Answered step by step

Verified Expert Solution

Question

1 Approved Answer

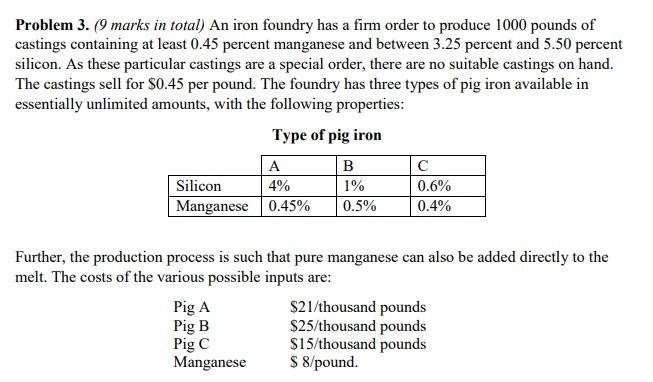

Problem 3. (9 marks in total) An iron foundry has a firm order to produce 1000 pounds of castings containing at least 0.45 percent

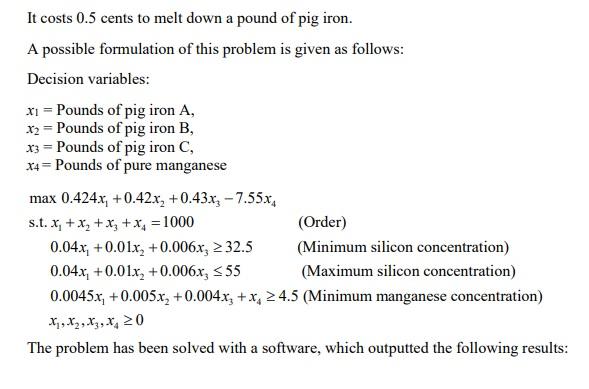

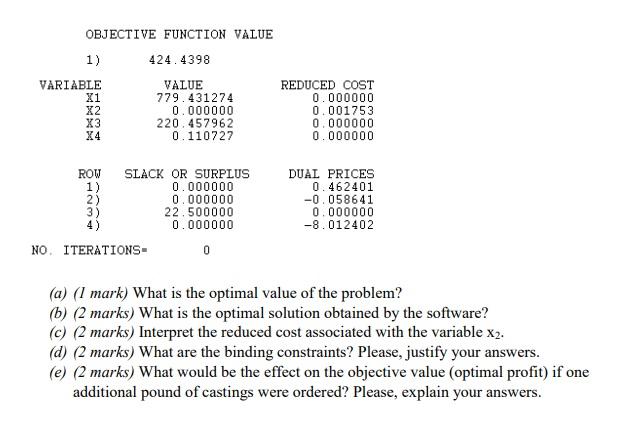

Problem 3. (9 marks in total) An iron foundry has a firm order to produce 1000 pounds of castings containing at least 0.45 percent manganese and between 3.25 percent and 5.50 percent silicon. As these particular castings are a special order, there are no suitable castings on hand. The castings sell for $0.45 per pound. The foundry has three types of pig iron available in essentially unlimited amounts, with the following properties: Type of pig iron A Silicon 4% Manganese 0.45% B Pig A Pig B Pig C Manganese 1% 0.5% C 0.6% 0.4% Further, the production process is such that pure manganese can also be added directly to the melt. The costs of the various possible inputs are: $21/thousand pounds $25/thousand pounds $15/thousand pounds $ 8/pound. It costs 0.5 cents to melt down a pound of pig iron. A possible formulation of this problem is given as follows: Decision variables: x = Pounds of pig iron A, x = Pounds of pig iron B, x3 = Pounds of pig iron C, x4 Pounds of pure manganese max 0.424x, +0.42x +0.43x -7.55x4 s.t. x + x + x + x = 1000 (Order) (Minimum silicon concentration) 0.04x, +0.01x +0.006x, 232.5 0.04x, +0.01x +0.006x, 55 (Maximum silicon concentration) 0.0045x, +0.005x +0.004x3+x24.5 (Minimum manganese concentration) X, X, X3, X 20 The problem has been solved with a software, which outputted the following results: OBJECTIVE FUNCTION VALUE 1) VARIABLE X1 X2 X3 X4 424.4398 VALUE 779.431274 0.000000 220.457962 0.110727 ROW SLACK OR SURPLUS 1) 2) 3) NO. ITERATIONS- 0.000000 0.000000 22.500000 0.000000 0 REDUCED COST 0.000000 0.001753 0.000000 0.000000 DUAL PRICES 0.462401 -0.058641 0.000000 -8.012402 (a) (1 mark) What is the optimal value of the problem? (b) (2 marks) What is the optimal solution obtained by the software? (c) (2 marks) Interpret the reduced cost associated with the variable x2. (d) (2 marks) What are the binding constraints? Please, justify your answers. (e) (2 marks) What would be the effect on the objective value (optimal profit) if one additional pound of castings were ordered? Please, explain your answers.

Step by Step Solution

★★★★★

3.20 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

a Optimal value 4244398 the first line of the solution re...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started