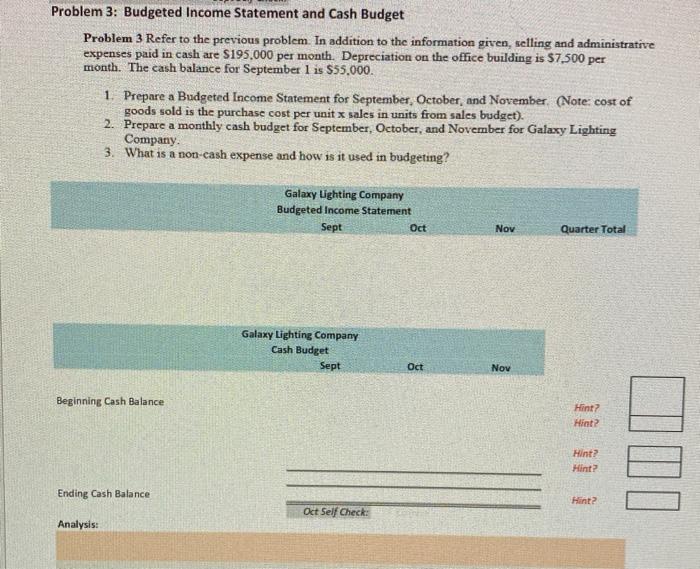

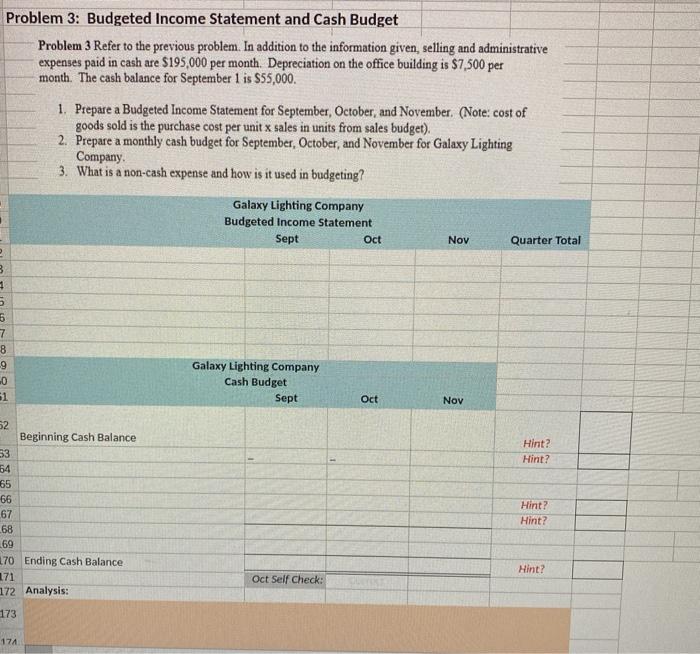

Problem 3: Budgeted Income Statement and Cash Budget Problem 3 Refer to the previous problem. In addition to the information given, selling and administrative expenses paid in cash are $195.000 per month. Depreciation on the office building is $7,500 per month. The cash balance for September 1 is $55,000 1. Prepare a Budgeted Income Statement for September October, and November. (Note: cost of goods sold is the purchase cost per unit x sales in units from sales budget). 2. Prepare a monthly cash budget for September, October, and November for Galaxy Lighting Company 3. What is a non-cash expense and how is it used in budgeting? Galaxy Lighting Company Budgeted Income Statement Sept Oct Nov Quarter Total Galaxy Lighting Company Cash Budget Sept Oct Nov Beginning Cash Balance Hint? Hint? Hint? Hint? Ending Cash Balance Hinta Oct Self Check: Analysis: Problem 3: Budgeted Income Statement and Cash Budget Problem 3 Refer to the previous problem. In addition to the information given, selling and administrative expenses paid in cash are $195,000 per month. Depreciation on the office building is $7,500 per month. The cash balance for September 1 is $55,000 1. Prepare a Budgeted Income Statement for September, October, and November. (Note: cost of goods sold is the purchase cost per unit x sales in units from sales budget). 2. Prepare a monthly cash budget for September October, and November for Galaxy Lighting Company 3. What is a non-cash expense and how is it used in budgeting? Galaxy Lighting Company Budgeted Income Statement Sept Oct Quarter Total 2 3 5 6 7 8 9 .0 51 Galaxy Lighting Company Cash Budget Sept Oct Nov Hint? Hint? Beginning Cash Balance 53 54 65 66 67 68 69 170 Ending Cash Balance 171 172 Analysis: Hint? Hint? Hint? Oct Self Check: 173 174 Problem 3: Budgeted Income Statement and Cash Budget Problem 3 Refer to the previous problem. In addition to the information given, selling and administrative expenses paid in cash are $195.000 per month. Depreciation on the office building is $7,500 per month. The cash balance for September 1 is $55,000 1. Prepare a Budgeted Income Statement for September October, and November. (Note: cost of goods sold is the purchase cost per unit x sales in units from sales budget). 2. Prepare a monthly cash budget for September, October, and November for Galaxy Lighting Company 3. What is a non-cash expense and how is it used in budgeting? Galaxy Lighting Company Budgeted Income Statement Sept Oct Nov Quarter Total Galaxy Lighting Company Cash Budget Sept Oct Nov Beginning Cash Balance Hint? Hint? Hint? Hint? Ending Cash Balance Hinta Oct Self Check: Analysis: Problem 3: Budgeted Income Statement and Cash Budget Problem 3 Refer to the previous problem. In addition to the information given, selling and administrative expenses paid in cash are $195,000 per month. Depreciation on the office building is $7,500 per month. The cash balance for September 1 is $55,000 1. Prepare a Budgeted Income Statement for September, October, and November. (Note: cost of goods sold is the purchase cost per unit x sales in units from sales budget). 2. Prepare a monthly cash budget for September October, and November for Galaxy Lighting Company 3. What is a non-cash expense and how is it used in budgeting? Galaxy Lighting Company Budgeted Income Statement Sept Oct Quarter Total 2 3 5 6 7 8 9 .0 51 Galaxy Lighting Company Cash Budget Sept Oct Nov Hint? Hint? Beginning Cash Balance 53 54 65 66 67 68 69 170 Ending Cash Balance 171 172 Analysis: Hint? Hint? Hint? Oct Self Check: 173 174