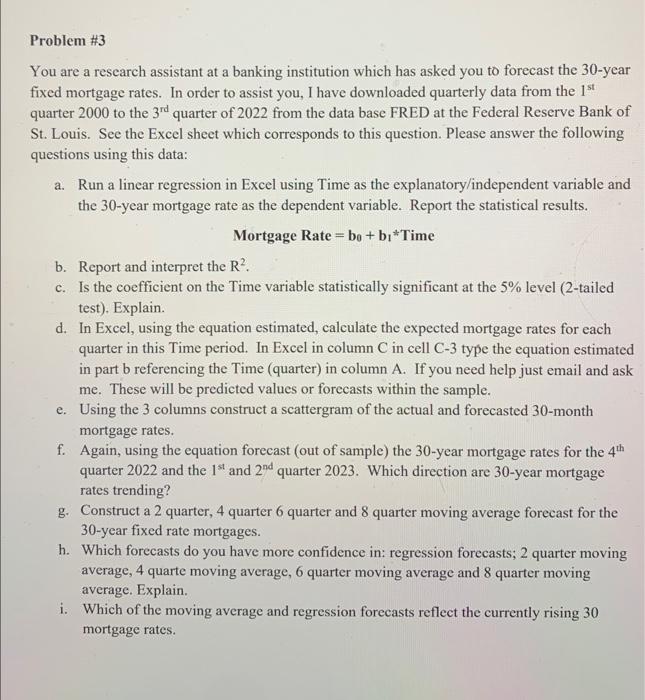

Problem #3 You are a research assistant at a banking institution which has asked you to forecast the 30 -year fixed mortgage rates. In order to assist you, I have downloaded quarterly data from the 1st quarter 2000 to the 3rd quarter of 2022 from the data base FRED at the Federal Reserve Bank of St. Louis. See the Excel sheet which corresponds to this question. Please answer the following questions using this data: a. Run a linear regression in Excel using Time as the explanatory/independent variable and the 30 -year mortgage rate as the dependent variable. Report the statistical results. Mortgage Rate =b0+b1 Time b. Report and interpret the R2. c. Is the coefficient on the Time variable statistically significant at the 5% level (2-tailed test). Explain. d. In Excel, using the equation estimated, calculate the expected mortgage rates for each quarter in this Time period. In Excel in column C in cell C-3 type the equation estimated in part b referencing the Time (quarter) in column A. If you need help just email and ask me. These will be predicted values or forecasts within the sample. e. Using the 3 columns construct a scattergram of the actual and forecasted 30 -month mortgage rates. f. Again, using the equation forecast (out of sample) the 30 -year mortgage rates for the 4th quarter 2022 and the 1st and 2nd quarter 2023. Which direction are 30 -year mortgage rates trending? g. Construct a 2 quarter, 4 quarter 6 quarter and 8 quarter moving average forecast for the 30-year fixed rate mortgages. h. Which forecasts do you have more confidence in: regression forecasts; 2 quarter moving average, 4 quarte moving average, 6 quarter moving average and 8 quarter moving average. Explain. i. Which of the moving average and regression forecasts reflect the currently rising 30 mortgage rates. Problem #3 You are a research assistant at a banking institution which has asked you to forecast the 30 -year fixed mortgage rates. In order to assist you, I have downloaded quarterly data from the 1st quarter 2000 to the 3rd quarter of 2022 from the data base FRED at the Federal Reserve Bank of St. Louis. See the Excel sheet which corresponds to this question. Please answer the following questions using this data: a. Run a linear regression in Excel using Time as the explanatory/independent variable and the 30 -year mortgage rate as the dependent variable. Report the statistical results. Mortgage Rate =b0+b1 Time b. Report and interpret the R2. c. Is the coefficient on the Time variable statistically significant at the 5% level (2-tailed test). Explain. d. In Excel, using the equation estimated, calculate the expected mortgage rates for each quarter in this Time period. In Excel in column C in cell C-3 type the equation estimated in part b referencing the Time (quarter) in column A. If you need help just email and ask me. These will be predicted values or forecasts within the sample. e. Using the 3 columns construct a scattergram of the actual and forecasted 30 -month mortgage rates. f. Again, using the equation forecast (out of sample) the 30 -year mortgage rates for the 4th quarter 2022 and the 1st and 2nd quarter 2023. Which direction are 30 -year mortgage rates trending? g. Construct a 2 quarter, 4 quarter 6 quarter and 8 quarter moving average forecast for the 30-year fixed rate mortgages. h. Which forecasts do you have more confidence in: regression forecasts; 2 quarter moving average, 4 quarte moving average, 6 quarter moving average and 8 quarter moving average. Explain. i. Which of the moving average and regression forecasts reflect the currently rising 30 mortgage rates