Answered step by step

Verified Expert Solution

Question

1 Approved Answer

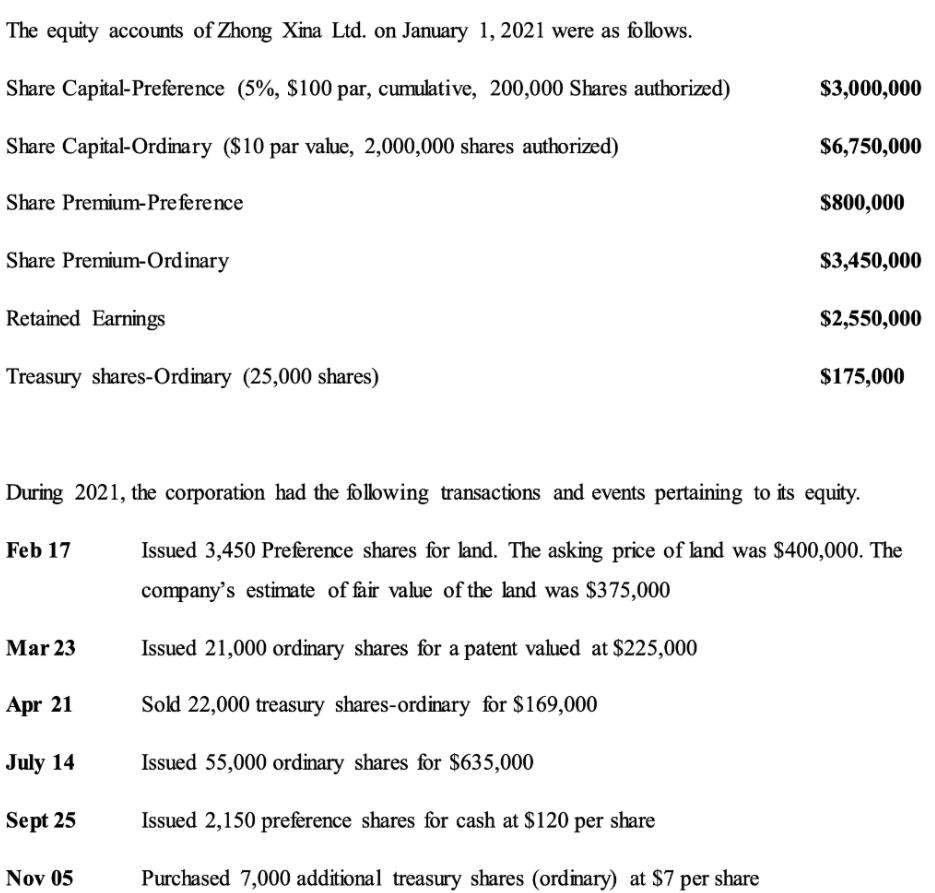

The equity accounts of Zhong Xina Ltd. on January 1, 2021 were as follows. Share Capital-Preference (5%, $100 par, cumulative, 200,000 Shares authorized) $3,000,000

