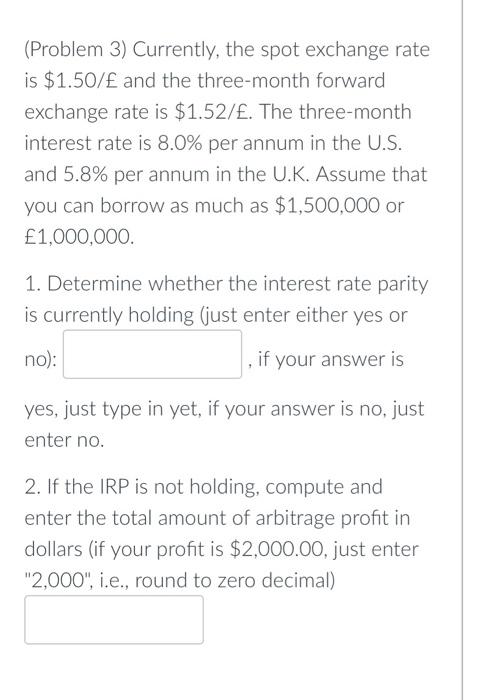

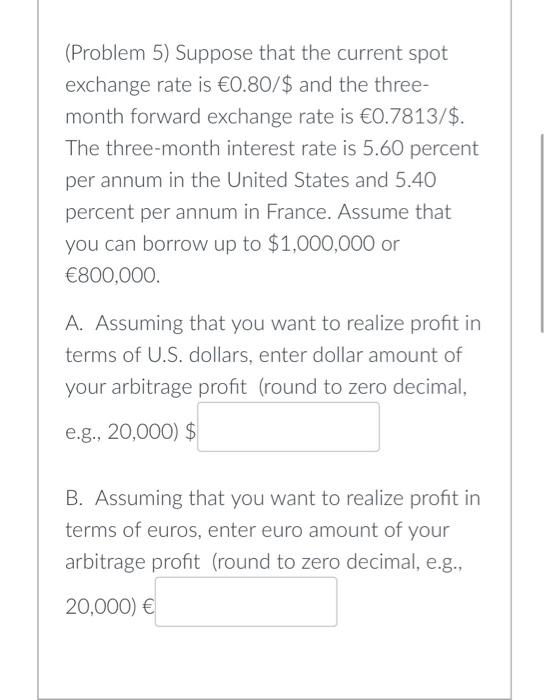

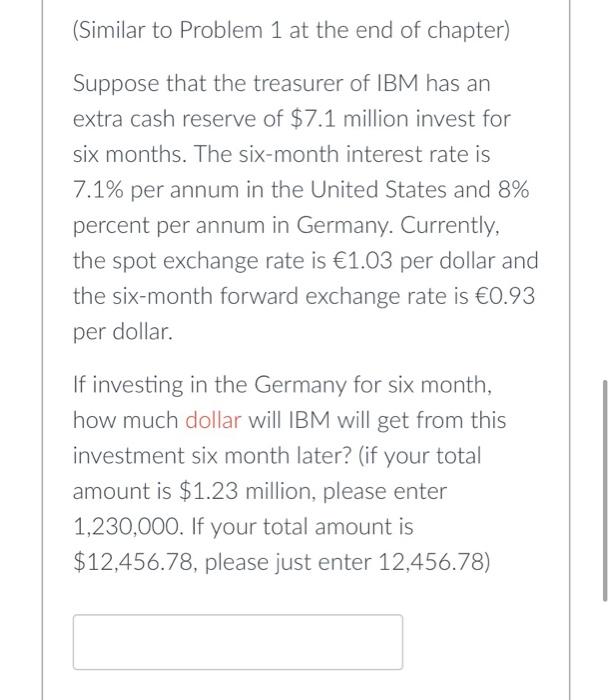

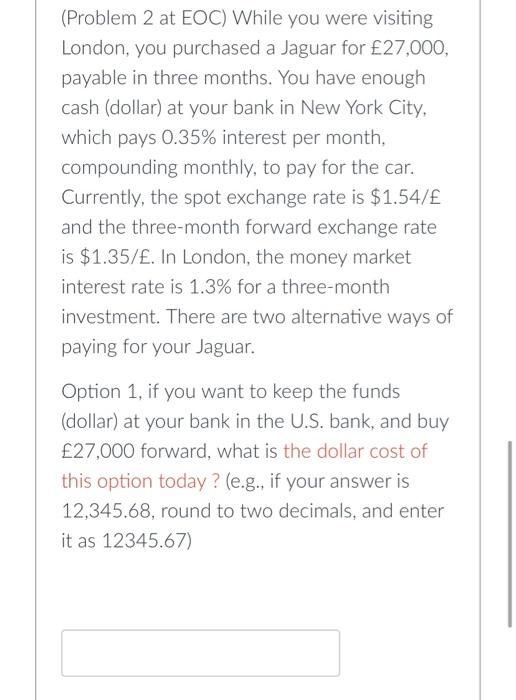

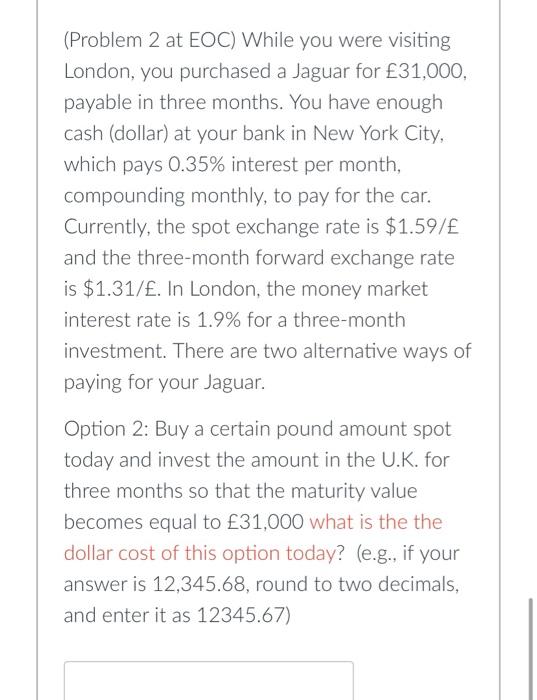

(Problem 3) Currently, the spot exchange rate is $1.50/ and the three-month forward exchange rate is $1.52/. The three-month interest rate is 8.0% per annum in the U.S. and 5.8% per annum in the U.K. Assume that you can borrow as much as $1,500,000 or 1,000,000. 1. Determine whether the interest rate parity is currently holding (just enter either yes or no): if your answer is yes, just type in yet, if your answer is no, just enter no. 2. If the IRP is not holding, compute and enter the total amount of arbitrage profit in dollars (if your profit is $2,000.00, just enter "2,000", i.e., round to zero decimal) (Problem 5) Suppose that the current spot exchange rate is 0.80/$ and the three- month forward exchange rate is 0.7813/$. The three-month interest rate is 5.60 percent per annum in the United States and 5.40 percent per annum in France. Assume that you can borrow up to $1,000,000 or 800,000. A. Assuming that you want to realize profit in terms of U.S. dollars, enter dollar amount of your arbitrage profit (round to zero decimal, e.g., 20,000) $ B. Assuming that you want to realize profit in terms of euros, enter euro amount of your arbitrage profit (round to zero decimal, e.g., 20,000) (Similar to Problem 1 at the end of chapter) Suppose that the treasurer of IBM has an extra cash reserve of $7.1 million invest for six months. The six-month interest rate is 7.1% per annum in the United States and 8% percent per annum in Germany. Currently, the spot exchange rate is 1.03 per dollar and the six-month forward exchange rate