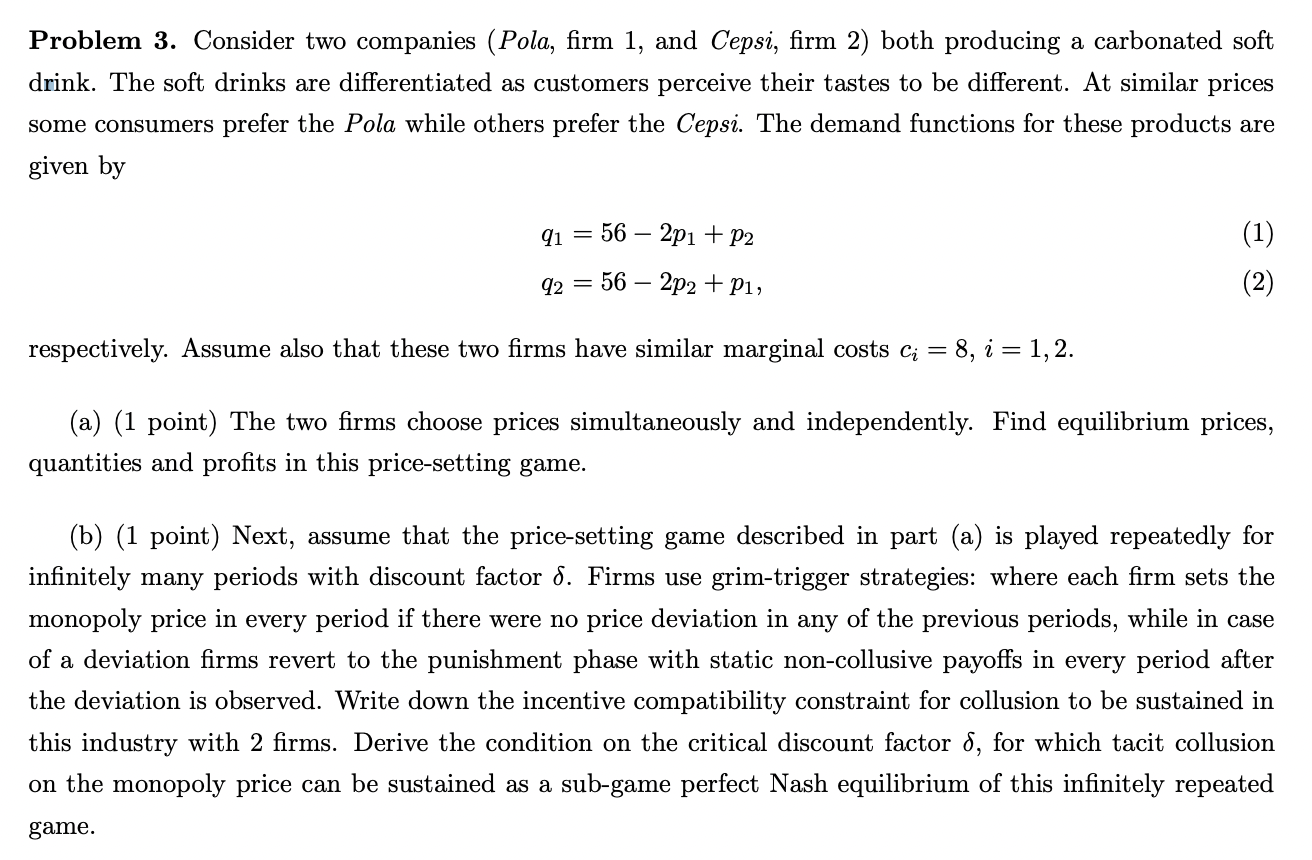

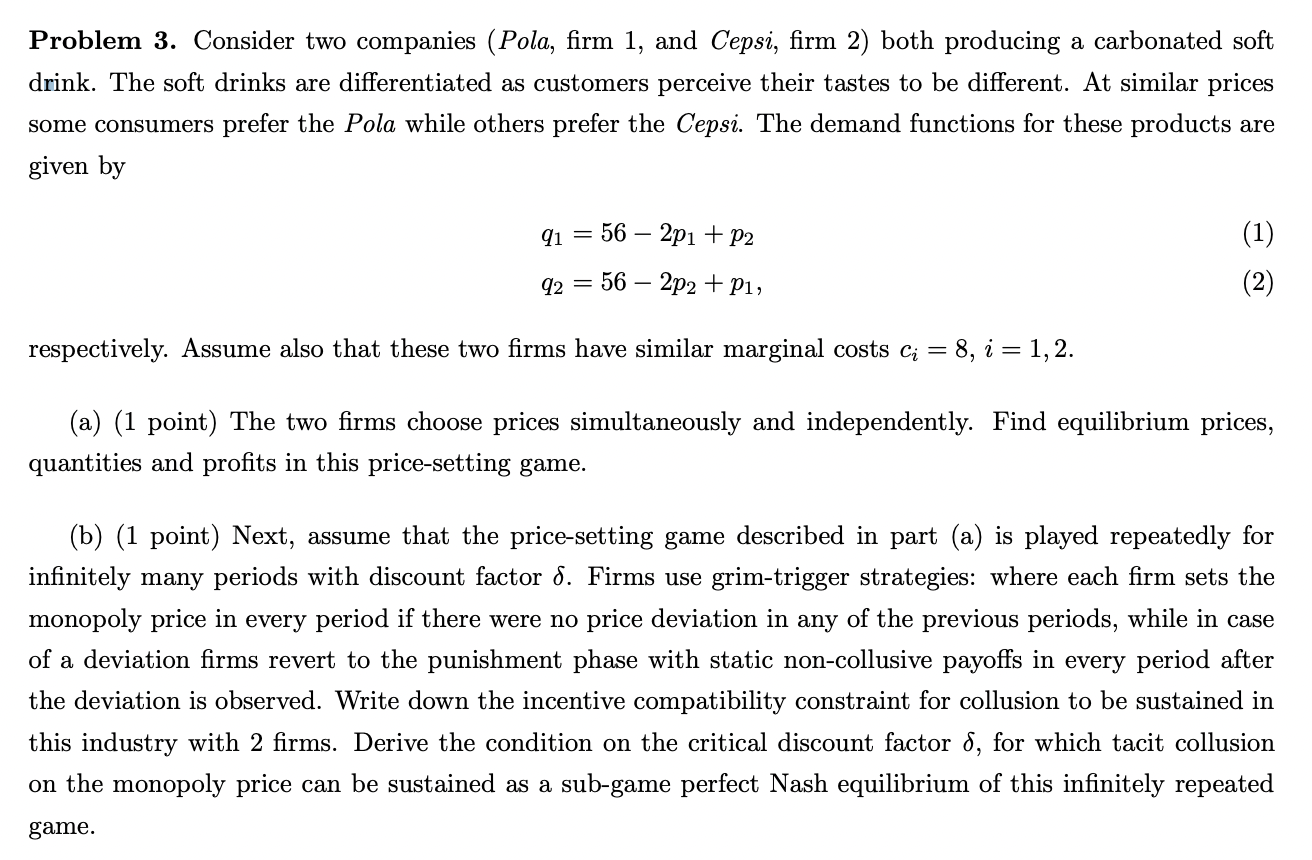

Problem 3. Consider two companies (Pola, firm 1, and Cepsi, firm 2) both producing a carbonated soft drink. The soft drinks are differentiated as customers perceive their tastes to be different. At similar prices some consumers prefer the Pola while others prefer the Cepsi. The demand functions for these products are given by q1=562p1+p2q2=562p2+p1, respectively. Assume also that these two firms have similar marginal costs ci=8,i=1,2. (a) (1 point) The two firms choose prices simultaneously and independently. Find equilibrium prices, quantities and profits in this price-setting game. (b) (1 point) Next, assume that the price-setting game described in part (a) is played repeatedly for infinitely many periods with discount factor . Firms use grim-trigger strategies: where each firm sets the monopoly price in every period if there were no price deviation in any of the previous periods, while in case of a deviation firms revert to the punishment phase with static non-collusive payoffs in every period after the deviation is observed. Write down the incentive compatibility constraint for collusion to be sustained in this industry with 2 firms. Derive the condition on the critical discount factor , for which tacit collusion on the monopoly price can be sustained as a sub-game perfect Nash equilibrium of this infinitely repeated game. Problem 3. Consider two companies (Pola, firm 1, and Cepsi, firm 2) both producing a carbonated soft drink. The soft drinks are differentiated as customers perceive their tastes to be different. At similar prices some consumers prefer the Pola while others prefer the Cepsi. The demand functions for these products are given by q1=562p1+p2q2=562p2+p1, respectively. Assume also that these two firms have similar marginal costs ci=8,i=1,2. (a) (1 point) The two firms choose prices simultaneously and independently. Find equilibrium prices, quantities and profits in this price-setting game. (b) (1 point) Next, assume that the price-setting game described in part (a) is played repeatedly for infinitely many periods with discount factor . Firms use grim-trigger strategies: where each firm sets the monopoly price in every period if there were no price deviation in any of the previous periods, while in case of a deviation firms revert to the punishment phase with static non-collusive payoffs in every period after the deviation is observed. Write down the incentive compatibility constraint for collusion to be sustained in this industry with 2 firms. Derive the condition on the critical discount factor , for which tacit collusion on the monopoly price can be sustained as a sub-game perfect Nash equilibrium of this infinitely repeated game