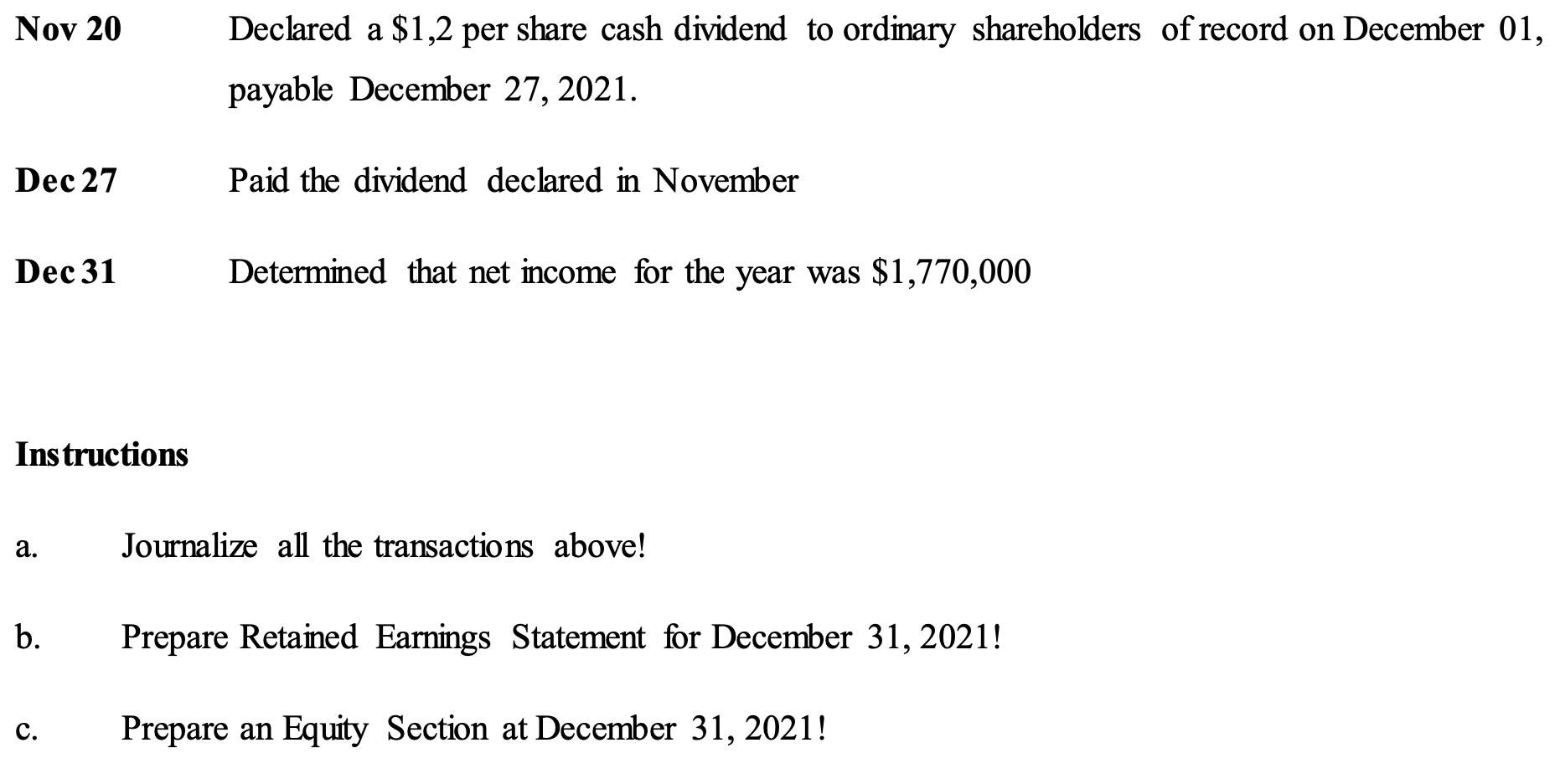

The equity accounts of Zhong Xina Ltd. on January 1, 2021 were as follows. Share Capital-Preference (5%, $100 par, cumulative, 200,000 Shares authorized) $3,000,000 Share Capital-Ordinary ($10 par value, 2,000,000 shares authorized) $6,750,000 Share Premium-Pre ference $800,000 Share Premium-Ordinary $3,450,000 Retained Earnings $2,550,000 Treasury shares-Ordinary (25,000 shares) $175,000 During 2021, the corporation had the following transactions and events pertaining to its equity. Feb 17 Issued 3,450 Preference shares for land. The asking price of land was $400,000. The company's estimate of fair value of the land was $375,000 Mar 23 Issued 21,000 ordinary shares for a patent valued at $225,000 Apr 21 Sold 22,000 treasury shares-ordinary for $169,000 July 14 Issued 55,000 ordinary shares for $635,000 Sept 25 Issued 2,150 preference shares for cash at $120 per share Nov 05 Purchased 7,000 additional treasury shares (ordinary) at $7 per share Nov 20 Declared a $1,2 per share cash dividend to ordinary shareholders of record on December 01, payable December 27, 2021. Dec 27 Paid the dividend declared in November Dec 31 Determined that net income for the year was $1,770,000 Instructions . Journalize all the transactions above! b. Prepare Retained Earnings Statement for December 31, 2021! . Prepare an Equity Section at December 31, 2021!

Step by Step Solution

★★★★★

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Facts Share Capital Preference 5 100 par cumulative 200000 shared authorised 3000000 Oridnary 10 par value 200000 shared authorised 6750000 Share Prem...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started