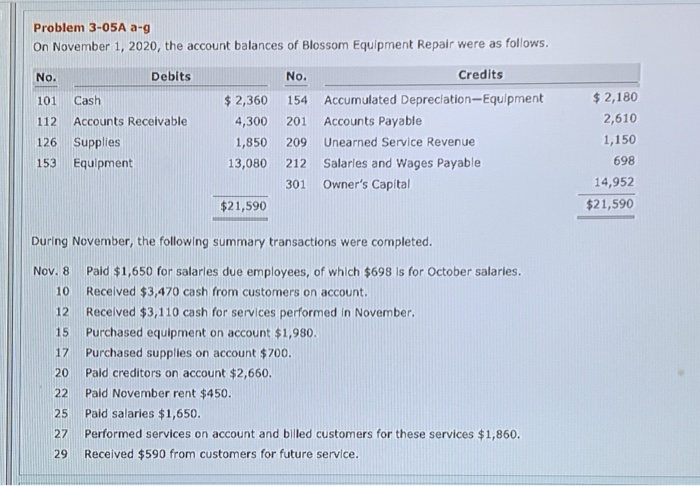

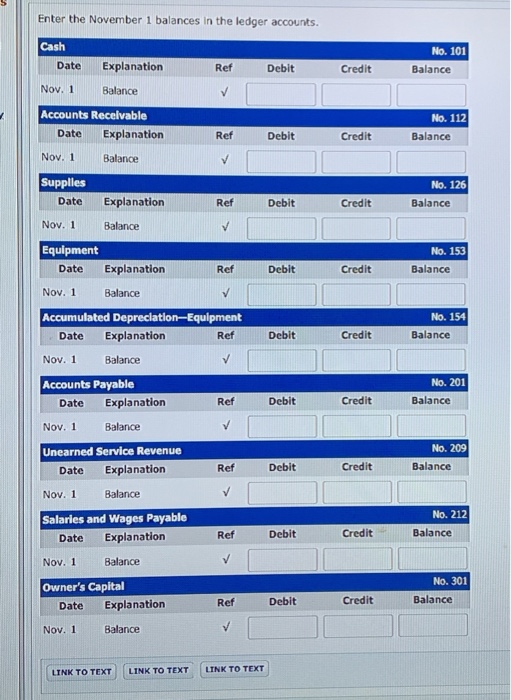

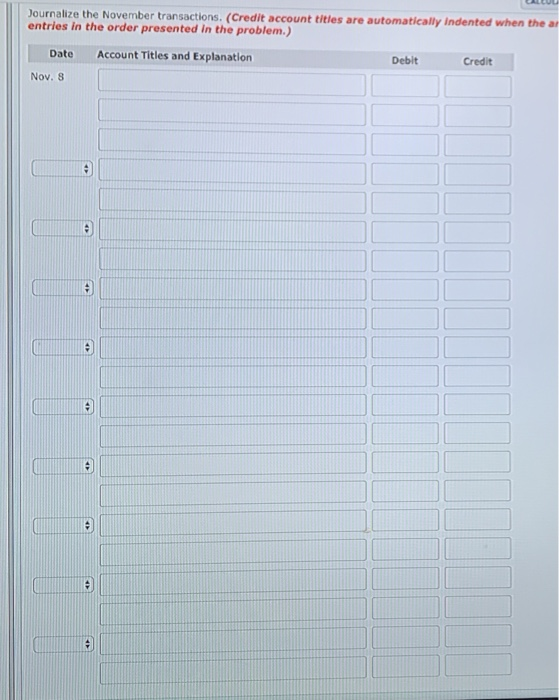

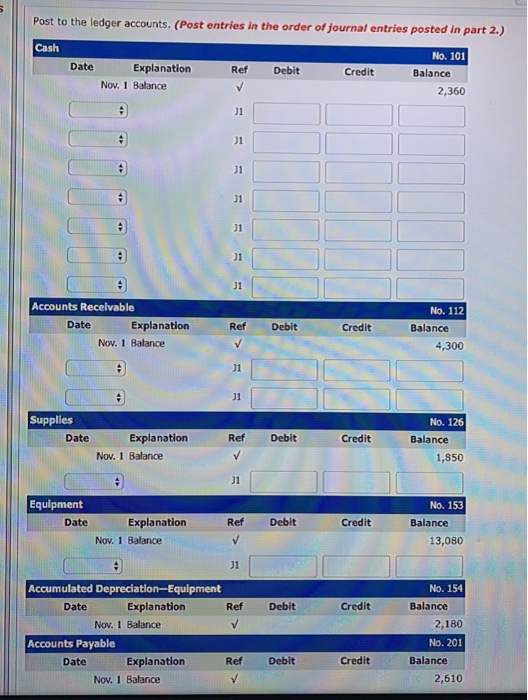

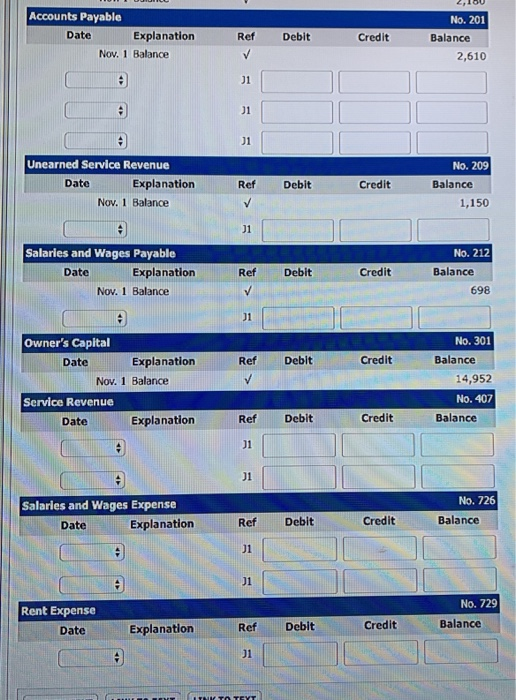

Problem 3-05A a-g On November 1, 2020, the account balances of Blossom Equipment Repair were as follows. No. 101 Caslh 112 Accounts Receivable 126 Supplies 153 Equipment Credits Debits No. $ 2,180 2,610 1,150 698 14,952 $21,590 $2,360 154 Accumulated Depreciation-Equipment 4,300 201 Accounts Payable 1,850 209 Unearned Service Revenue 13,080 212 Salaries and Wages Payable 301 Owner's Capital $21,590 During November, the following summary transactions were completed. Nov. 8 Paid $1,650 for salarles due employees, of which $698 Is for October salaries. 10 Received $3,470 cash from customers on account. 12 Received $3,110 cash for services performed in November. 15 Purchased equipment on account $1,980 17 Purchased supplies on account $700. 20 Pald creditors on account $2,660. 22 Paid November rent $450. 25 Paid salaries $1,650. 27 Performed services on account and billed customers for these services $1,860. 29 Received $590 from customers for future service. Enter the November 1 balances in the ledger accounts Cash No. 101 Date Explanation Nov. 1 Balance Accounts Receivable Debit Credit Balance No. 112 Date Explanation Ref Debit Balance Credit Nov. 1 Balanoe No. 126 Date Explanation Nov. 1 Balanoe Equipment Ref Debit Credit Balance No. 153 Date Explanation Nov. 1 Balance Accumulated Depreclation-Equipment Ref Debit Balance Credit No. 154 Ref Balance Date Explanation Nov. 1 Balance Accounts Payable Debit Credit No. 201 Balance Ref Debit Credit Date Explanation Nov. 1 Balance Unearned