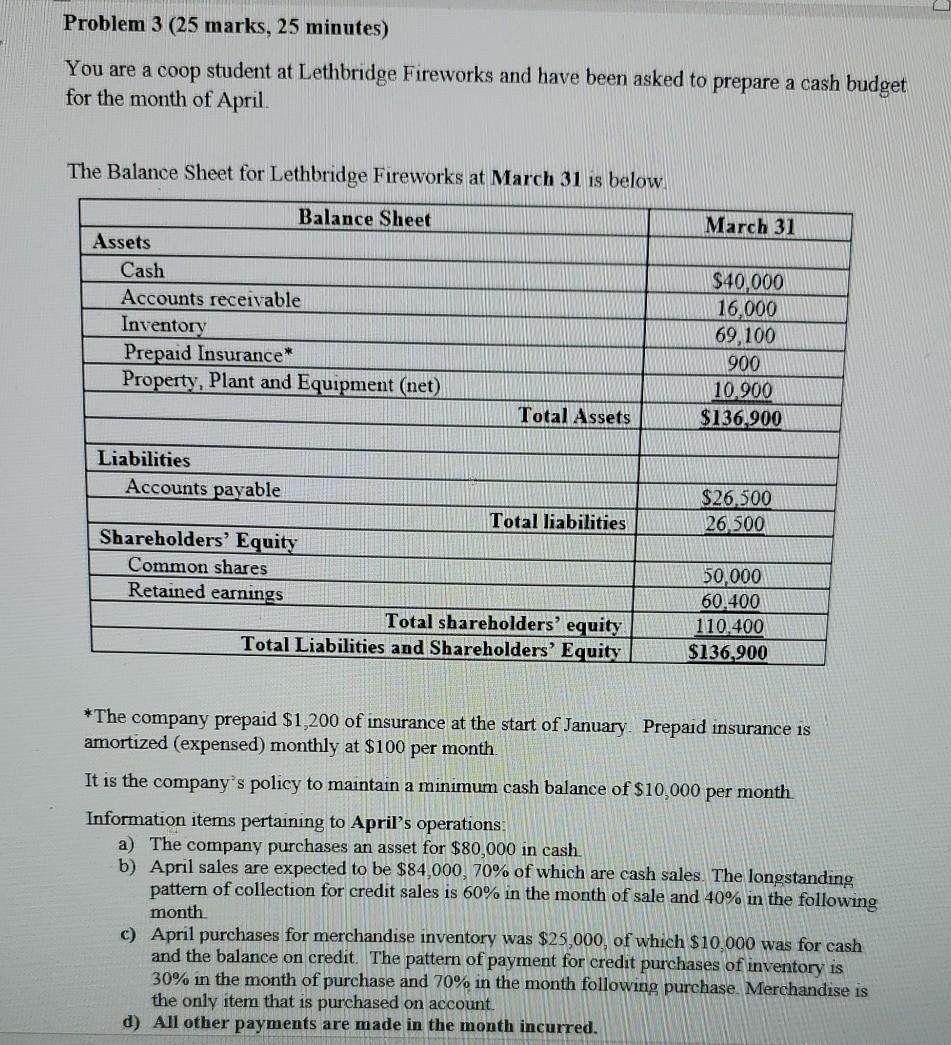

Problem 3 (25 marks, 25 minutes) You are a coop student at Lethbridge Fireworks and have been asked to prepare a cash budget for the

