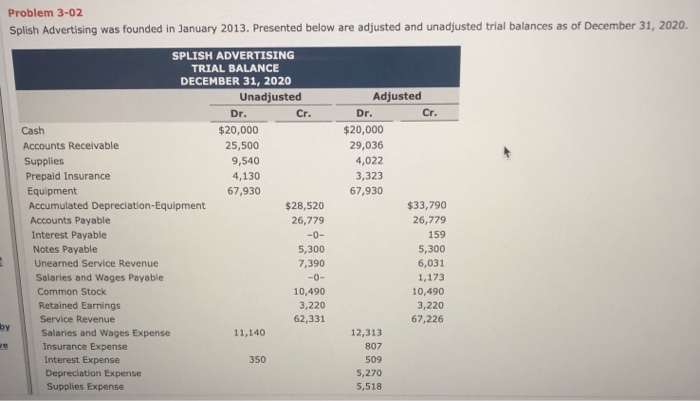

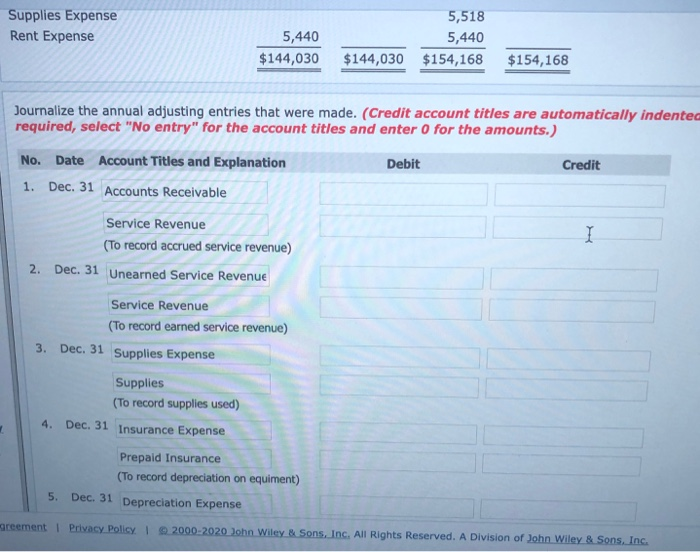

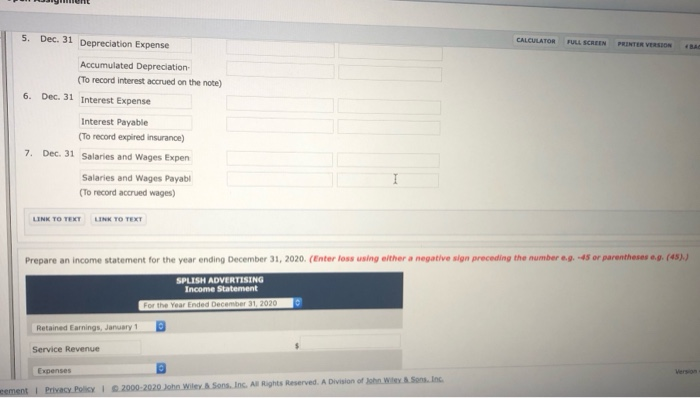

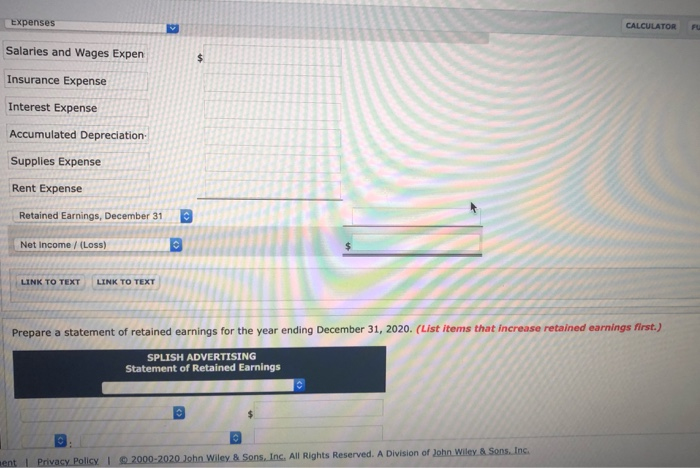

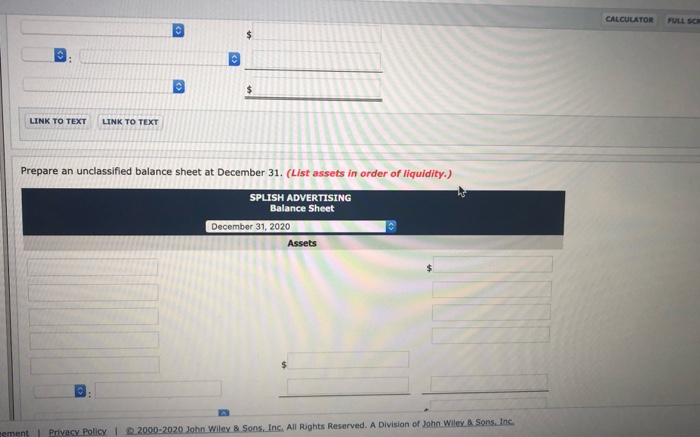

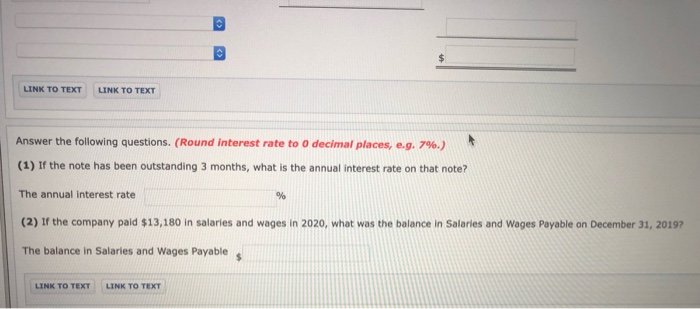

Problem 3-02 Splish Advertising was founded in January 2013. Presented below are adjusted and unadjusted trial balances as of December 31, 2020. SPLISH ADVERTISING TRIAL BALANCE DECEMBER 31, 2020 Unadjusted Dr. Cr. Cash $20,000 Accounts Receivable 25,500 Supplies 9,540 Prepaid Insurance 4,130 Equipment 67,930 Accumulated Depreciation-Equipment $28,520 Accounts Payable 26,779 Interest Payable -0- Notes Payable 5,300 Unearned Service Revenue 7,390 Salaries and Wages Payable -0- Common Stock 10,490 Retained Earnings 3,220 Service Revenue 62,331 Salaries and Wages Expense 11,140 Insurance Expense Interest Expense 350 Depreciation Expense Supplies Expense Adjusted Dr. Cr. $20,000 29,036 4,022 3,323 67,930 $33,790 26,779 159 5,300 6,031 1,173 10,490 3,220 67,226 12,313 807 509 5,270 5,518 by we Supplies Expense Rent Expense 5,440 $144,030 5,518 5,440 $144,030 $154,168 $154,168 1. Journalize the annual adjusting entries that were made. (Credit account titles are automatically indentec required, select "No entry" for the account titles and enter o for the amounts.) No. Date Account Titles and Explanation Debit Credit Dec. 31 Accounts Receivable Service Revenue I (To record accrued service revenue) 2. Dec. 31 Unearned Service Revenue Service Revenue (To record earned service revenue) Dec. 31 Supplies Expense 3. Supplies (To record supplies used) 4. Dec. 31 Insurance Expense Prepaid Insurance (To record depreciation on equiment) 5. Dec. 31 Depreciation Expense greement | Privacy Policy. I 2000-2020 John Wiley & Sons, Inc. All Rights Reserved. A Division of John Wiley & Sons, Inc. 5. Dec. 31 Depreciation Expense CALCULATOR FULL SCREEN PRINTER VERSION