Question

Problem 3: Risk Preferences and Insurance Steve, Clark, and Drew are sunflower farmers in the village of Gold. They each have zero wealth, so their

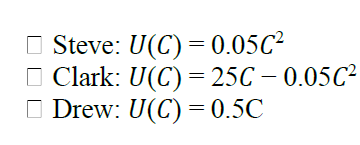

Problem 3: Risk Preferences and Insurance Steve, Clark, and Drew are sunflower farmers in the village of Gold. They each have zero wealth, so their consumption is equal to the income they earn from their economic activity. Each of them must choose one (and only one) of the following three activities: Activity 1: Full time farming. Sunflower farming is risky because of a combination of weather and pests. Under full time farming, the farmer works 7 days per week on their farm. There is a 50% probability of having a GOOD harvest and a 50% chance of having a BAD harvest. If the harvest is GOOD, the farmer earns an income of $200. If the harvest is BAD, the farmer earns an income of only $40. Activity 2: Full time construction work. This activity has no risk. An individual who decides to work full time in construction earns $80 with certainty. Activity 3: Part-time farming. In this third activity, the farmer works during the week as a sunflower farmer and works in construction during the weekend. Since she is not able to work full time on the farm, the probability of having a GOOD harvest and earning $200 drops to 25%, and the probability of having a BAD harvest and earning only $40 increases to 75%. The individual also earns $30 with certainty as a construction worker (the person earns this $30 from construction in addition to her farm income under both a GOOD and BAD harvest).

Jordan is an insurance agent who offers conventional crop insurance contracts only to full time farmers. He is not interested in offering insurance to part time farmers. The contracts are straightforward. At the beginning of the season, farmers pay a premium of $50. At the end of the season, Jordan pays farmers an indemnity payment of $100 if the farmer had a BAD harvest. If the farmer had a GOOD harvest, Jordan doesnt pay the farmer anything. For questions e-f, assume that Jordan has perfect information about the farmers activity choice. In other words, he can write and enforce a contract that requires the farmer to choose full time farming. (e)What is Jordans expected profit from this contract? (Jordans profit is just the premium he collectsfrom the farmer minus the indemnity payment he makes to the farmer).

(f)What is the expected consumption for an individual who chooses full-time farming withJordans insurance contract?

Steve: U(C) = 0.05C Clark: U(C) = 25C -0.05C Drew: U(C) = 0.5C Steve: U(C) = 0.05C Clark: U(C) = 25C -0.05C Drew: U(C) = 0.5CStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started