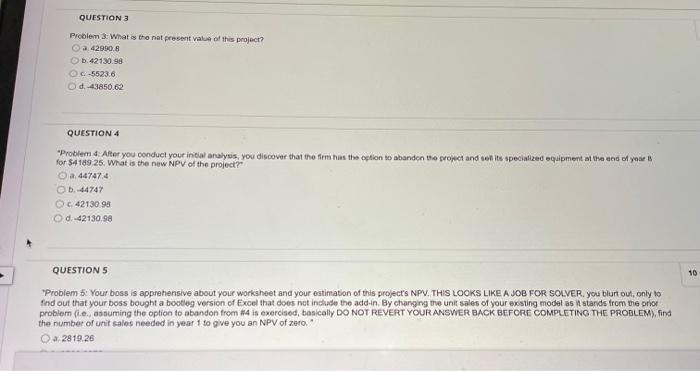

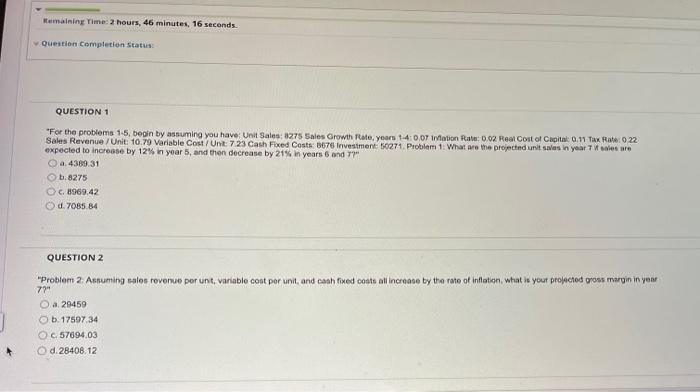

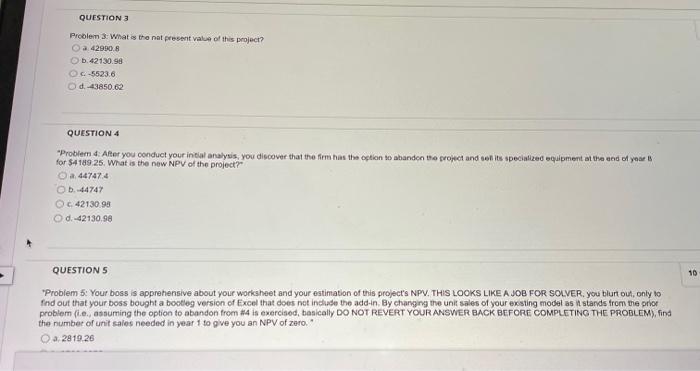

Problem 3: What is tho nat present valua of this project? a. 42990.8 b. 42130.98 c. 5523.6 d. 43850.62 QUESTION 4 Froblem d: Afer you conduct your in ial analysis, you discover that the firm has the option so abanden the gropect and sen its specialized equlipment at the end of yoae B for $4189.25. What is the new NPV of the project? . 44747.4 b. 44747 c. 4213099 d. 42130,98 QUESTION 5 'Problem 5: Your boss is apprehensive about your worksheet and your estimation of this project's NPY. THIS LOOKS LIKE A JOB FOR SOLVER, you blurt but, only to find out that your boss bought a bostleg version of Excel that does net include the add-in. By changing the unit sales of your exsting model as it stands from the priot problem (i.e., assuming the option to abandon from in4 is exercisod, basically DO NOT REVERT YOUR ANSWER BACK BEFORE COMPLETING THE PROBLEM), find the number of unit sales needed in year 1 to give you an NPV of zero." 3,2819,26 expecled to increase by 12% in year 5 , and then decrease by 21% in years 6 and 7?" a. 4369.31 b. 8275 c. 8969.42 d. 7085.84 QUESTION 2 "Problem 2: Assuming eales revenue per unt, variable cost por unit, and cash fixed coats allincrease by tha rate of inflatian, what is yout profected gross margin in year 7?7 a. 29459 b. 17597.34 c. 57694.03 d. 28408.12 Problem 3: What is tho nat present valua of this project? a. 42990.8 b. 42130.98 c. 5523.6 d. 43850.62 QUESTION 4 Froblem d: Afer you conduct your in ial analysis, you discover that the firm has the option so abanden the gropect and sen its specialized equlipment at the end of yoae B for $4189.25. What is the new NPV of the project? . 44747.4 b. 44747 c. 4213099 d. 42130,98 QUESTION 5 'Problem 5: Your boss is apprehensive about your worksheet and your estimation of this project's NPY. THIS LOOKS LIKE A JOB FOR SOLVER, you blurt but, only to find out that your boss bought a bostleg version of Excel that does net include the add-in. By changing the unit sales of your exsting model as it stands from the priot problem (i.e., assuming the option to abandon from in4 is exercisod, basically DO NOT REVERT YOUR ANSWER BACK BEFORE COMPLETING THE PROBLEM), find the number of unit sales needed in year 1 to give you an NPV of zero." 3,2819,26 Problem 3: What is tho nat present valua of this project? a. 42990.8 b. 42130.98 c. 5523.6 d. 43850.62 QUESTION 4 Froblem d: Afer you conduct your in ial analysis, you discover that the firm has the option so abanden the gropect and sen its specialized equlipment at the end of yoae B for $4189.25. What is the new NPV of the project? . 44747.4 b. 44747 c. 4213099 d. 42130,98 QUESTION 5 'Problem 5: Your boss is apprehensive about your worksheet and your estimation of this project's NPY. THIS LOOKS LIKE A JOB FOR SOLVER, you blurt but, only to find out that your boss bought a bostleg version of Excel that does net include the add-in. By changing the unit sales of your exsting model as it stands from the priot problem (i.e., assuming the option to abandon from in4 is exercisod, basically DO NOT REVERT YOUR ANSWER BACK BEFORE COMPLETING THE PROBLEM), find the number of unit sales needed in year 1 to give you an NPV of zero." 3,2819,26 expecled to increase by 12% in year 5 , and then decrease by 21% in years 6 and 7?" a. 4369.31 b. 8275 c. 8969.42 d. 7085.84 QUESTION 2 "Problem 2: Assuming eales revenue per unt, variable cost por unit, and cash fixed coats allincrease by tha rate of inflatian, what is yout profected gross margin in year 7?7 a. 29459 b. 17597.34 c. 57694.03 d. 28408.12 Problem 3: What is tho nat present valua of this project? a. 42990.8 b. 42130.98 c. 5523.6 d. 43850.62 QUESTION 4 Froblem d: Afer you conduct your in ial analysis, you discover that the firm has the option so abanden the gropect and sen its specialized equlipment at the end of yoae B for $4189.25. What is the new NPV of the project? . 44747.4 b. 44747 c. 4213099 d. 42130,98 QUESTION 5 'Problem 5: Your boss is apprehensive about your worksheet and your estimation of this project's NPY. THIS LOOKS LIKE A JOB FOR SOLVER, you blurt but, only to find out that your boss bought a bostleg version of Excel that does net include the add-in. By changing the unit sales of your exsting model as it stands from the priot problem (i.e., assuming the option to abandon from in4 is exercisod, basically DO NOT REVERT YOUR ANSWER BACK BEFORE COMPLETING THE PROBLEM), find the number of unit sales needed in year 1 to give you an NPV of zero." 3,2819,26