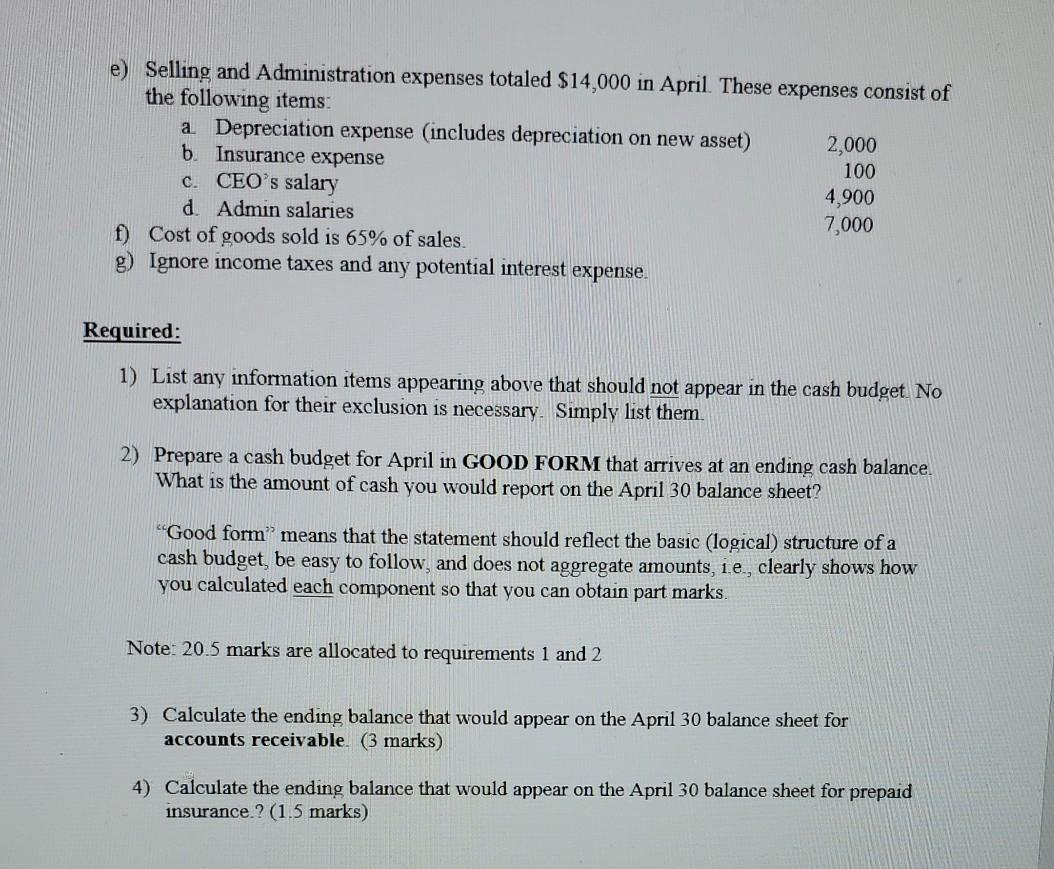

Problem 3 (25 marks, 25 minutes) You are a coop student at Lethbridge Fireworks and have been asked to prepare a cash budget for the month of April. March 31 The Balance Sheet for Lethbridge Fireworks at March 31 is below. Balance Sheet Assets Cash Accounts receivable Inventory Prepaid Insurance* Property, Plant and Equipment (net) Total Assets $40,000 16,000 69,100 900 10.900 $136.900 $26.500 26 500 Liabilities Accounts payable Total liabilities Shareholders' Equity Common shares Retained earnings Total shareholders' equity Total Liabilities and Shareholders' Equity 50,000 60.400 110.400 $136.900 *The company prepaid $1,200 of insurance at the start of January. Prepaid insurance is amortized (expensed) monthly at $100 per month It is the company's policy to maintain a minimum cash balance of $10,000 per month Information items pertaining to April's operations: a) The company purchases an asset for $80,000 in cash. b) April sales are expected to be $84,000, 70% of which are cash sales. The longstanding pattern of collection for credit sales is 60% in the month of sale and 40% in the following month c) April purchases for merchandise inventory was $25,000, of which $10,000 was for cash and the balance on credit. The pattern of payment for credit purchases of inventory is 30% in the month of purchase and 70% in the month following purchase. Merchandise is the only item that is purchased on account. d) All other payments are made in the month incurred. e) Selling and Administration expenses totaled $14,000 in April. These expenses consist of the following items: a Depreciation expense (includes depreciation on new asset) 2,000 b. Insurance expense 100 c. CEO's salary 4,900 d Admin salaries 7,000 f) Cost of goods sold is 65% of sales. g) Ignore income taxes and any potential interest expense. Required: 1) List any information items appearing above that should not appear in the cash budget. No explanation for their exclusion is necessary. Simply list them. 2) Prepare a cash budget for April in GOOD FORM that arrives at an ending cash balance. What is the amount of cash you would report on the April 30 balance sheet? "Good form means that the statement should reflect the basic (logical structure of a cash budget, be easy to follow, and does not aggregate amounts, i.e., clearly shows how you calculated each component so that you can obtain part marks. Note: 20.5 marks are allocated to requirements 1 and 2 3) Calculate the ending balance that would appear on the April 30 balance sheet for accounts receivable. (3 marks) 4) Calculate the ending balance that would appear on the April 30 balance sheet for prepaid insurance.? (1.5 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started