Answered step by step

Verified Expert Solution

Question

1 Approved Answer

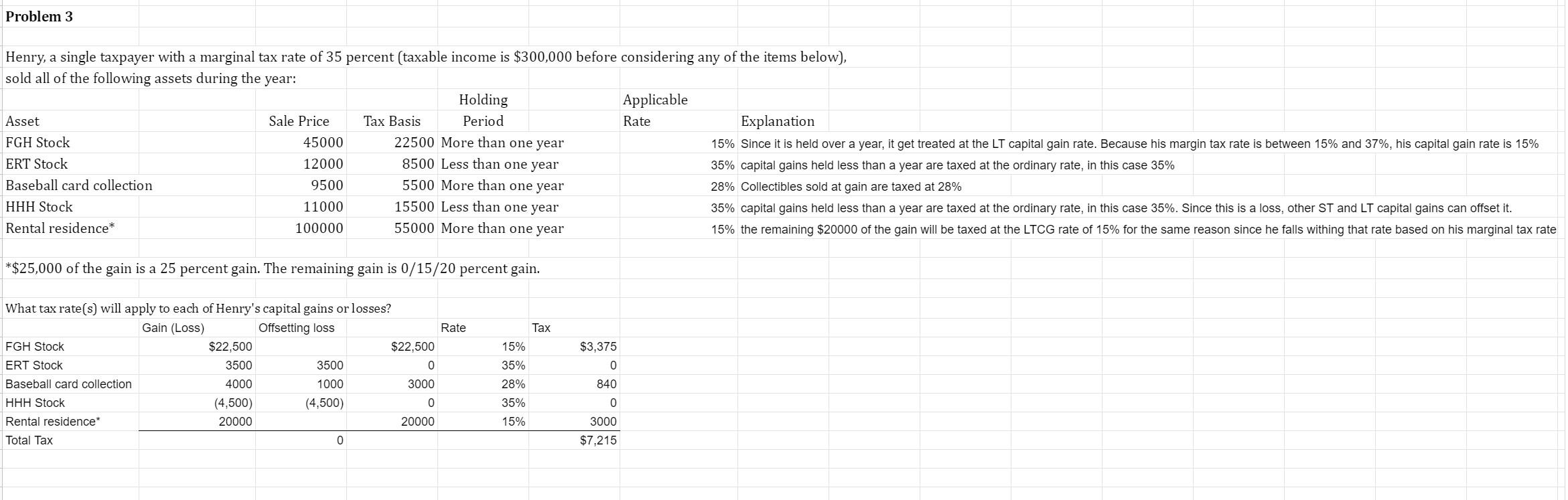

Problem 3 Henry, a single taxpayer with a marginal tax rate of 35 percent (taxable income is $300,000 before considering any of the items

Problem 3 Henry, a single taxpayer with a marginal tax rate of 35 percent (taxable income is $300,000 before considering any of the items below), sold all of the following assets during the year: Asset FGH Stock ERT Stock Baseball card collection HHH Stock Rental residence* Sale Price Tax Basis Holding Period Applicable Rate 45000 12000 9500 11000 100000 22500 More than one year 8500 Less than one year 5500 More than one year 15500 Less than one year 55000 More than one year *$25,000 of the gain is a 25 percent gain. The remaining gain is 0/15/20 percent gain. What tax rate(s) will apply to each of Henry's capital gains or losses? Gain (Loss) Offsetting loss Rate Tax FGH Stock ERT Stock $22,500 3500 $22,500 15% $3,375 3500 0 35% 0 Baseball card collection 4000 HHH Stock (4,500) 1000 (4,500) 3000 28% 840 0 35% 0 Rental residence* 20000 20000 15% 3000 Total Tax 0 $7,215 Explanation 15% Since it is held over a year, it get treated at the LT capital gain rate. Because his margin tax rate is between 15% and 37%, his capital gain rate is 15% 35% capital gains held less than a year are taxed at the ordinary rate, in this case 35% 28% Collectibles sold at gain are taxed at 28% 35% capital gains held less than a year are taxed at the ordinary rate, in this case 35%. Since this is a loss, other ST and LT capital gains can offset it. 15% the remaining $20000 of the gain will be taxed at the LTCG rate of 15% for the same reason since he falls withing that rate based on his marginal tax rate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets break down the taxes on each of Henrys assets FGH Stock Sale Price 45000 Tax Basis 22500 Holdin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started