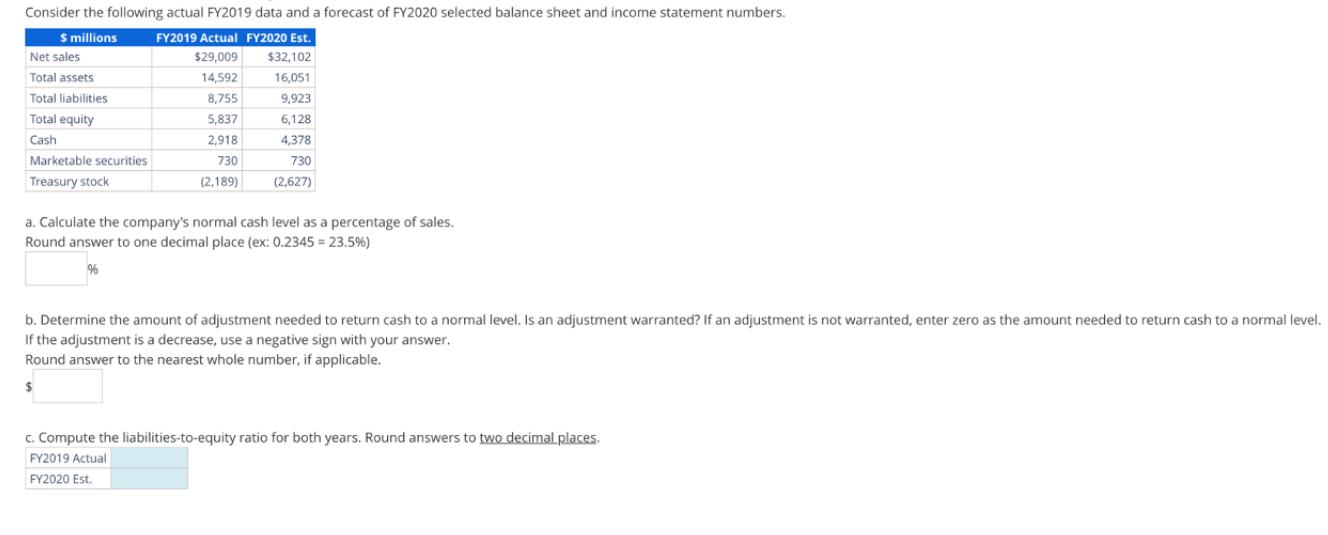

Consider the following actual FY2019 data and a forecast of FY2020 selected balance sheet and income statement numbers. $ millions FY2019 Actual FY2020 Est.

