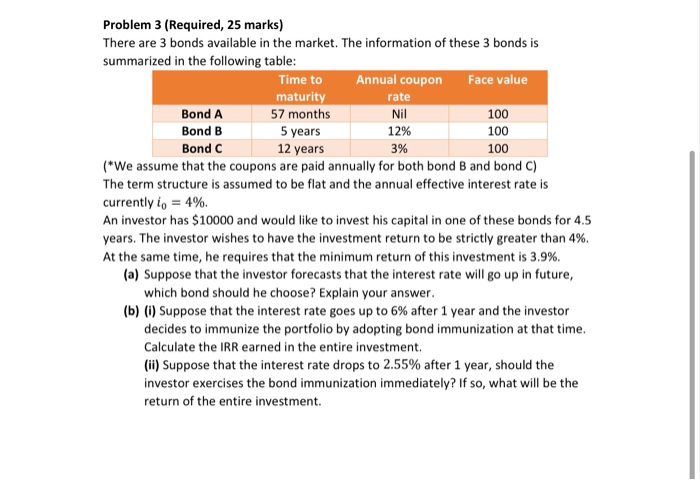

Problem 3 (Required, 25 marks) There are 3 bonds available in the market. The information of these 3 bonds is summarized in the following table: Time to Annual coupon Face value maturity rate Bond A 57 months Nil 100 Bond B 5 years 12% 100 Bond C 12 years 3% 100 (We assume that the coupons are paid annually for both bond B and bond C) The term structure is assumed to be flat and the annual effective interest rate is currently lo = 4%. An investor has $10000 and would like to invest his capital in one of these bonds for 4.5 years. The investor wishes to have the investment return to be strictly greater than 4%. At the same time, he requires that the minimum return of this investment is 3.9% (a) Suppose that the investor forecasts that the interest rate will go up in future, which bond should he choose? Explain your answer. (b) (i) Suppose that the interest rate goes up to 6% after 1 year and the investor decides to immunize the portfolio by adopting bond immunization at that time. Calculate the IRR earned in the entire investment. (ii) Suppose that the interest rate drops to 2.55% after 1 year, should the investor exercises the bond immunization immediately? If so, what will be the return of the entire investment. Problem 3 (Required, 25 marks) There are 3 bonds available in the market. The information of these 3 bonds is summarized in the following table: Time to Annual coupon Face value maturity rate Bond A 57 months Nil 100 Bond B 5 years 12% 100 Bond C 12 years 3% 100 (We assume that the coupons are paid annually for both bond B and bond C) The term structure is assumed to be flat and the annual effective interest rate is currently lo = 4%. An investor has $10000 and would like to invest his capital in one of these bonds for 4.5 years. The investor wishes to have the investment return to be strictly greater than 4%. At the same time, he requires that the minimum return of this investment is 3.9% (a) Suppose that the investor forecasts that the interest rate will go up in future, which bond should he choose? Explain your answer. (b) (i) Suppose that the interest rate goes up to 6% after 1 year and the investor decides to immunize the portfolio by adopting bond immunization at that time. Calculate the IRR earned in the entire investment. (ii) Suppose that the interest rate drops to 2.55% after 1 year, should the investor exercises the bond immunization immediately? If so, what will be the return of the entire investment