Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PROBLEM 30-4 Weighted Average with Bonus Issue On January 1 of the current year, Stephanie Company had 200,000 issued and outstanding ordinary shares. The entity

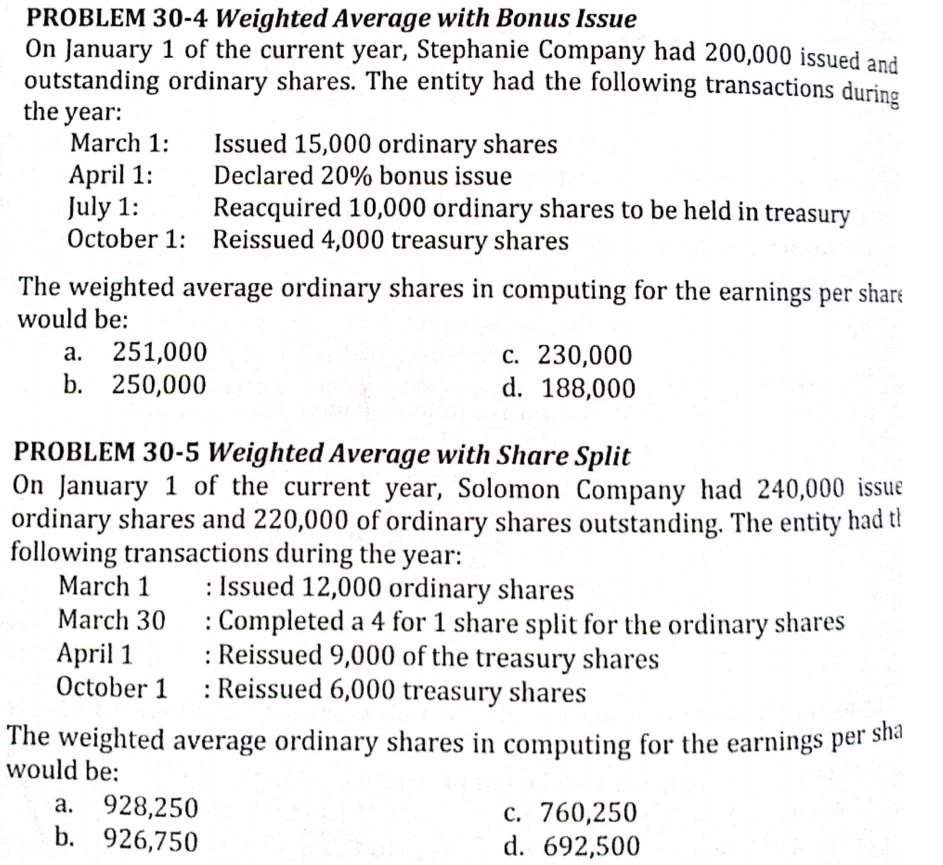

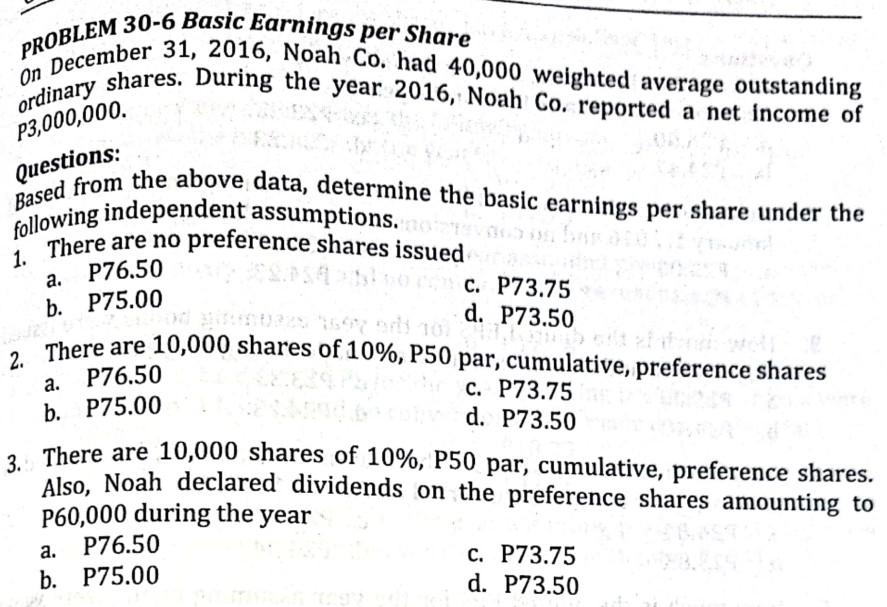

PROBLEM 30-4 Weighted Average with Bonus Issue On January 1 of the current year, Stephanie Company had 200,000 issued and outstanding ordinary shares. The entity had the following transactions during the year: March 1: Issued 15,000 ordinary shares April 1: Declared 20% bonus issue July 1: Reacquired 10,000 ordinary shares to be held in treasury October 1: Reissued 4,000 treasury shares The weighted average ordinary shares in computing for the earnings per share would be: a. 251,000 c. 230,000 b. 250,000 d. 188,000 PROBLEM 30-5 Weighted Average with Share Split On January 1 of the current year, Solomon Company had 240,000 issue ordinary shares and 220,000 of ordinary shares outstanding. The entity had th following transactions during the year: March 1 : Issued 12,000 ordinary shares March 30 : Completed a 4 for 1 share split for the ordinary shares April 1 : Reissued 9,000 of the treasury shares October 1 : Reissued 6,000 treasury shares The weighted average ordinary shares in computing for the earnings per sha would be: a. 928,250 c. 760,250 b. 926,750 d. 692,500 PROBLEM 30-6 Basic Earnings per Share On December 31, 2016, Noah Co. had 40,000 weighted average outstanding ordinary shares. During the year 2016, Noah Co. reported a net income of P3,000,000. Questions: Based from the above data, determine the basic earnings per share under the following independent assumptions. 1. There are no preference shares issued c. P73.75 LESSER A 10 d. P73.50 2. There are 10,000 shares of 10%, P50 par, cumulative, preference shares P76.50 c. P73.75 a. P76.50 b. P75.00 a. b. P75.00 d. P73.50 3. There are 10,000 shares of 10%, P50 par, cumulative, preference shares. Also, Noah declared dividends on the preference shares amounting to P60,000 during the year a. P76.50 b. P75.00 c. P73.75 d. P73.50

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started