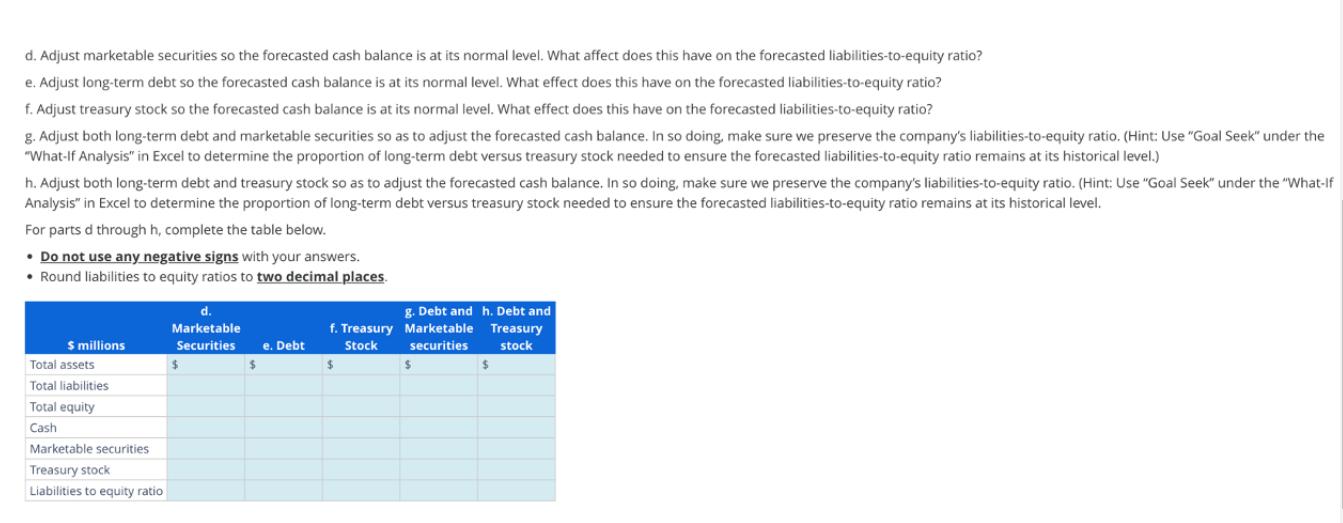

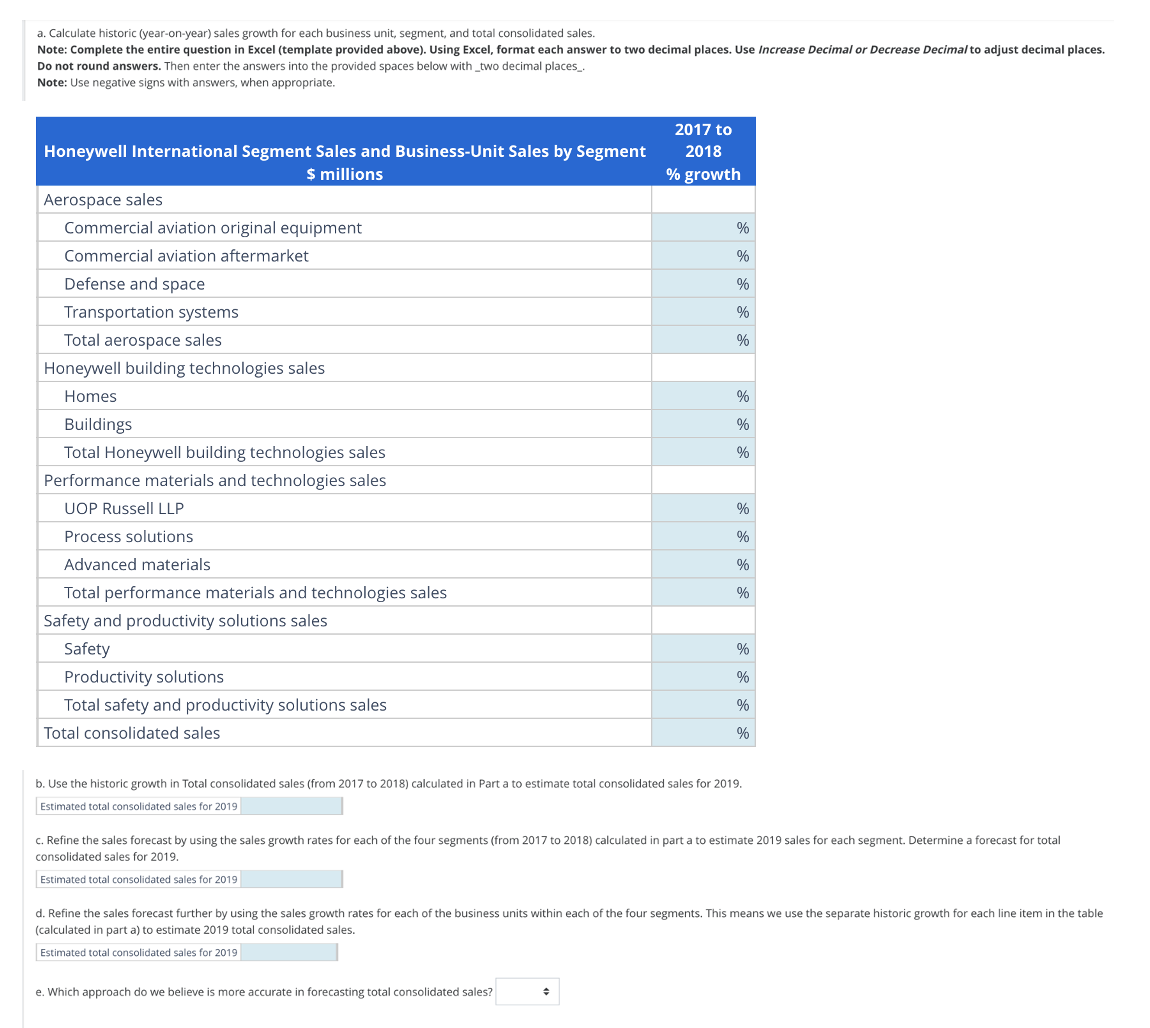

Consider the following actual FY2019 data and a forecast of FY2020 selected balance sheet and income statement numbers. $ millions FY2019 Actual FY2020 Est. $29,009 $32,102 14,592 16,051 8,755 9,923 5,837 6,128 2,918 4,378 730 730 (2,189) (2,627) Net sales Total assets Total liabilities Total equity Cash Marketable securities Treasury stock a. Calculate the company's normal cash level as a percentage of sales. Round answer to one decimal place (ex: 0.2345= 23.5%) % b. Determine the amount of adjustment needed to return cash to a normal level. Is an adjustment warranted? If an adjustment is not warranted, enter zero as the amount needed to return cash to a normal level. If the adjustment is a decrease, use a negative sign with your answer. Round answer to the nearest whole number, if applicable. $ c. Compute the liabilities-to-equity ratio for both years. Round answers to two decimal places. FY2019 Actual FY2020 Est. d. Adjust marketable securities so the forecasted cash balance is at its normal level. What affect does this have on the forecasted liabilities-to-equity ratio? e. Adjust long-term debt so the forecasted cash balance is at its normal level. What effect does this have on the forecasted liabilities-to-equity ratio? f. Adjust treasury stock so the forecasted cash balance is at its normal level. What effect does this have on the forecasted liabilities-to-equity ratio? g. Adjust both long-term debt and marketable securities so as to adjust the forecasted cash balance. In so doing, make sure we preserve the company's liabilities-to-equity ratio. (Hint: Use "Goal Seek" under the "What-If Analysis" in Excel to determine the proportion of long-term debt versus treasury stock needed to ensure the forecasted liabilities-to-equity ratio remains at its historical level.) h. Adjust both long-term debt and treasury stock so as to adjust the forecasted cash balance. In so doing, make sure we preserve the company's liabilities-to-equity ratio. (Hint: Use "Goal Seek" under the "What-if Analysis" in Excel to determine the proportion of long-term debt versus treasury stock needed to ensure the forecasted liabilities-to-equity ratio remains at its historical level. For parts d through h, complete the table below. Do not use any negative signs with your answers. Round liabilities to equity ratios to two decimal places. $ millions Total assets Total liabilities Total equity