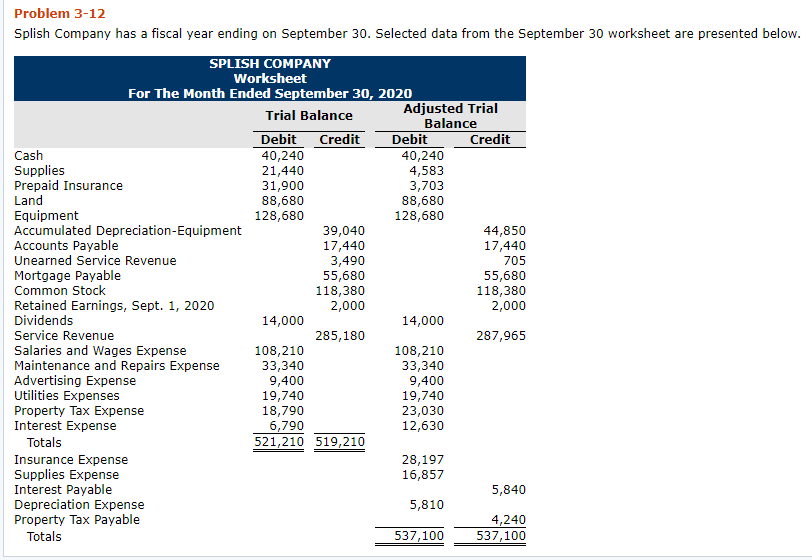

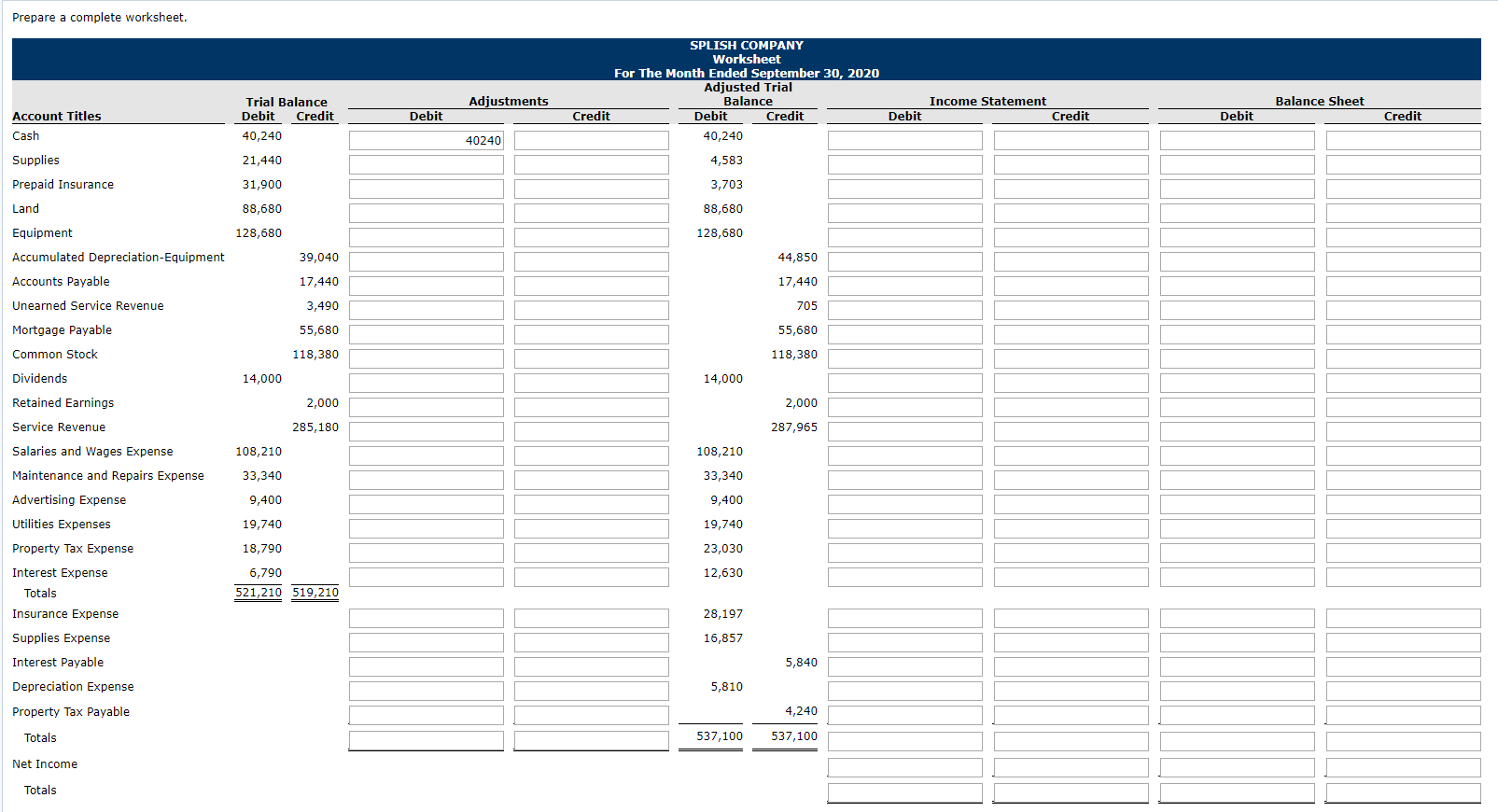

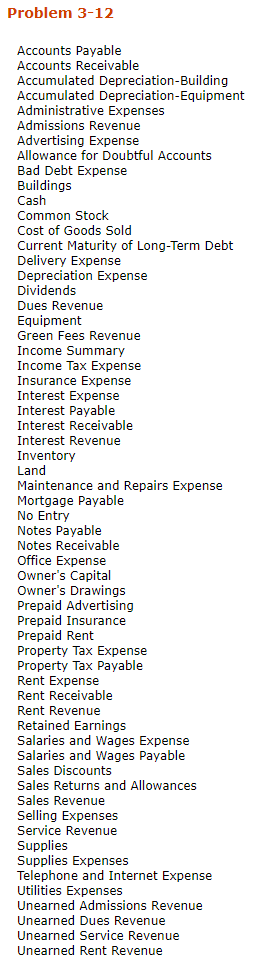

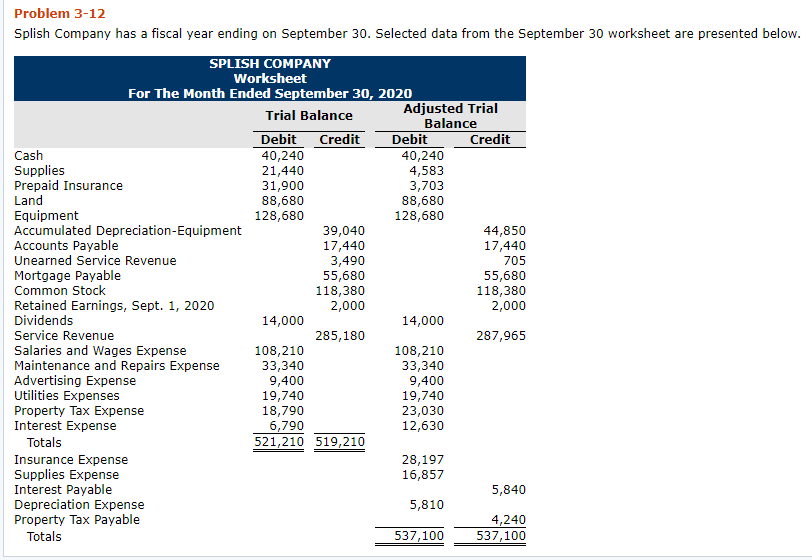

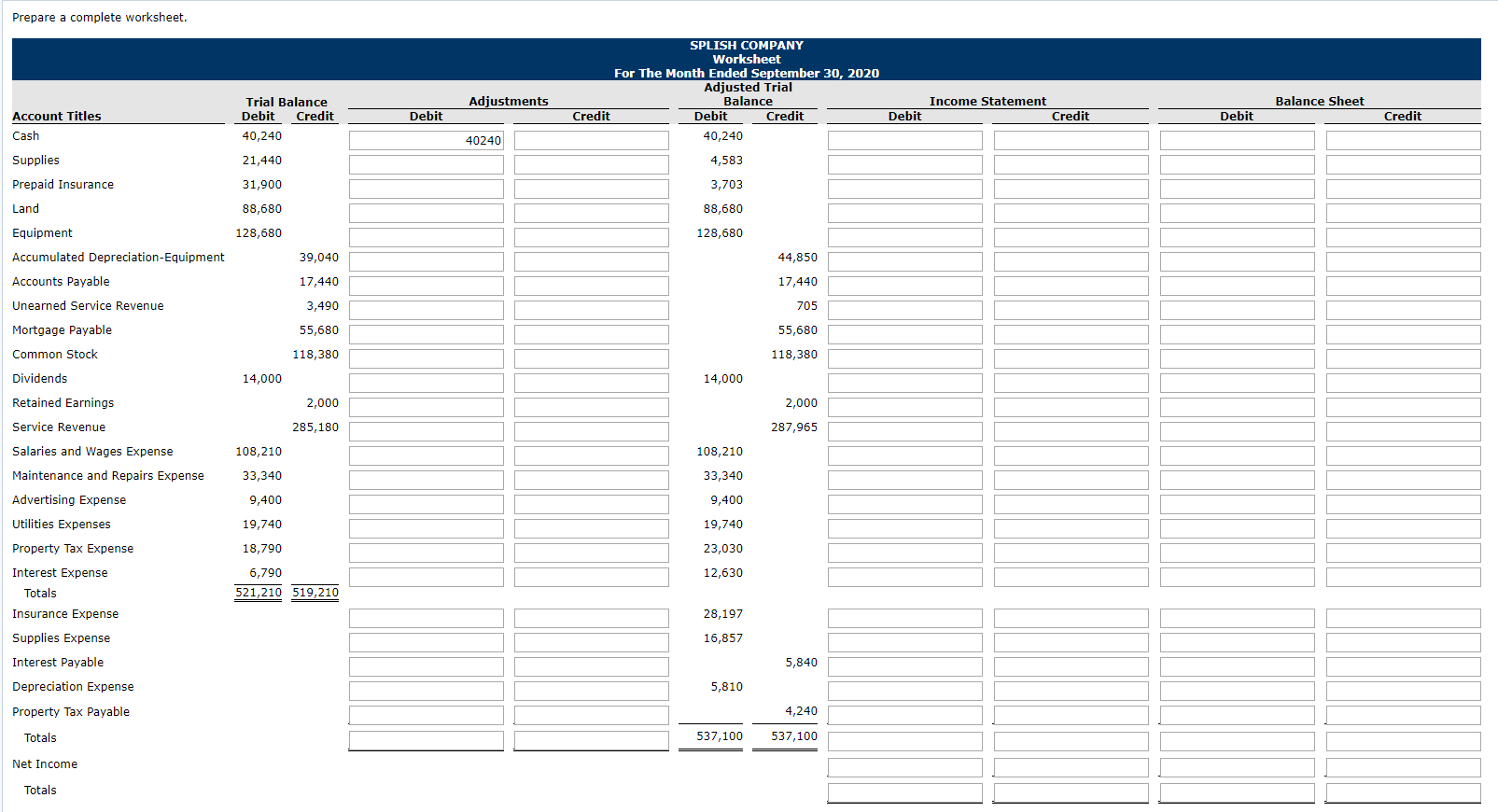

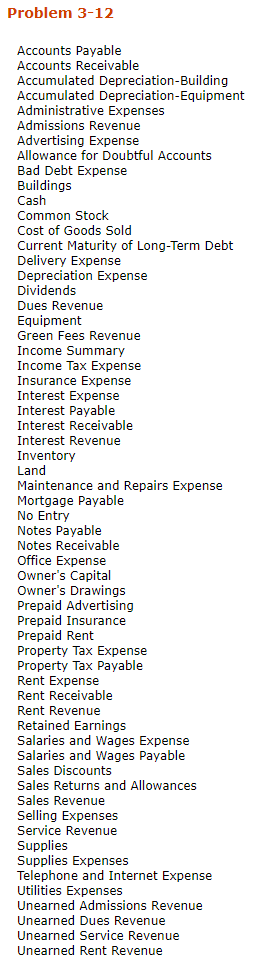

Problem 3-12 Splish Company has a fiscal year ending on September 30. Selected data from the September 30 worksheet are presented below. SPLISH COMPANY Worksheet For The Month Ended September 30, 2020 Adjusted Trial Trial Balance Balance Debit Credit Debit Credit Cash 