Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 3 Hello. Can I have the complete solution pls. and proper amortization table if necessary. I already uploaded this but some of the answers

Problem 3

Hello. Can I have the complete solution pls. and proper amortization table if necessary. I already uploaded this but some of the answers I got are wrong. I really need the correct answer. Thank you for your help

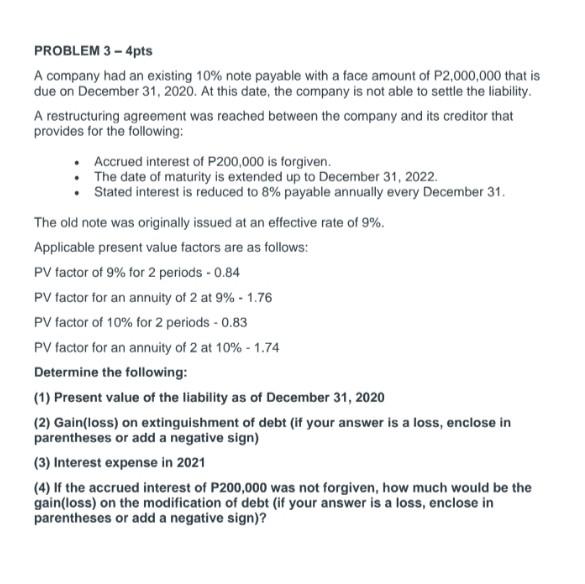

PROBLEM 3 - 4pts A company had an existing 10% note payable with a face amount of P2,000,000 that is due on December 31, 2020. At this date, the company is not able to settle the liability. A restructuring agreement was reached between the company and its creditor that provides for the following: Accrued interest of P200,000 is forgiven. The date of maturity is extended up to December 31, 2022. Stated interest is reduced to 8% payable annually every December 31 The old note was originally issued at an effective rate of 9%. Applicable present value factors are as follows: PV factor of 9% for 2 periods - 0.84 PV factor for an annuity of 2 at 9% - 1.76 PV factor of 10% for 2 periods - 0.83 PV factor for an annuity of 2 at 10% - 1.74 Determine the following: (1) Present value of the liability as of December 31, 2020 (2) Gain(loss) on extinguishment of debt (if your answer is a loss, enclose in parentheses or add a negative sign) (3) Interest expense in 2021 (4) If the accrued interest of P200,000 was not forgiven, how much would be the gain(loss) on the modification of debt (if your answer is a loss, enclose in parentheses or add a negative sign)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started