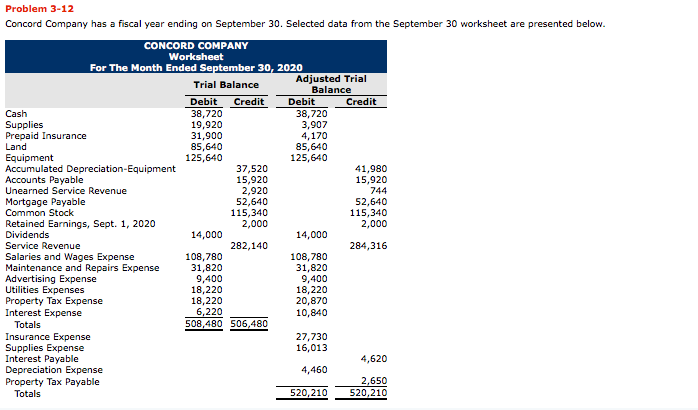

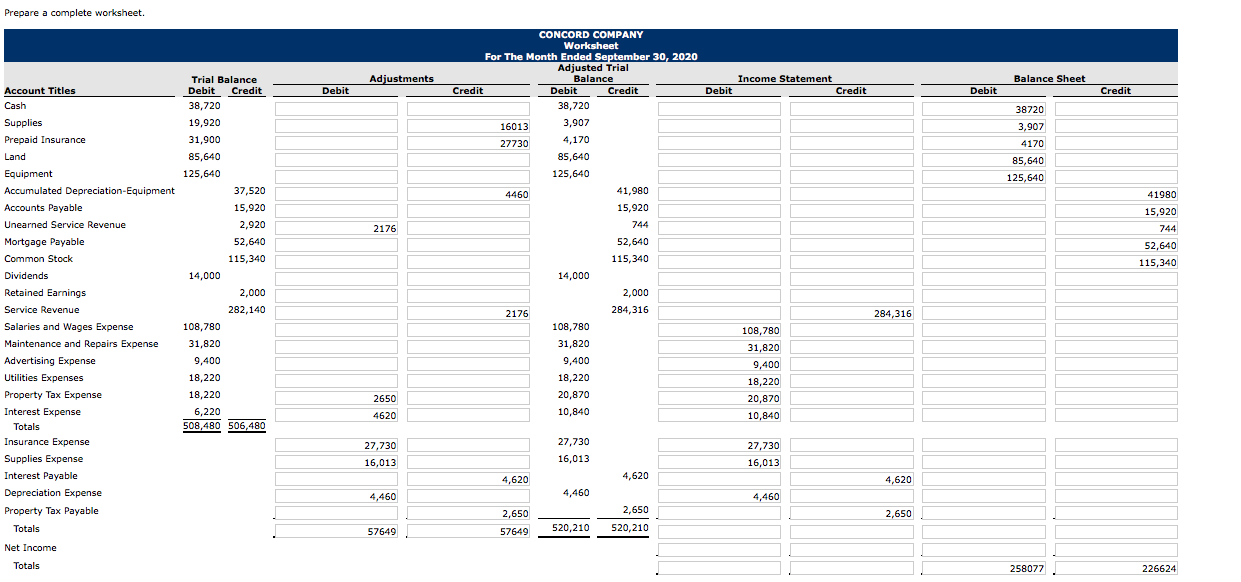

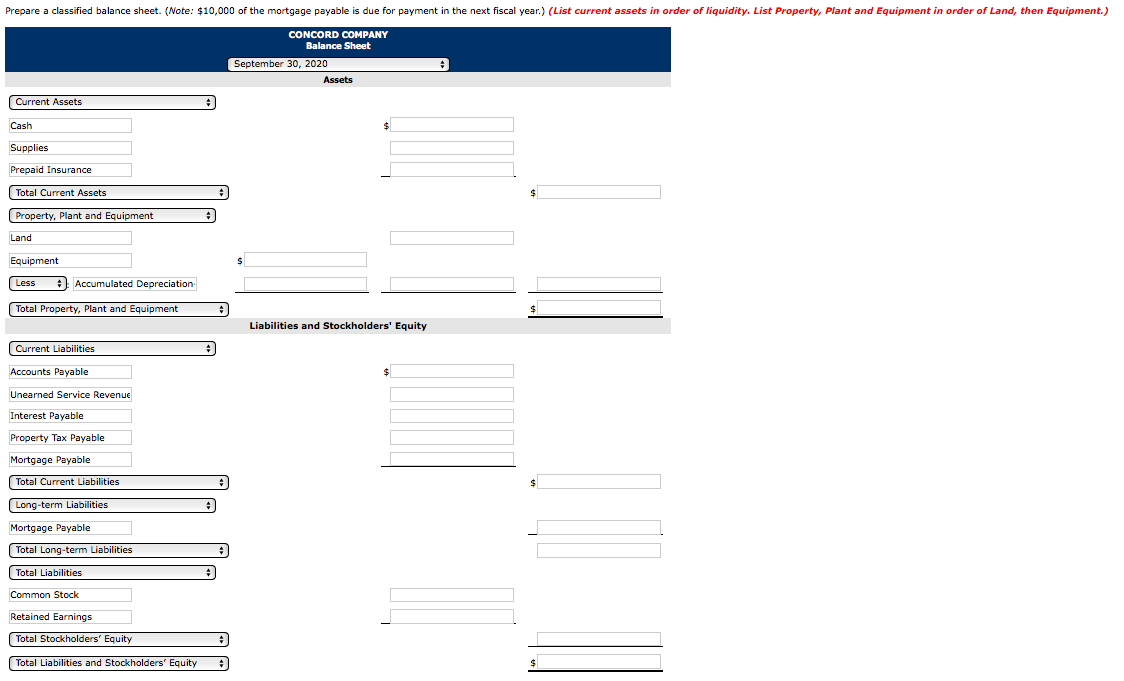

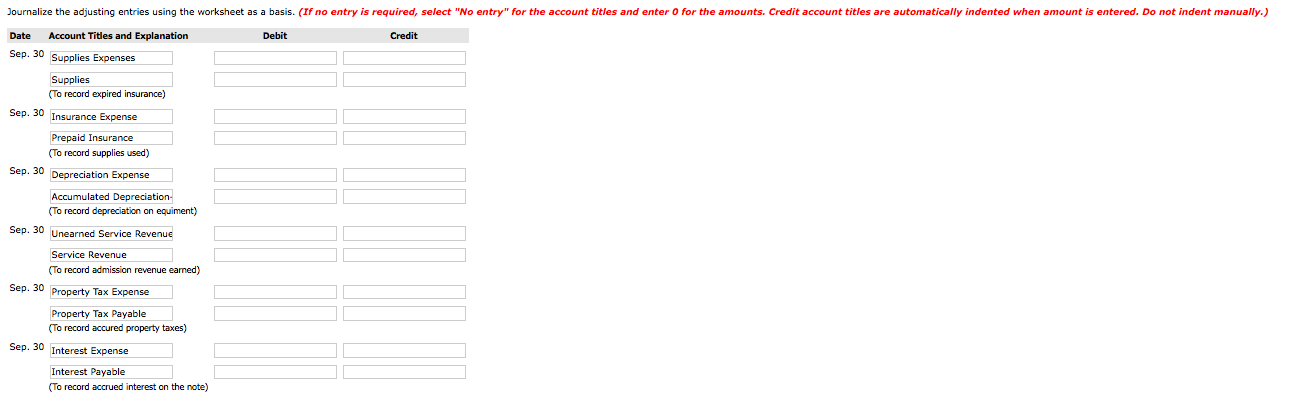

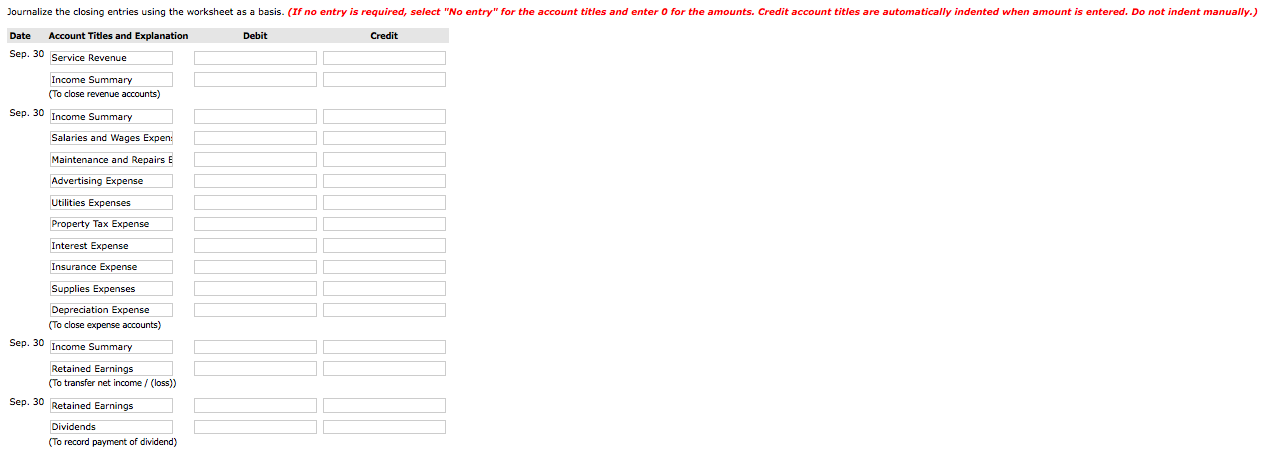

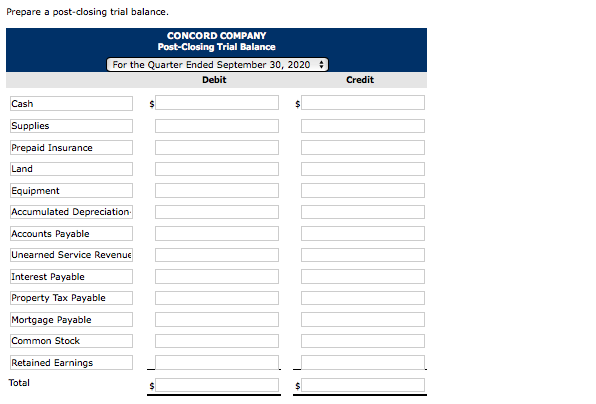

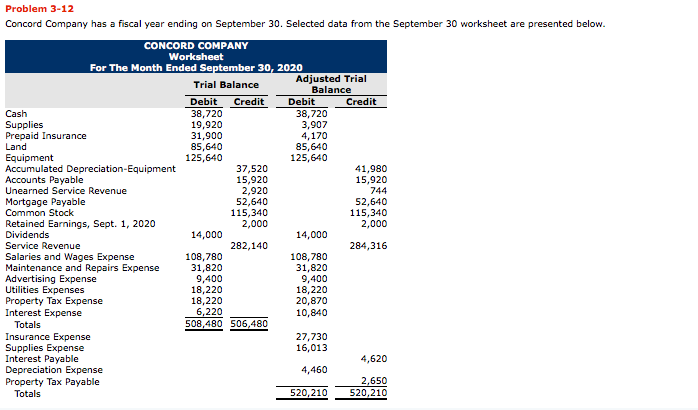

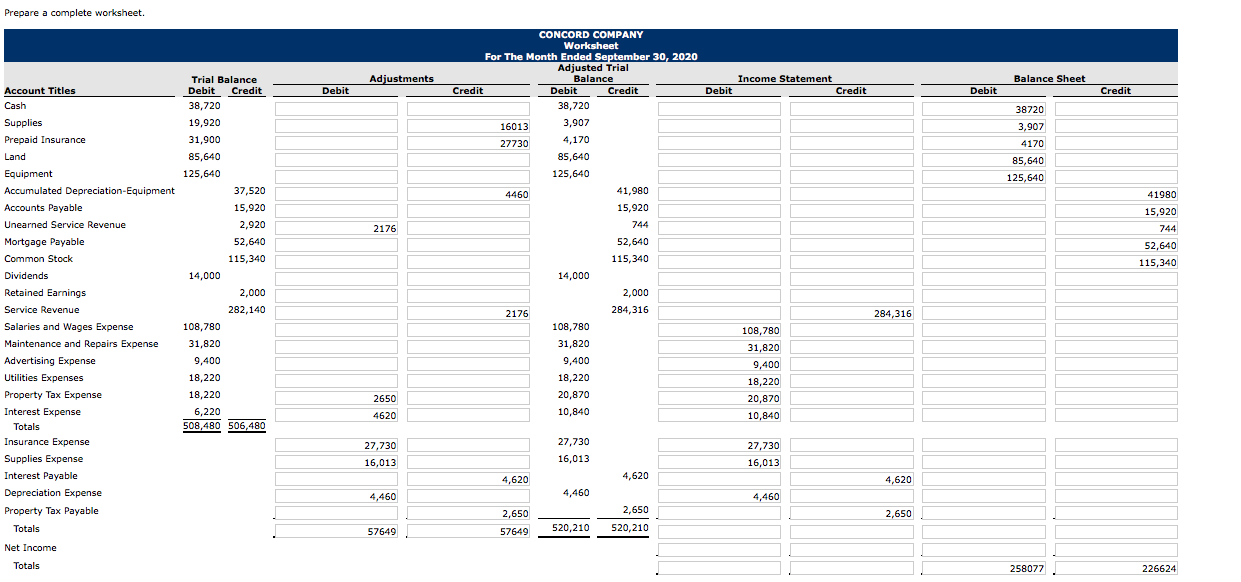

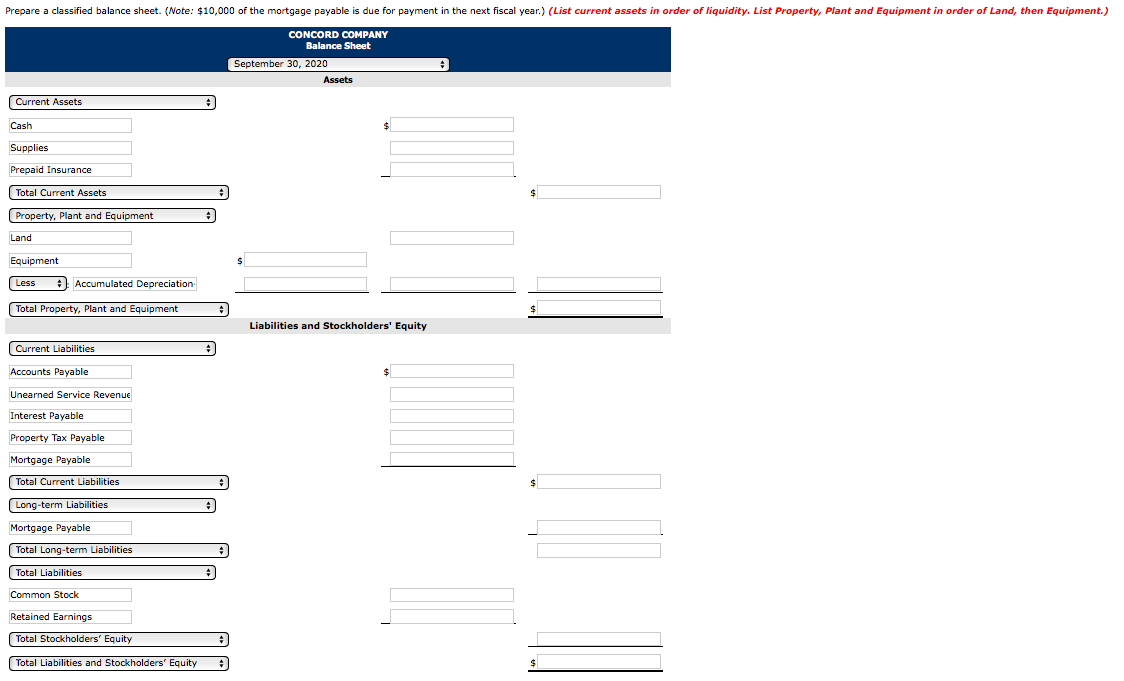

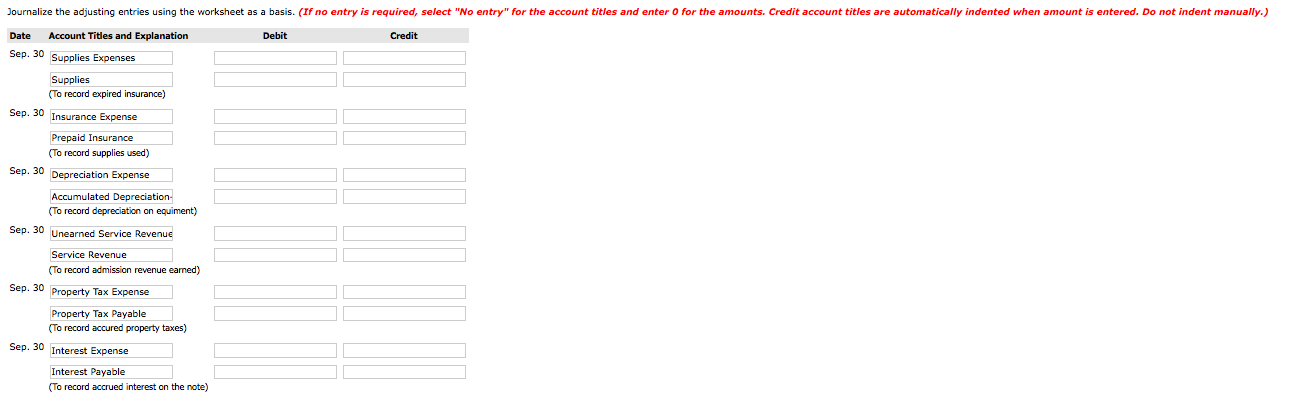

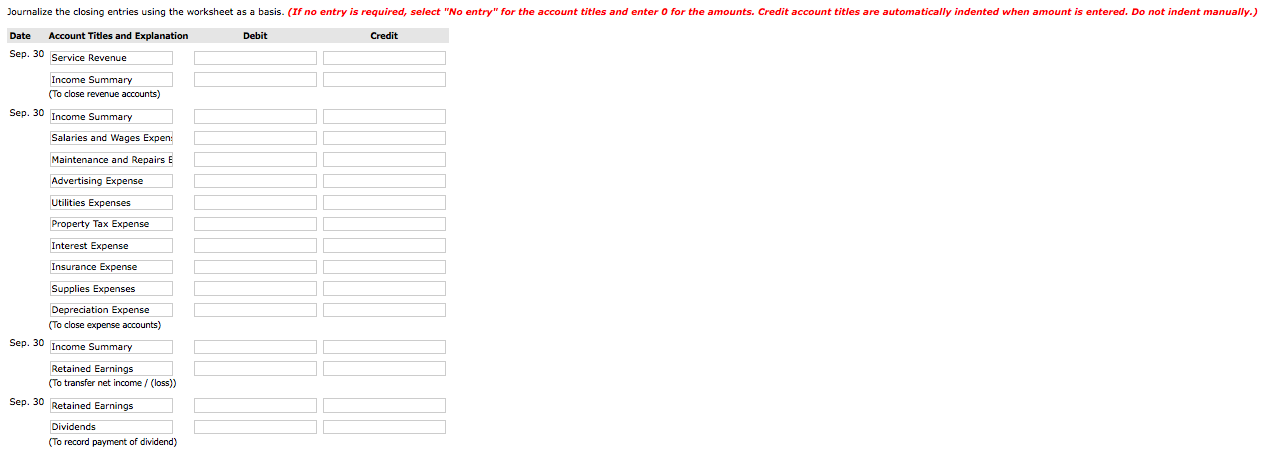

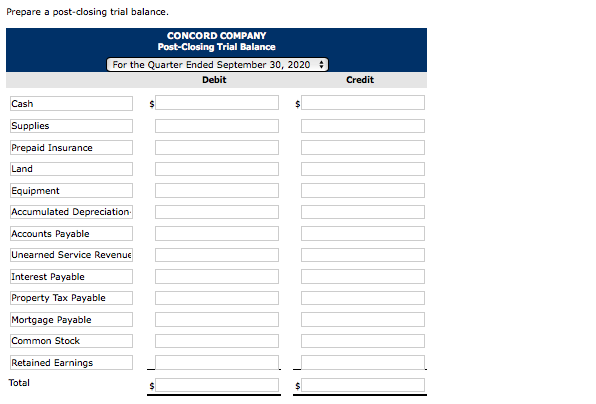

Problem 3-12 Concord Company has a fiscal year ending on September 30. Selected data from the September 30 worksheet are presented below CONCORD COMPANY Worksheet For The Month Ended September 30, 2020 Adjusted Trial Balance Trial Balance Debit Credit Debit Credit 38,720 Cash 38,720 3,907 4,170 85,640 125,640 Supplies Prepaid Insurance Land 19,920 31,900 85,640 125,640 Equipment