Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 3: ABC LTD purchased a machine for $2000 on 1st January 2001 which had a useful life of 5 years and an estimated residual

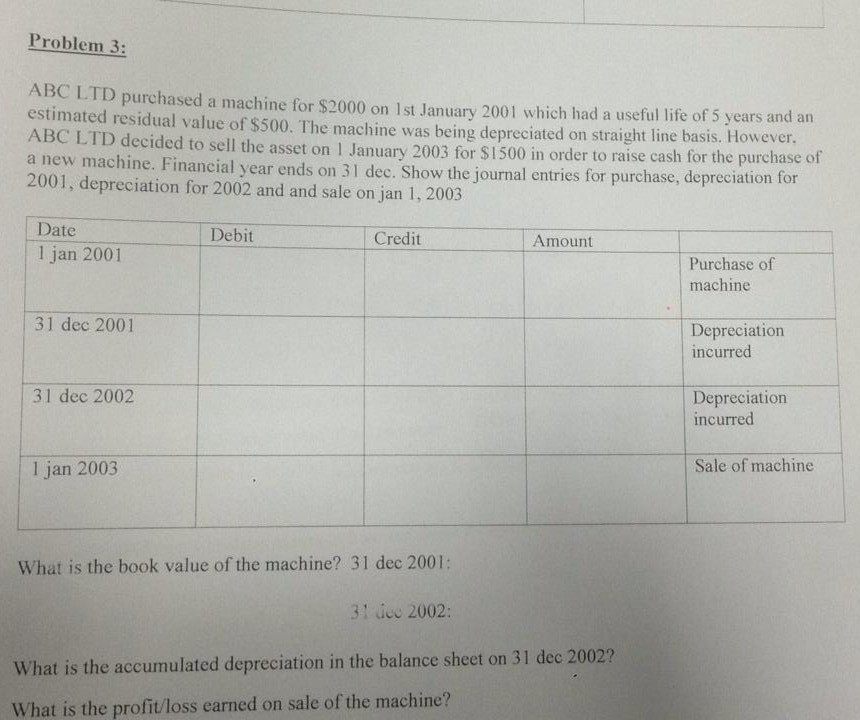

Problem 3: ABC LTD purchased a machine for $2000 on 1st January 2001 which had a useful life of 5 years and an estimated residual value of $500. The machine was being depreciated on straight line basis. However ABC LTD decided to sell the asset on 1 January 2003 for $1500 in order to raise cash for the purchase of a new machine. Financial year ends on 31 dec. Show the journal entries for purchase, depreciation for 2001, depreciation for 2002 and and sale on jan 1, 2003 Date Debit Credit Amount 1 jan 2001 Purchase of machine 31 dec 2001 Depreciation incurred 31 dec 2002 Depreciation incurred Sale of machine 1 jan 2003 What is the book value of the machine? 31 dec 2001: 31 dec 2002: What is the accumulated depreciation in the balance sheet on 31 dec 2002? What is the profit/loss earned on sale of the machine

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started