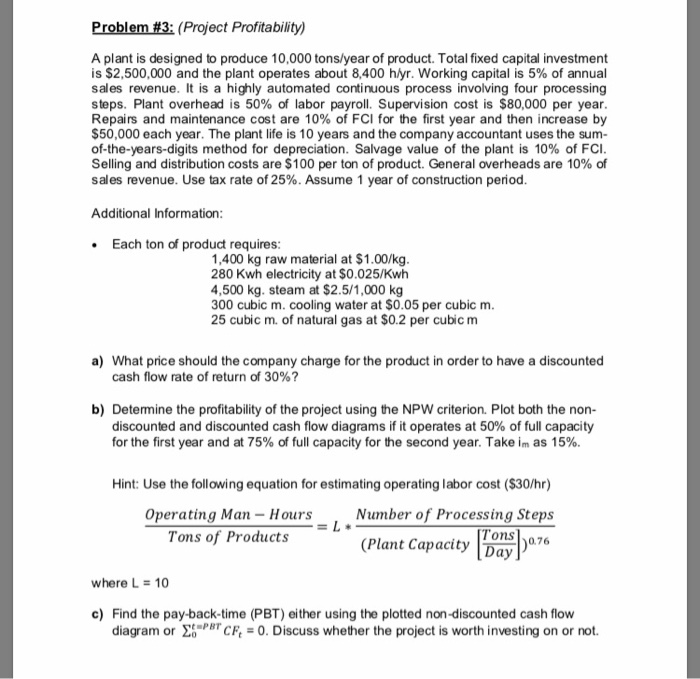

Problem #3: (Project Profitability) A plant is designed to produce 10,000 tons/year of product. Total fixed capital investment is $2,500,000 and the plant operates about 8,400 h/yr. Working capital is 5% of annual sales revenue. It is a highly automated continuous process involving four processing steps. Plant overhead is 50% of labor payroll. Supervision cost is $80,000 per year Repairs and maintenance cost are 10 % of FCI for the first year and then increase by $50,000 each year. The plant life is 10 years and the company accountant uses the sum- of-the-years-digits method for depreciation. Salvage value of the plant is 10% of FCI. Selling and distribution costs are $100 per ton of product. General overheads are 10% of sales revenue. Use tax rate of 25%. Assume 1 year of construction period. Additional Information: Each ton of product requires: 1,400 kg raw material at $1.00/kg. 280 Kwh electricity at $0.025/Kwh 4,500 kg. steam at $2.5/1,000 kg 300 cubic m. cooling water at $0.05 per cubic m. 25 cubic m. of natural gas at $0.2 per cubic m a) What price should the company charge for the product in order to have a discounted cash flow rate of return of 30%? b) Detemine the profitability of the project using the NPW criterion. Plot both the non- discounted and discounted cash flow diagrams if it operates at 50 % of full capacity for the first year and at 75% of full capacity for the second year. Take im as 15%. Hint: Use the following equation for estimating operating labor cost ($30/hr) Number of Process ing Steps Operating Man- Hours Tons of Products [Tons (Plant Capacity Day where L 10 c) Find the pay-back-time (PBT) either using the plotted non-discounted cash flow diagram or Tcf, = 0. Discuss whether the project is worth investing on or not. Problem #3: (Project Profitability) A plant is designed to produce 10,000 tons/year of product. Total fixed capital investment is $2,500,000 and the plant operates about 8,400 h/yr. Working capital is 5% of annual sales revenue. It is a highly automated continuous process involving four processing steps. Plant overhead is 50% of labor payroll. Supervision cost is $80,000 per year Repairs and maintenance cost are 10 % of FCI for the first year and then increase by $50,000 each year. The plant life is 10 years and the company accountant uses the sum- of-the-years-digits method for depreciation. Salvage value of the plant is 10% of FCI. Selling and distribution costs are $100 per ton of product. General overheads are 10% of sales revenue. Use tax rate of 25%. Assume 1 year of construction period. Additional Information: Each ton of product requires: 1,400 kg raw material at $1.00/kg. 280 Kwh electricity at $0.025/Kwh 4,500 kg. steam at $2.5/1,000 kg 300 cubic m. cooling water at $0.05 per cubic m. 25 cubic m. of natural gas at $0.2 per cubic m a) What price should the company charge for the product in order to have a discounted cash flow rate of return of 30%? b) Detemine the profitability of the project using the NPW criterion. Plot both the non- discounted and discounted cash flow diagrams if it operates at 50 % of full capacity for the first year and at 75% of full capacity for the second year. Take im as 15%. Hint: Use the following equation for estimating operating labor cost ($30/hr) Number of Process ing Steps Operating Man- Hours Tons of Products [Tons (Plant Capacity Day where L 10 c) Find the pay-back-time (PBT) either using the plotted non-discounted cash flow diagram or Tcf, = 0. Discuss whether the project is worth investing on or not