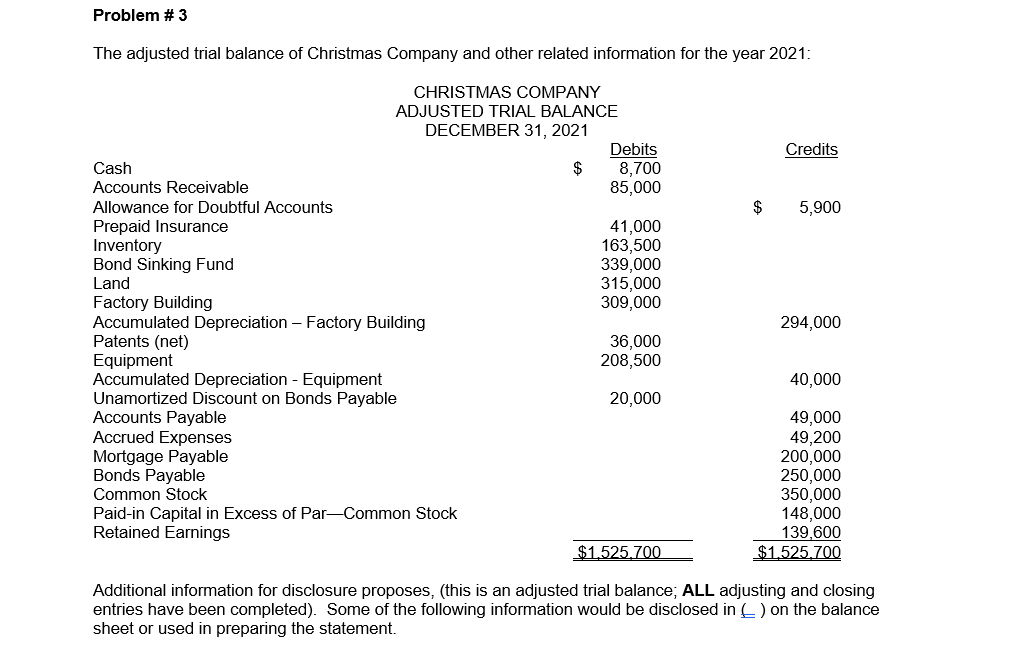

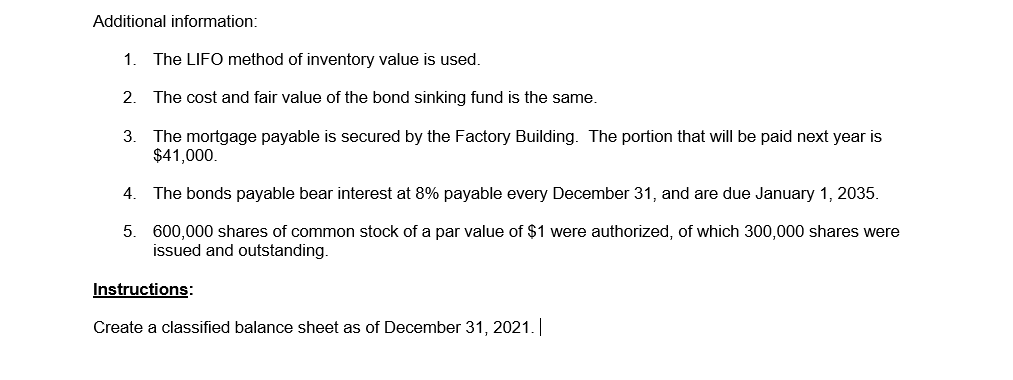

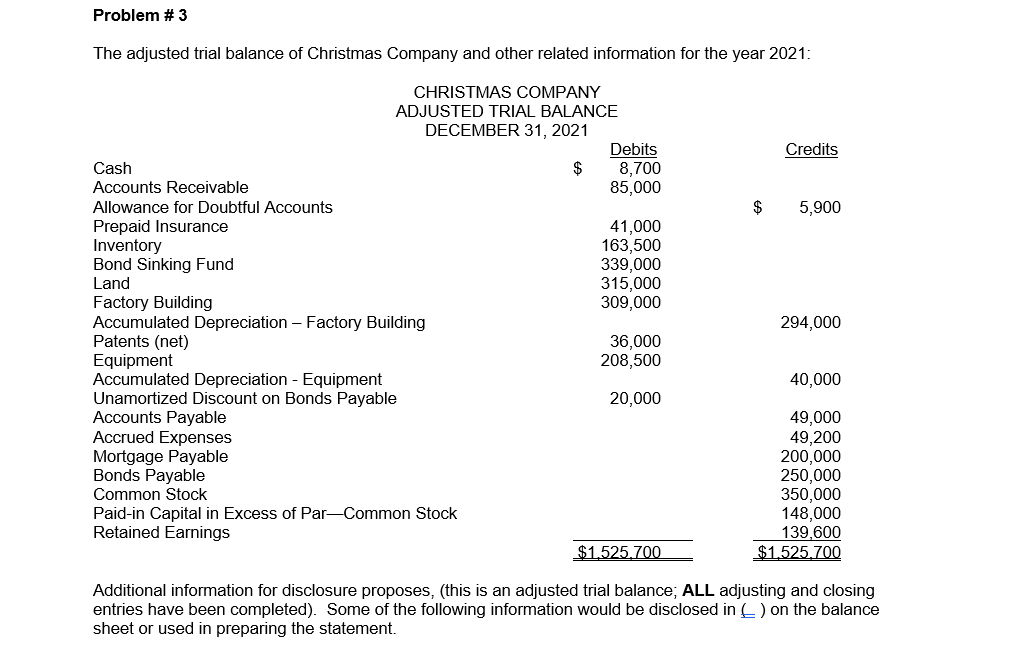

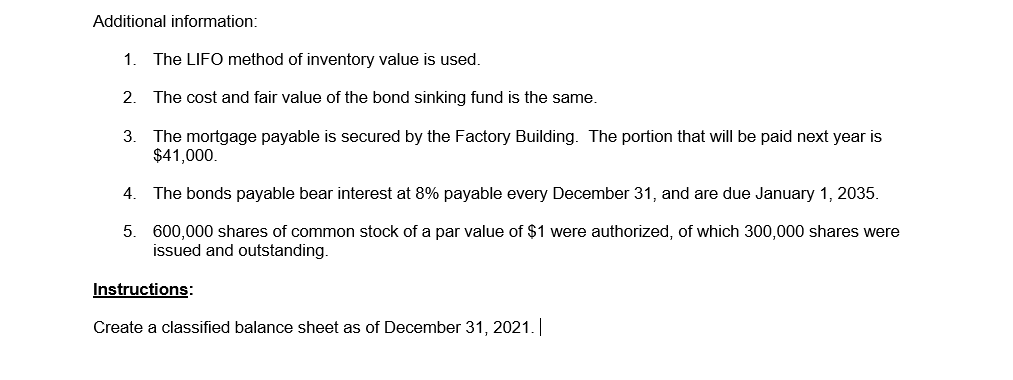

Problem #3 The adjusted trial balance of Christmas Company and other related information for the year 2021: Credits $ 5,900 CHRISTMAS COMPANY ADJUSTED TRIAL BALANCE DECEMBER 31, 2021 Debits Cash $ 8,700 Accounts Receivable 85,000 Allowance for Doubtful Accounts Prepaid Insurance 41,000 Inventory 163,500 Bond Sinking Fund 339,000 Land 315,000 Factory Building 309,000 Accumulated Depreciation - Factory Building Patents (net) 36,000 Equipment 208,500 Accumulated Depreciation - Equipment Unamortized Discount on Bonds Payable 20,000 Accounts Payable Accrued Expenses Mortgage Payable Bonds Payable Common Stock Paid-in Capital in Excess of ParCommon Stock Retained Earnings $1.525.700 294,000 40,000 49,000 49,200 200,000 250,000 350,000 148,000 139,600 $1.525.700 Additional information for disclosure proposes, (this is an adjusted trial balance; ALL adjusting and closing entries have been completed). Some of the following information would be disclosed in E) on the balance sheet or used in preparing the statement. Additional information: 1. The LIFO method of inventory value is used. 2. The cost and fair value of the bond sinking fund is the same. 3. The mortgage payable is secured by the Factory Building. The portion that will be paid next year is $41,000. 4. The bonds payable bear interest at 8% payable every December 31, and are due January 1, 2035. 5. 600,000 shares of common stock of a par value of $1 were authorized, of which 300,000 shares were issued and outstanding. Instructions: Create a classified balance sheet as of December 31, 2021.