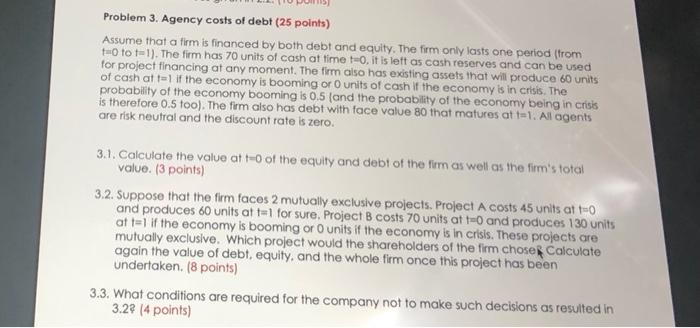

Problem 3. Agency costs of debt (25 points) Assume that a firm is financed by both debt and equity. The firm only lasts one period (from t#0 tot 1). The firm has 70 units of cash at time to. it is left as cash reserves and can be used for project financing at any moment. The firm also has existing assets that will produce 60 units of cash at t=1 if the economy is booming or o units of cash if the economy is in crisis. The probability of the economy booming is 0.5 (and the probability of the economy being in crisis is therefore 0.5 too). The firm also has debt with face value 80 that matures at t=1. Al agents are risk neutral and the discount rate is zero. 3.1. Calculate the value at tuo of the equity and debt of the firm as well as the firm's total value. (3 points) 3.2. Suppose that the firm faces 2 mutually exclusive projects. Project A costs 45 units at t0 and produces 60 units at t=1 for sure. Project B costs 70 units at t=0 and produces 130 units at t=1 if the economy is booming or units if the economy is in crisis. These projects are mutually exclusive. Which project would the shareholders of the firm chose Calculate again the value of debt, equity, and the whole firm once this project has been undertaken. (8 points) 3.3. What conditions are required for the company not to make such decisions as resulted in 3.28 (4 points) Problem 3. Agency costs of debt (25 points) Assume that a firm is financed by both debt and equity. The firm only lasts one period (from t#0 tot 1). The firm has 70 units of cash at time to. it is left as cash reserves and can be used for project financing at any moment. The firm also has existing assets that will produce 60 units of cash at t=1 if the economy is booming or o units of cash if the economy is in crisis. The probability of the economy booming is 0.5 (and the probability of the economy being in crisis is therefore 0.5 too). The firm also has debt with face value 80 that matures at t=1. Al agents are risk neutral and the discount rate is zero. 3.1. Calculate the value at tuo of the equity and debt of the firm as well as the firm's total value. (3 points) 3.2. Suppose that the firm faces 2 mutually exclusive projects. Project A costs 45 units at t0 and produces 60 units at t=1 for sure. Project B costs 70 units at t=0 and produces 130 units at t=1 if the economy is booming or units if the economy is in crisis. These projects are mutually exclusive. Which project would the shareholders of the firm chose Calculate again the value of debt, equity, and the whole firm once this project has been undertaken. (8 points) 3.3. What conditions are required for the company not to make such decisions as resulted in 3.28 (4 points)