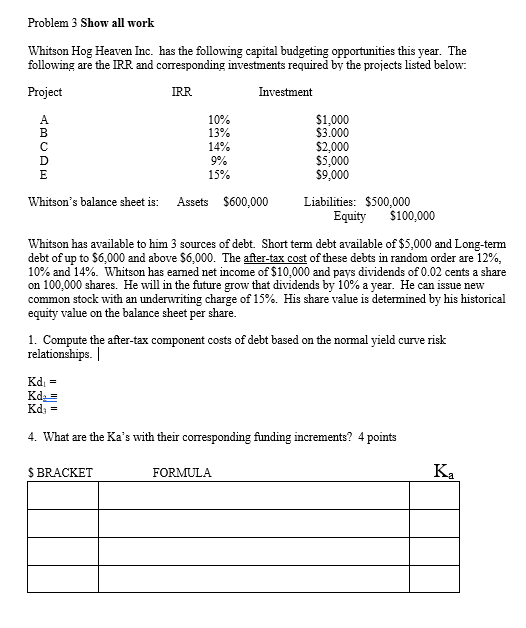

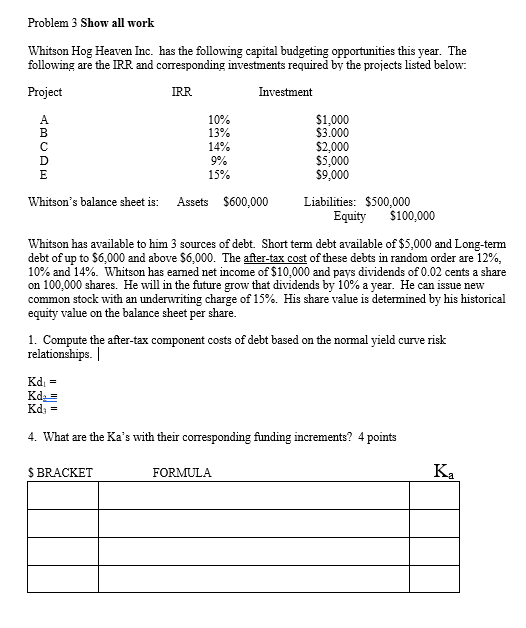

Problem 3 Show all work Whitson Hog Heaven Inc. has the following capital budgeting opportunities this year. The following are the IRR and corresponding investments required by the projects listed below: Project IRR Investment CUA 10% 13% 14% 9% 15% $1,000 $3.000 $2,000 $5,000 $9,000 Whitson's balance sheet is: Assets $600,000 Liabilities: $500,000 Equity $100,000 Whitson has available to him 3 sources of debt. Short term debt available of $5,000 and Long-term debt of up to $6,000 and above $6,000. The after-tax cost of these debts in random order are 12%, 10% and 14%. Whitson has earned net income of $10,000 and pays dividends of 0.02 cents a share on 100,000 shares. He will in the future grow that dividends by 10% a year. He can issue new common stock with an underwriting charge of 15%. His share value is determined by his historical equity value on the balance sheet per share. 1. Compute the after-tax component costs of debt based on the normal yield curve risk relationships. | Kd = Kde Kd = 4. What are the Ka's with their corresponding funding increments? 4 points S BRACKET FORMULA K, Problem 3 Show all work Whitson Hog Heaven Inc. has the following capital budgeting opportunities this year. The following are the IRR and corresponding investments required by the projects listed below: Project IRR Investment CUA 10% 13% 14% 9% 15% $1,000 $3.000 $2,000 $5,000 $9,000 Whitson's balance sheet is: Assets $600,000 Liabilities: $500,000 Equity $100,000 Whitson has available to him 3 sources of debt. Short term debt available of $5,000 and Long-term debt of up to $6,000 and above $6,000. The after-tax cost of these debts in random order are 12%, 10% and 14%. Whitson has earned net income of $10,000 and pays dividends of 0.02 cents a share on 100,000 shares. He will in the future grow that dividends by 10% a year. He can issue new common stock with an underwriting charge of 15%. His share value is determined by his historical equity value on the balance sheet per share. 1. Compute the after-tax component costs of debt based on the normal yield curve risk relationships. | Kd = Kde Kd = 4. What are the Ka's with their corresponding funding increments? 4 points S BRACKET FORMULA K