Question

PROBLEM 3 - ANALYSIS OF COSTS WITH INFLATION A Dole food company is considering purchasing equipment to conduct quality inspections of one of its finished

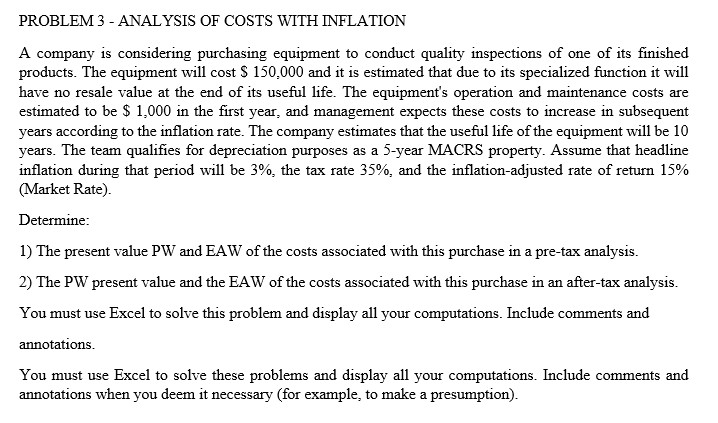

PROBLEM 3 - ANALYSIS OF COSTS WITH INFLATION

A Dole food company is considering purchasing equipment to conduct quality inspections of one of its finished products. The equipment will cost $ 150,000 and it is estimated that due to its specialized function it will have no resale value at the end of its useful life. The equipment's operation and maintenance costs are estimated to be $ 1,000 in the first year, and management expects these costs to increase in subsequent years according to the inflation rate. The company estimates that the useful life of the equipment will be 10 years. The team qualifies for depreciation purposes as a 5-year MACRS property. Assume that headline inflation during that period will be 3%, the tax rate 35%, and the inflation-adjusted rate of return 15% (Market Rate). Determine: 1) The present value PW and EAW of the costs associated with this purchase in a pre-tax analysis. 2) The PW present value and the EAW of the costs associated with this purchase in an after-tax analysis. You must use Excel to solve this problem and display all your computations. Include comments and annotations. You must use Excel to solve these problems and display all your computations. Include comments and annotations when you deem it necessary (for example, to make a presumption).

I need to know which is the correct answer since I have several and I don't know which is the correct one. Please do it correctly! **PLEASE USE EXCEL ONLY AND IT'S FUNCTIONAL FUNCTIONS AND CALCULATIONS PLEASE. HELP ME, IT'S VERY IMPORTANT TO MY CLASS** THANKS A LOT!

Answer all the questions please!

PROBLEM 3 - ANALYSIS OF COSTS WITH INFLATION A company is considering purchasing equipment to conduct quality inspections of one of its finished products. The equipment will cost $ 150,000 and it is estimated that due to its specialized function it will have no resale value at the end of its useful life. The equipment's operation and maintenance costs are estimated to be $ 1,000 in the first year, and management expects these costs to increase in subsequent years according to the inflation rate. The company estimates that the useful life of the equipment will be 10 years. The team qualifies for depreciation purposes as a 5-year MACRS property. Assume that headline inflation during that period will be 3%, the tax rate 35%, and the inflation-adjusted rate of return 15% (Market Rate). Determine: 1) The present value PW and EAW of the costs associated with this purchase in a pre-tax analysis. 2) The PW present value and the EAW of the costs associated with this purchase in an after-tax analysis. You must use Excel to solve this problem and display all your computations. Include comments and annotations. You must use Excel to solve these problems and display all your computations. Include comments and annotations when you deem it necessary (for example, to make a presumption)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started