Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 3: Sidney's Barber Shop in Singapore has five barbers. (Sidney is not one of them.) Each barber is paid $6 per hour and

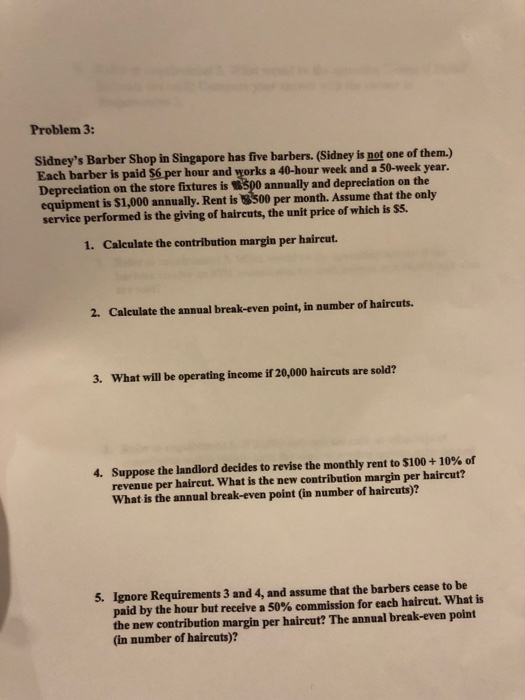

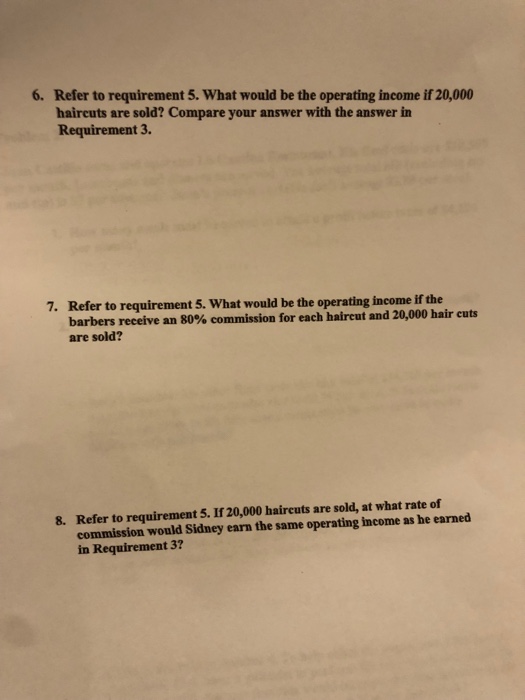

Problem 3: Sidney's Barber Shop in Singapore has five barbers. (Sidney is not one of them.) Each barber is paid $6 per hour and works a 40-hour week and a 50-week year. Depreciation on the store fixtures is 500 annually and depreciation on the equipment is $1,000 annually. Rent is $500 per month. Assume that the only service performed is the giving of haircuts, the unit price of which is $5. 1. Calculate the contribution margin per haircut. 2. Calculate the annual break-even point, in number of haircuts. 3. What will be operating income if 20,000 haircuts are sold? 4. Suppose the landlord decides to revise the monthly rent to $100 + 10% of revenue per haircut. What is the new contribution margin per haircut? What is the annual break-even point (in number of haircuts)? 5. Ignore Requirements 3 and 4, and assume that the barbers cease to be paid by the hour but receive a 50% commission for each haircut. What is the new contribution margin per haircut? The annual break-even point (in number of haircuts)? 6. Refer to requirement 5. What would be the operating income if 20,000 haircuts are sold? Compare your answer with the answer in Requirement 3. 7. Refer to requirement 5. What would be the operating income if the barbers receive an 80% commission for each haircut and 20,000 hair cuts are sold? 8. Refer to requirement 5. If 20,000 haircuts are sold, at what rate of commission would Sidney earn the same operating income as he earned in Requirement 3?

Step by Step Solution

★★★★★

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

1 2 3 4 Cost Item Barber Dep Fixtures Depequipments Rent Total CostTot...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started