Answered step by step

Verified Expert Solution

Question

1 Approved Answer

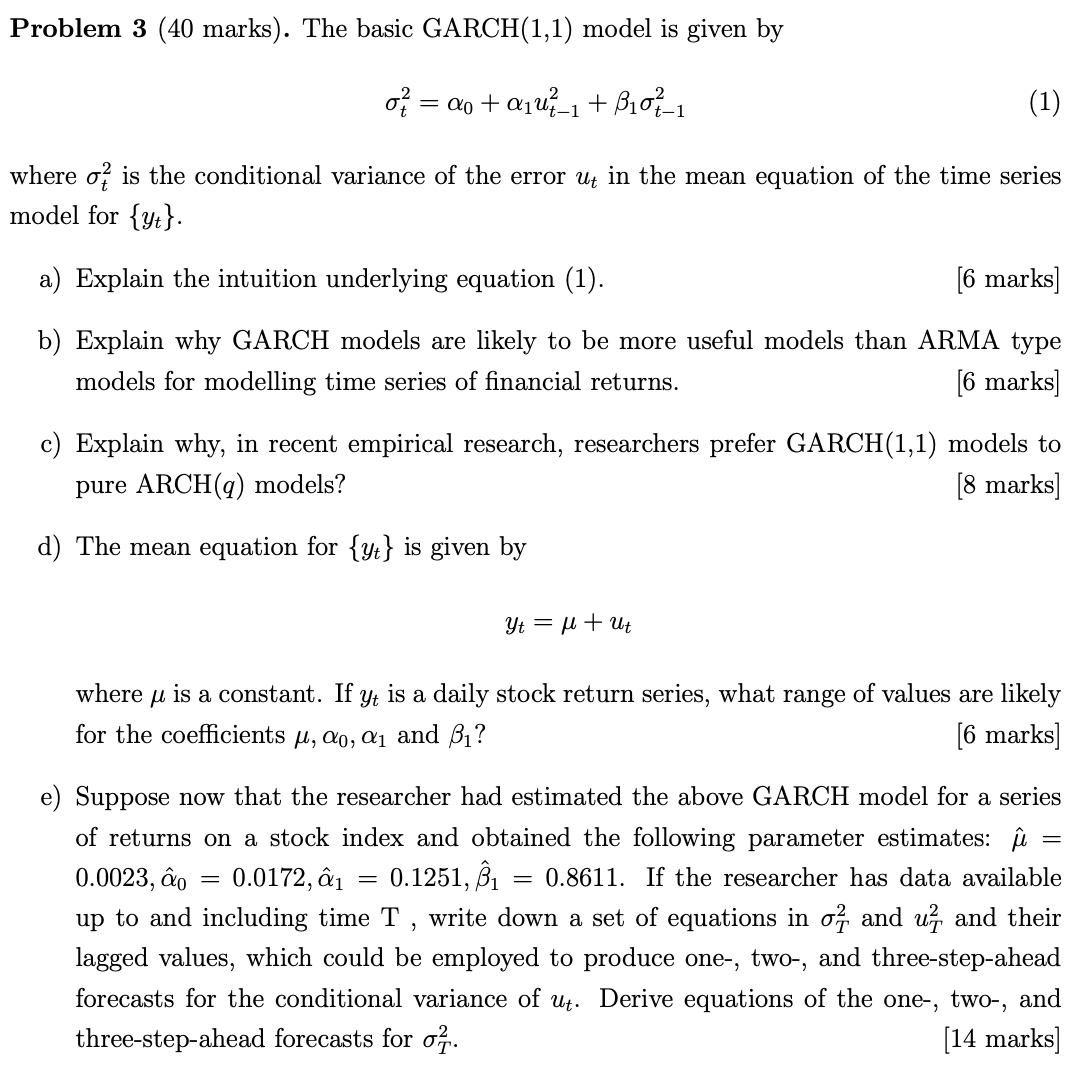

Problem 3 (40 marks). The basic GARCH(1,1) model is given by a1u = 0 + u 1 + 10-1 -1 (1) where is the

Problem 3 (40 marks). The basic GARCH(1,1) model is given by a1u = 0 + u 1 + 10-1 -1 (1) where is the conditional variance of the error u in the mean equation of the time series model for {y}. a) Explain the intuition underlying equation (1). [6 marks] b) Explain why GARCH models are likely to be more useful models than ARMA type models for modelling time series of financial returns. [6 marks] c) Explain why, in recent empirical research, researchers prefer GARCH(1,1) models to pure ARCH(q) models? d) The mean equation for {y} is given by [8 marks] Yt = + Ut where is a constant. If yt is a daily stock return series, what range of values are likely for the coefficients , o, and ? = 0.0172, 1 = [6 marks] = e) Suppose now that the researcher had estimated the above GARCH model for a series of returns on a stock index and obtained the following parameter estimates: 0.0023, o 0.1251, B1 = 0.8611. If the researcher has data available up to and including time T, write down a set of equations in and u and their lagged values, which could be employed to produce one-, two-, and three-step-ahead forecasts for the conditional variance of ut. Derive equations of the one-, two-, and three-step-ahead forecasts for . [14 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started