Question: Problem 3 - 3 8 ( Algorithmic ) ( L 0 . 5 , 6 , 8 ) David and Ruby are engaged and plan

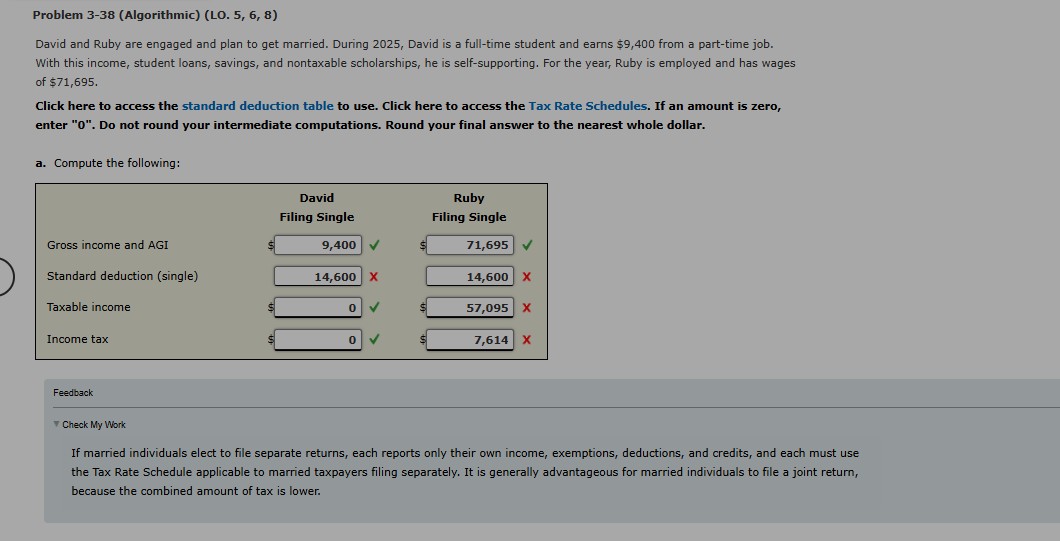

Problem AlgorithmicL David and Ruby are engaged and plan to get married. During David is a fulltime student and earns $ from a parttime job. With this income, student loans, savings, and nontaxable scholarships, he is selfsupporting. For the year, Ruby is employed and has wages of $ Click here to access the standard deduction table to use. Click here to access the Tax Rate Schedules. If an amount is zero, enter Do not round your intermediate computations. Round your final answer to the nearest whole dollar. a Compute the following:Gross income and AGI Standard deduction single Taxable income Income taxDavid Filing SingleRuby Filing Single x checkmark checkmark Feedback Check My Work If married individuals elect to file separate returns, each reports only their own income, exemptions, deductions, and credits, and each must use the Tax Rate Schedule applicable to married taxpayers filing separately. It is generally advantageous for married individuals to file a joint return, because the combined amount of tax is lower.

b Assume that David and Ruby get married in and file a joint return. What is their taxable income and income tax? Round your

final answer to the nearest whole dollar.

Gross income and AGI

Standard deduction married filing jointly

Taxable income

Income tax

Married

Filing Jointly

x

x

x

c How much income tax can David and Ruby save if they get married in and file a joint return?

x

I NEED A STEP BY STEP WALKTHROUGH PLEASE

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock