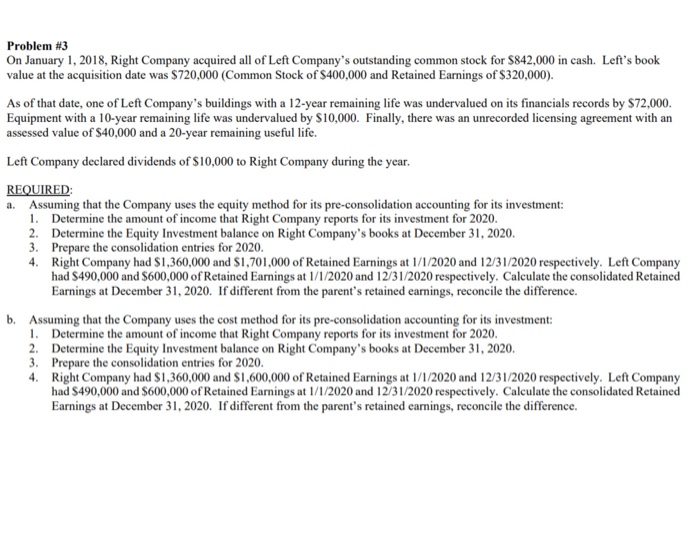

Problem #3 On January 1, 2018, Right Company acquired all of Left Company's outstanding common stock for $842,000 in cash. Left's book value at the acquisition date was $720,000 (Common Stock of $400,000 and Retained Earnings of $320,000). As of that date, one of Left Company's buildings with a 12-year remaining life was undervalued on its financials records by $72,000. Equipment with a 10-year remaining life was undervalued by $10,000. Finally, there was an unrecorded licensing agreement with an assessed value of $40,000 and a 20-year remaining useful life. Left Company declared dividends of $10,000 to Right Company during the year. REQUIRED: a. Assuming that the Company uses the equity method for its pre-consolidation accounting for its investment: 1. Determine the amount of income that Right Company reports for its investment for 2020. 2. Determine the Equity Investment balance on Right Company's books at December 31, 2020. 3. Prepare the consolidation entries for 2020. 4. Right Company had $1,360,000 and $1,701,000 of Retained Earnings at 1/1/2020 and 12/31/2020 respectively. Left Company had S490,000 and $600,000 of Retained Earnings at 1/1/2020 and 12/31/2020 respectively. Calculate the consolidated Retained Earnings at December 31, 2020. If different from the parent's retained earnings, reconcile the difference. the cost method for its pre-consolidation accounting for its investment: 1. Determine the amount of income that Right Company reports for its investment for 2020. 2. Determine the Equity Investment balance on Right Company's books at December 31, 2020, 3. Prepare the consolidation entries for 2020. 4. Right Company had $1,360,000 and $1,600,000 of Retained Earnings at 1/1/2020 and 12/31/2020 respectively. Left Company had $490,000 and $600,000 of Retained Earnings at 1/1/2020 and 12/31/2020 respectively. Calculate the consolidated Retained Earnings at December 31, 2020. If different from the parent's retained earnings, reconcile the difference. Problem #3 On January 1, 2018, Right Company acquired all of Left Company's outstanding common stock for $842,000 in cash. Left's book value at the acquisition date was $720,000 (Common Stock of $400,000 and Retained Earnings of $320,000). As of that date, one of Left Company's buildings with a 12-year remaining life was undervalued on its financials records by $72,000. Equipment with a 10-year remaining life was undervalued by $10,000. Finally, there was an unrecorded licensing agreement with an assessed value of $40,000 and a 20-year remaining useful life. Left Company declared dividends of $10,000 to Right Company during the year. REQUIRED: a. Assuming that the Company uses the equity method for its pre-consolidation accounting for its investment: 1. Determine the amount of income that Right Company reports for its investment for 2020. 2. Determine the Equity Investment balance on Right Company's books at December 31, 2020. 3. Prepare the consolidation entries for 2020. 4. Right Company had $1,360,000 and $1,701,000 of Retained Earnings at 1/1/2020 and 12/31/2020 respectively. Left Company had S490,000 and $600,000 of Retained Earnings at 1/1/2020 and 12/31/2020 respectively. Calculate the consolidated Retained Earnings at December 31, 2020. If different from the parent's retained earnings, reconcile the difference. the cost method for its pre-consolidation accounting for its investment: 1. Determine the amount of income that Right Company reports for its investment for 2020. 2. Determine the Equity Investment balance on Right Company's books at December 31, 2020, 3. Prepare the consolidation entries for 2020. 4. Right Company had $1,360,000 and $1,600,000 of Retained Earnings at 1/1/2020 and 12/31/2020 respectively. Left Company had $490,000 and $600,000 of Retained Earnings at 1/1/2020 and 12/31/2020 respectively. Calculate the consolidated Retained Earnings at December 31, 2020. If different from the parent's retained earnings, reconcile the difference