Service Revenue No. 209 Balance Debit Credit Ref Date Explanation Nov. 1 Balance Salaries and Wages Payable No. 212 Balance Debit Credit Date Explanation Nov. 1 Balance Owner's Capital Ref No. 301 Balance Debit Credit Date Explanation Nov. 1 Balance LINK TO TEXT LINK TO TEXT LINK TO TEXT ournalize the November transactions. (Credit account titles are automatically Indented when the ar entries in the order presented in the problem Account Titles and Explanation Credit Date Debit Nov. s Post to the ledger accounts. (Post entries in the order of journal entries posted in part 2.) Cash No. 101 Explanation Ref Debit Date Credit Balance Nov. 1 Balance 2,360 01 01 01 01 01 No. 112 Accounts Recelvable Credit Balance Ref Debit Explanation Date 4,300 Nov. 1 Balance 01 No. 126 Supplies Credit Balance Debit Ref Explanation Date 1,850 Nov. 1 Balance J1 No. 153 Equipment Credit Balance Date Explanation Nov. 1 Balance Ref Debit 13,080 No. 154 Accumulated Depreclation-Equipment Balance Credit Ref Debit Explanation Date 2,180 No. 201 Nov. 1 Balance Accounts Payable Balance Credit Ref Debit Explanation Date 2,610 Nov. 1 Balance Accounts Payable Date No. 201 Explanatiorn Ref Debit Credit Balance Nov. 1 Balance 2,610 01 J1 Unearned Service Revenue No. 209 Date Explanation Credit Ref Debit Balance Nov. 1 Balance 1,150 Salaries and Wages Payable No. 212 Credit Explanation Balance Date Ref Debit Nov. 1 Balance 698 No. 301 owner's Capital Ref Debit Credit Balance Explanation Date 14,952 No. 407 Nov. 1 Balance Service Revenue Credit Balance Ref Debit Explanation Date 01 No. 726 Salarles and Wages Expense Balance Credit Ref Debit Explanation Date 01 No. 729 Rent Expense Balance Credit Ref Debit Explanation Date