Accumulated Depreciation (To record interest accrued on the note) Dec. 31 Interest Expense 6. Interest Payable (To record expired insurance) 7. Dec. 31 Salaries and Wages Expen Salaries and Wages Payabl (To record accrued wages) LINK TO TEXT LINK TO TEXT Prepare an income statement for the year ending December 31, 2020. (Enter loss using either a negative slon preceding the number 4.0.45 or parentheses 0.9 (48)) SPLISH ADVERTISING Income Statement For the Year Ended December 31, 2020 Retained Earnings, January 1 Service Revenue Expenses eement | Privacy Policy | 2000-2020 John Wiley & Sons, Inc. All Rights Reserved. A Division of John Wiley & Sons, Inc. Expenses CALCULATOR F Salaries and Wages Expen $ Insurance Expense Interest Expense Accumulated Depreciation Supplies Expense Rent Expense Retained Earnings, December 31 C Net Income /(Loss) LINK TO TEXT LINK TO TEXT Prepare a statement of retained earnings for the year ending December 31, 2020. (List items that increase retained earnings first.) SPLISH ADVERTISING Statement of Retained Earnings rent | Privacy Policy 2000-2020 John Wiley & Sons, Inc. All Rights Reserved. A Division of John Wiley & Sons, Inc. CALCULATOR FULL SC $ $ LINK TO TEXT LINK TO TEXT Prepare an unclassified balance sheet at December 31. (List assets in order of liquidity.) SPLISH ADVERTISING Balance Sheet December 31, 2020 Assets : eement Privacy Policy | 2000-2020 John Wiley & Sons, Inc. All Rights Reserved. A Division of John Wiley & Sons, Inc. $ LINK TO TEXT LINK TO TEXT Answer the following questions. (Round interest rate to o decimal places, e.g. 7%.) (1) If the note has been outstanding 3 months, what is the annual interest rate on that note? The annual interest rate (2) If the company paid $13,180 in salaries and wages in 2020, what was the balance in Salaries and Wages Payable on December 31, 20197 The balance in Salaries and Wages Payable % $ LINK TO TEXT LINK TO TEXT