Answered step by step

Verified Expert Solution

Question

1 Approved Answer

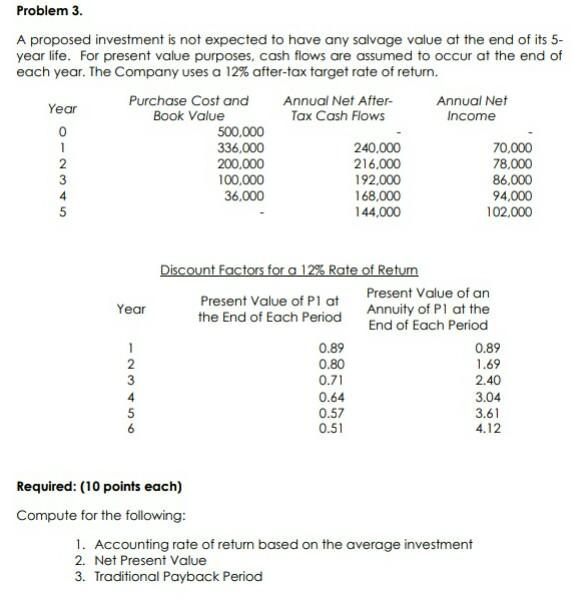

Problem 3. A proposed investment is not expected to have any salvage value at the end of its 5- year life. For present value purposes,

Problem 3. A proposed investment is not expected to have any salvage value at the end of its 5- year life. For present value purposes, cash flows are assumed to occur at the end of each year. The Company uses a 12% after-tax target rate of return. Purchase Cost and Annual Net After- Year Annual Net Book Value Tax Cash Flows Income 500,000 1 336.000 240,000 70,000 2 200,000 216,000 78,000 3 100,000 192,000 86,000 36.000 168,000 94,000 5 144,000 102,000 CAN-O Year 1 2 3 4 5 6 Discount factors for a 12% Rate of Return Present Value of Pl at Present Value of an the End of Each Period Annuity of PI at the End of Each Period 0.89 0.89 0.80 1.69 0.71 2.40 0.64 3.04 0.57 3.61 0.51 4.12 Required: (10 points each) Compute for the following: 1. Accounting rate of retum based on the average investment 2. Net Present Value 3. Traditional Payback Period

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started