Cash Marketable securities Treasury stock Liabilities to equity ratio d. Marketable Securities e. Debt $ f. Treasury Stock $ g. Debt and h. Debt and Marketable Treasury securities stock $ $ a. Calculate historic (year-on-year) sales growth for each business unit, segment, and total consolidated sales. Note: Complete the entire question in Excel (template provided above). Using Excel, format each answer to two decimal places. Use Increase Decimal or Decrease Decimal to adjust decimal places. Do not round answers. Then enter the answers into the provided spaces below with two decimal places_. Note: Use negative signs with answers, when appropriate. Honeywell International Segment Sales and Business-Unit Sales by Segment $ millions Aerospace sales Commercial aviation original equipment Commercial aviation aftermarket Defense and space Transportation systems Total aerospace sales Honeywell building technologies sales Homes Buildings Total Honeywell building technologies sales Performance materials and technologies sales UOP Russell LLP Process solutions Advanced materials Total performance materials and technologies sales Safety and productivity solutions sales Safety Productivity solutions Total safety and productivity solutions sales. Total consolidated sales 2017 to 2018 % growth % % % % % e. Which approach do we believe is more accurate in forecasting total consolidated sales? % % % + % % % % % % % b. Use the historic growth in Total consolidated sales (from 2017 to 2018) calculated in Part a to estimate total consolidated sales for 2019. Estimated total consolidated sales for 2019 % c. Refine the sales forecast by using the sales growth rates for each of the four segments (from 2017 to 2018) calculated in part a to estimate 2019 sales for each segment. Determine a forecast for total consolidated sales for 2019. Estimated total consolidated sales for 2019 d. Refine the sales forecast further by using the sales growth rates for each of the business units within each of the four segments. This means we use the separate historic growth for each line item in the table (calculated in part a) to estimate 2019 total consolidated sales. Estimated total consolidated sales for 2019

Step by Step Solution

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION Here are the answers based on the provided data a Historic Sales Growth Rates 20172018 Aerospace sales Commercial aviation original equipment ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started