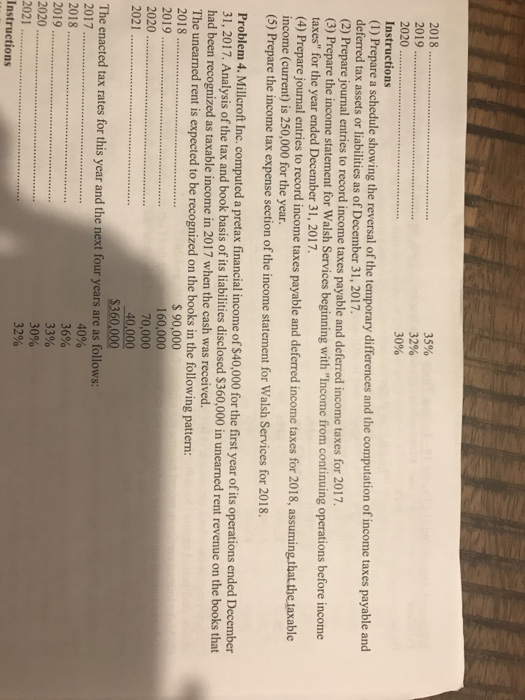

Problem 3 continues at the top of the second photo

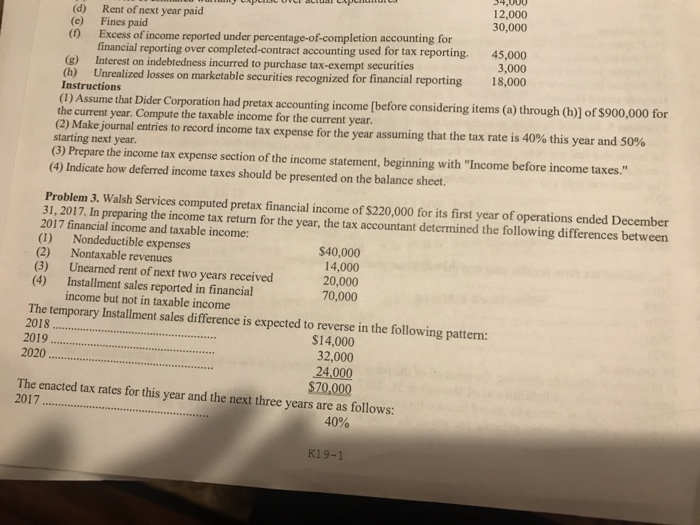

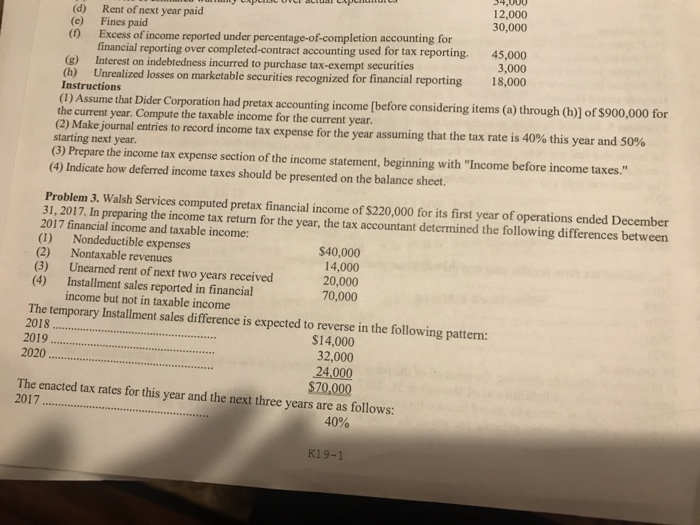

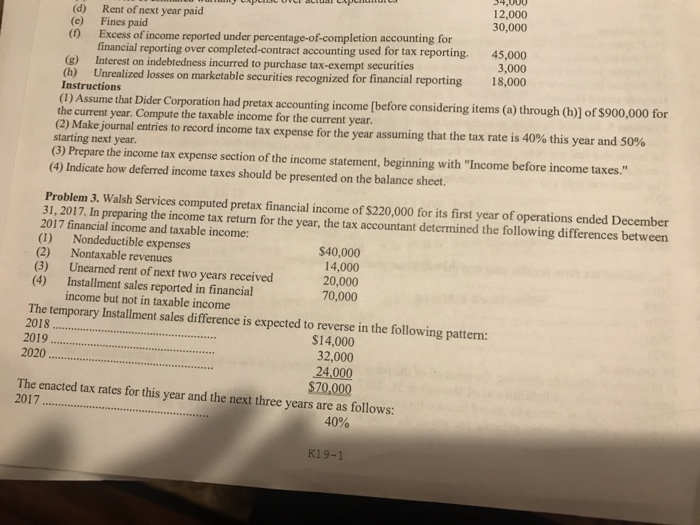

12,000 30,000 (d) Rent of next year paid (e) Fines paid Excess of income reported under percentage-of-completion accounting for nterest n idebiednes ncurred to purchase tax-exempt securties (o 45,000 3,000 financial reporting over completed-contract accounting used for tax reporting. (h) Unrealized losses on marketable securities recognized for financial reporting 18,000 ) throh00 for Instructions (1) Assume that Dider Corporation had pretax accounting income [before considering items (a the current year. Compute the taxable income for the current year (2) Make journal entries to record income tax expense for the year suming that the tax rate is 40% this year and 50% starting next year. (3) Prepare the income tax expense section of the income statement, beginning with "Income before income taxes." (4) Indicate how deferred income taxes should be presented on the balance sheet Problem 3. Walsh Services computed pretax financial income of $220,000 for its first year of operations ended December 31, 2017. In preparing the income tax return for the year, the tax accountant determined the following differences between 2017 financial income and taxable income: (1) Nondeductible expenses (2) Nontaxable revenues (3) Unearned rent of next two years received (4) Installment sales reported in financial $40,000 14,000 20,000 70,000 income but not in taxable income The temporary Installment sales difference is expected to reverse in the following pattern: 2018 $14,000 32,000 24,000 $70,000 2019 2020 The enacted tax rates for this year and the next three years are as follows: 2017 40% K19-1 12,000 30,000 (d) Rent of next year paid (e) Fines paid Excess of income reported under percentage-of-completion accounting for nterest n idebiednes ncurred to purchase tax-exempt securties (o 45,000 3,000 financial reporting over completed-contract accounting used for tax reporting. (h) Unrealized losses on marketable securities recognized for financial reporting 18,000 ) throh00 for Instructions (1) Assume that Dider Corporation had pretax accounting income [before considering items (a the current year. Compute the taxable income for the current year (2) Make journal entries to record income tax expense for the year suming that the tax rate is 40% this year and 50% starting next year. (3) Prepare the income tax expense section of the income statement, beginning with "Income before income taxes." (4) Indicate how deferred income taxes should be presented on the balance sheet Problem 3. Walsh Services computed pretax financial income of $220,000 for its first year of operations ended December 31, 2017. In preparing the income tax return for the year, the tax accountant determined the following differences between 2017 financial income and taxable income: (1) Nondeductible expenses (2) Nontaxable revenues (3) Unearned rent of next two years received (4) Installment sales reported in financial $40,000 14,000 20,000 70,000 income but not in taxable income The temporary Installment sales difference is expected to reverse in the following pattern: 2018 $14,000 32,000 24,000 $70,000 2019 2020 The enacted tax rates for this year and the next three years are as follows: 2017 40% K19-1