| Problem #3 The adjusted trial balance of Christmas Company and other related information for the year 2021: Credits $ 5,900 CHRISTMAS COMPANY ADJUSTED TRIAL BALANCE DECEMBER 31, 2021 Debits Cash $ 8,700 Accounts Receivable 85,000 Allowance for Doubtful Accounts Prepaid Insurance 41,000 Inventory 163,500 Bond Sinking Fund 339,000 Land 315,000 Factory Building 309,000 Accumulated Depreciation - Factory Building Patents (net) 36,000 Equipment 208,500 Accumulated Depreciation - Equipment Unamortized Discount on Bonds Payable 20,000 Accounts Payable Accrued Expenses Mortgage Payable Bonds Payable Common Stock Paid-in Capital in Excess of ParCommon Stock Retained Earnings $1.525.700 294,000 40,000 49,000 49,200 200,000 250,000 350,000 148,000 139,600 $1.525.700 Additional information for disclosure proposes, (this is an adjusted trial balance; ALL adjusting and closing entries have been completed). Some of the following information would be disclosed in E) on the balance sheet or used in preparing the statement. Additional information: 1. The LIFO method of inventory value is used. 2. The cost and fair value of the bond sinking fund is the same. 3. The mortgage payable is secured by the Factory Building. The portion that will be paid next year is $41,000. 4. The bonds payable bear interest at 8% payable every December 31, and are due January 1, 2035. 5. 600,000 shares of common stock of a par value of $1 were authorized, of which 300,000 shares were issued and outstanding. Instructions: Create a classified balance sheet as of December 31, 2021.|