Accumulated Depreciation-Equipment Accounts Payable 37,520 15,920 2,920 52,640 115,340 2,000 41,980 15,920 Unearned Service Revenue 744 Mortgage Payable Common Stock 52,640 115,340 2,000 Retained Earnings, Sept. 1, 2020 Dividends 14,000 14,000 Service Revenue 282,140 284,316 Salaries and Wages Expense Maintenance and Repairs Expense Advertising Expense Utilities Expenses Property Tax Expense Interest Expense 108,780 31,820 9,400 18,220 18,220 6,220 508,480 506,480 108,780 31,820 9,400 18,220 20,870 10,840 Totals Insurance Expense Supplies Expense Interest Payable Depreciation Expense Property Tax Payable 27,730 16,013 4,620 4,460 2,650 520,210 520,210 Totals Prepare a complete worksheet. CONCORD COMPANY Worksheet For The Month Ended September 30, 2020 Adjusted Trial Balance Income Statement Balance Sheet Adjustments Trial Balance Debit Credit Debit Credit Account Titles Debit Credit Credit Debit Debit Credit Cash 38,720 38,720 38720 Supplies 19,920 3,907 16013 3,907 Prepaid Insurance 31,900 4,170 27730 4170 85,640 Land 85,640 85,640 Equipment 125,640 125,640 125,640 Accumulated Depreciation-Equipment 37,520 41,980 4460 41980 Accounts Payable 15,920 15,920 15,920 2,920 Unearned Service Revenue 744 2176 744 Mortgage Payable 52,640 52,640 52,640 115,340 Common Stock 115,340 115,340 Dividends 14,000 14,000 Retained Earnings 2,000 2,000 Service Revenue 282,140 284,316 284,316 2176 108,780 Salaries and Wages Expense 108,780 108,780 Maintenance and Repairs Expense 31,820 31,820 31,820 9,400 Advertising Expense 9,400 9,400 Utilities Expenses 18,220 18,220 18,220 18,220 Property Tax Expense 20,870 20,870 2650 Interest Expense 6,220 10,840 4620 10,840 508,480 506,480 Totals Insurance Expense 27,730 27,730 27,730 Supplies Expense 16,013 16,013 16,013 4,620 Interest Payable 