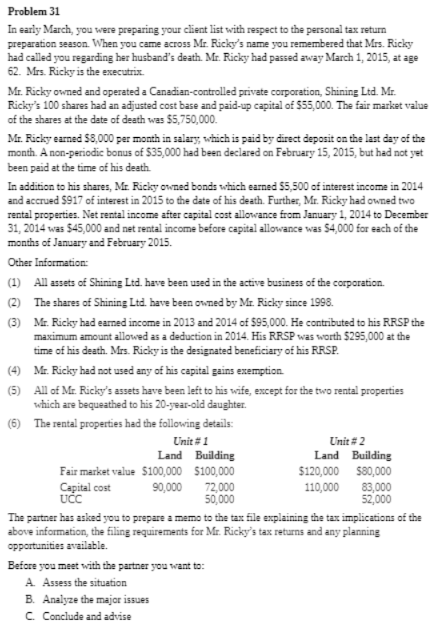

Problem 31 In early March, you were preparing your client list with respect to the personal tax return preparation season. When you came across Mr. Ricky's name you remembered that Mrs. Ricky had called you regarding her husband's death. Mr. Ricky had passed away March 1, 2015, at age 62. Mrs. Ricky is the executrix. Mr. Ricky owned and operated a Canadian-controlled private corporation, Shining Ltd. Mr. Ricky's 100 shares had an adjusted cost base and paid-up capital of $55,000. The fair market value of the shares at the date of death was $5,750,000. Mr. Ricky earned $6,000 per month in salary, which is paid by direct deposit on the last day of the month. A non-periodic bonus of $35,000 had been declared on February 15, 2015, but had not yet been paid at the time of his death. In addition to his shares, Mr. Ricky owned bonds which earned $5,500 of interest income in 2014 and accrued $917 of interest in 2015 to the date of his death. Further, Mr. Ricky had owned two rental properties. Net rental income after capital cost allowance from January 1, 2014 to December 31, 2014 was $45,000 and net rental income before capital allowance was $4,000 for each of the months of January and February 2015. Other Information: (1) All assets of Shining Ltd. have been used in the active business of the corporation. (2) The shares of Shining Ltd. have been owned by Mr. Ricky since 1996. (3) Mr. Ricky had earned income in 2013 and 2014 of $95,000. He contributed to his RRSP the maximum amount allowed as a deduction in 2014. His RRSP was worth $295,000 at the time of his death. Mrs. Ricky is the designated beneficiary of his RRSP. (4) Mr. Ricky had not used any of his capital gains exemption. (5) All of Mr. Ricky's assets have been left to his wife, except for the two rental properties which are bequeathed to his 20-year-old daughter. (6) The rental properties had the following details: Unit # 1 Unit # 2 Land Building Land Building Fair market value $100,000 $100,000 $120,000 $80,000 Capital cost 90,000 72,000 110,000 83,000 UCC 50,000 52,000 The partner has asked you to prepare a memo to the tax file explaining the tax implications of the above information, the filing requirements for Mr. Ricky's tax returns and any planning opportunities available. Before you meet with the partner you want to: A. Assess the situation B. Analyze the major issues C. Conclude and advise