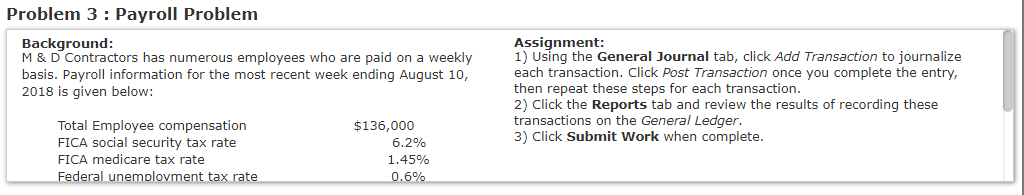

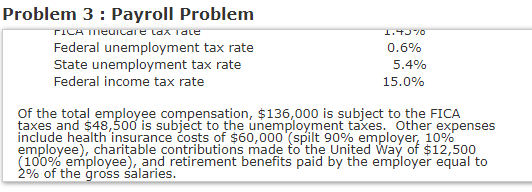

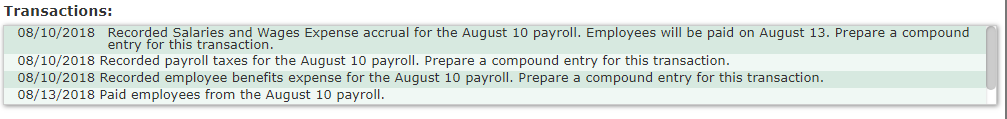

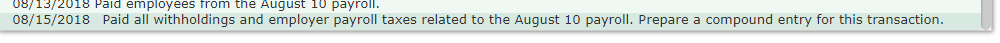

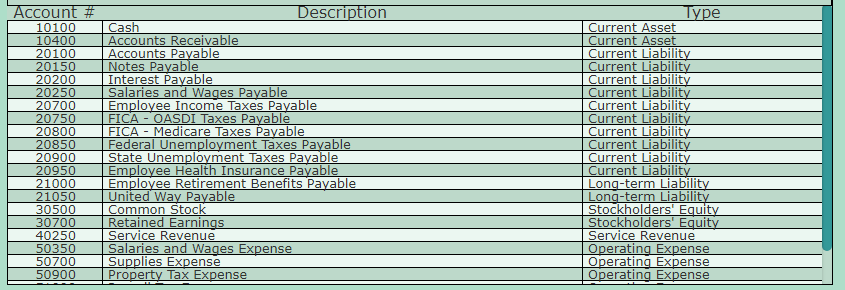

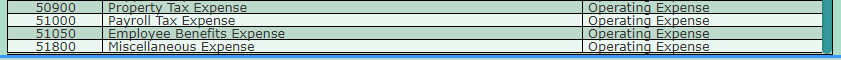

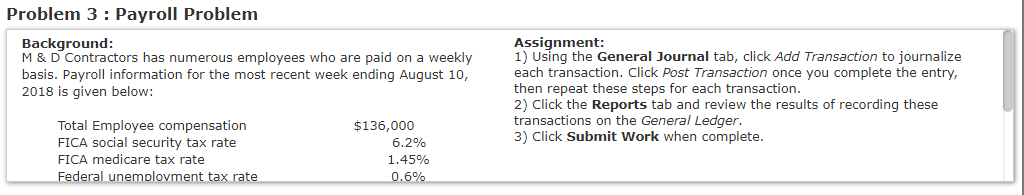

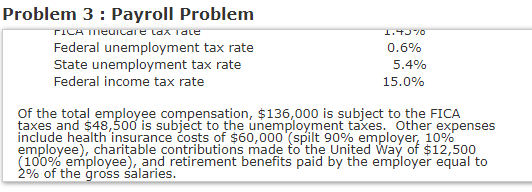

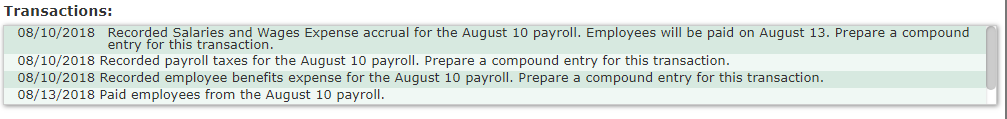

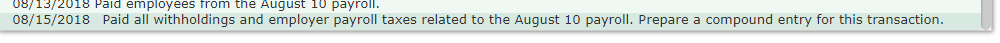

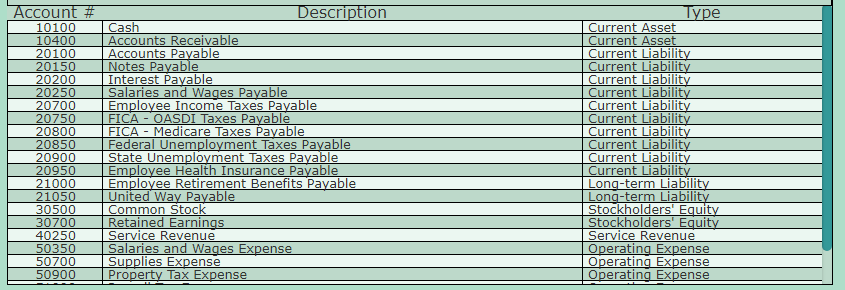

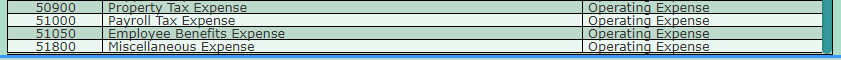

Problem 3 : Payroll Problem Background M & D Contractors has numerous employees who are paid on a weekly1) Using the General Journal tab, click Add Transaction to journalize basis. Payroll information for the most recent week ending August 10, 2018 is given below: Assignment: each transaction. Click Post Transaction once you complete the entry, then repeat these steps for each transaction 2) Click the Reports tab and review the results of recording these transactions on the General Ledger. 3) Click Submit Work when complete. Total Employee compensation FICA social security tax rate FICA medicare tax rate Federal unemplovment tax rate $136,000 6.2% 1.45% Problem 3 : Payroll Problenm Federal unemployment tax rate State unemployment tax rate Federal income tax rate 0.6% 5.490 15.0% Of the total employee compensation, $136,000 is subject to the FICA taxes and $48,500 is subject to the unemployment taxes. Other expenses include health insurance costs of $60,000 (split 90% employer, 10% employee, charitable contributions made to the United Way of $12,500 100% employee), and retirement benefits paid by the employer equal to % of the gross salaries Transactions: 08/10/2018 Recorded Salaries and Wages Expense accrual for the August 10 payroll. Employees will be paid on August 13. Prepare a compound entry for this transaction 08/10/2018 Recorded payroll taxes for the August 10 payroll. Prepare a compound entry for this transaction 08/10/2018 Recorded employee benefits expense for the August 10 payroll. Prepare a compound entry for this transaction 08/13/2018 Paid employees from the August 10 payroll 08/13/2018 Paid employees from the August 10 payroll 08/15/2018 Paid all withholdings and employer payroll taxes related to the August 10 payroll. Prepare a compound entry for this transaction ype Current Asset Current Liabilit 20700 Emp Current Liabilit 0 State Unemployment Taxes Pavable 1 .or#x1ITli l lihilii.Y Common Stock Service Revenue Supplies Expense Service Revenue Property Tax Expense Operating Expense 51000 Payroll Tax Expense Operating Expense Miscellaneous Expense Operating Expense