4,620 4,620 Depreciation Expense 4,460 4,460 4,460 2,650 Property Tax Payable 2,650 2,650 520,210 520,210 Totals 57649 57649 Net Income Totals 258077 226624 Prepare a classified balance sheet. (Note: $10,000 of the mortgage payable is due for payment in the next fiscal year.) (List current assets in order of liquidity. List Property, Plant and Equipment in order of Land, then Equipment.) CONCORD COMPANY Balance Sheet September 30, 2020 Assets Current Assets Cash Supplies Prepaid Insurance Total Current Assets Property, Plant and Equipment Land Equipment Less Accumulated Depreciation Total Property, Plant and Equipment Liabilities and Stockholders' Equity Current Liabilities Accounts Payable Unearned Service Revenue Interest Payable Property Tax Payable Mortgage Payable Total Current Liabilities Long-term Liabilities Mortgage Payable Total Long-term Liabilities Total Liabilities Common Stock Retained Earnings Total Stockholders' Equity Total Liabilities and Stockholders' Equity Journalize the adjusting entries using the worksheet as a basis. (If no entry is required, select "No entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount entered. Do not indent manually.) Account Titles and Explanation Debit Credit Sep. 30 Supplies Expenses Supplies (To record expired insurance) Sep. 30 Insurance Expense Prepaid Insurance (To record supplies used) Sep. 30 Decreciation Expense Accumulated Depreciation (To record depreciation on equiment) Sep. 30 Unearned Service Revenue Service Revenue (To record admission revenue eamed) Sep. 30 Property Tax Expense Property Tax Payable (To record accured property taxes) Sep. 30 Interest Expense Interest Payable (To record accrued interest on the note) Journalize the closing entries using the worksheet as a basis. (If no entry is required, select "No entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation Debit Credit Sep. 30 Service Revenue Income Summary (To close revenue accounts) Sep. 30 Income Summary Salaries and Wages Expen Maintenance and Repairs E Advertising Expense Utilities Expenses Property Tax Expense Interest Expense Insurance Expense Supplies Expenses Depreciation Expense (To close expense accounts) Sep. 30 Income Summary Retained Earnings (To transfer net income/(loss)) Sep. 30 Retained Earnings Dividends (To record payment of dividend) Prepare a post-closing trial balance CONCORD COMPANY Post-Closing Trial Balance For the Quarter Ended September 30, 2020 Debit Credit Cash S Supplies Prepaid Insurance Land Equipment Accumulated Depreciation- Accounts Payable Unearned Service Revenue Interest Payable Property Tax Payable Mortgage Payable Common Stock Retained Earnings Total