is 0.93 per dollar. If investing in the Germany for six month, how much dollar will IBM will get from this investment six month later? (if your total amount is $1.23 million, please enter 1,230,000. If your total amount is $12,456.78, please just enter 12,456.78) (Problem 2 at EOC) While you were visiting London, you purchased a Jaguar for 27,000, payable in three months. You have enough cash (dollar) at your bank in New York City, which pays 0.35% interest per month, compounding monthly, to pay for the car. Currently, the spot exchange rate is $1.54/ and the three-month forward exchange rate is $1.35/. In London, the money market interest rate is 1.3% for a three-month investment. There are two alternative ways of paying for your Jaguar. Option 1, if you want to keep the funds (dollar) at your bank in the U.S. bank, and buy 27,000 forward, what is the dollar cost of this option today? (e.g., if your answer is 12,345.68, round to two decimals, and enter it as 12345.67) (Problem 2 at EOC) While you were visiting London, you purchased a Jaguar for 31,000, payable in three months. You have enough cash (dollar) at your bank in New York City, which pays 0.35% interest per month, compounding monthly, to pay for the car. Currently, the spot exchange rate is $1.59/ and the three-month forward exchange rate is $1.31/. In London, the money market interest rate is 1.9% for a three-month investment. There are two alternative ways of paying for your Jaguar. Option 2: Buy a certain pound amount spot today and invest the amount in the U.K. for three months so that the maturity value becomes equal to 31,000 what is the the dollar cost of this option today? (e.g., if your answer is 12,345.68, round to two decimals, and enter it as 12345.67)