40,240 40,240 Supplies 21,440 4,583 Prepaid Insurance 31,900 3,703 Land 88,680 88,680 Equipment 128,680 128,680 Accumulated Depreciation Equipment 39,040 44,850 Accounts Payable 17,440 17,440 Unearned Service Revenue 3,490 705 Mortgage Payable 55,680 55,680 Common Stock 118,380 118,380 Retained Earnings, Sept. 1, 2020 2,000 2,000 Dividends 14,000 14,000 Service Revenue 285,180 287,965 Salaries and Wages Expense 108,210 108,210 Maintenance and Repairs Expense 33,340 33,340 Advertising Expense 9,400 9,400 Utilities Expenses 19,740 19,740 Property Tax Expense 18,790 23,030 Interest Expense 6,790 12,630 Totals 521,210 519,210 Insurance Expense 28,197 Supplies Expense 16,857 Interest Payable 5,840 Depreciation Expense 5,810 Property Tax Payable 4,240 Totals 537,100 537,100 Prepare a complete worksheet. Adjustments Balance Sheet Trial Balance Debit Credit 40,240 Account Titles Income Statement Credit Debit SPLISH COMPANY Worksheet For The Month Ended September 30, 2020 Adjusted Trial Balance Credit Debit Credit Debit 40,240 4,583 3,703 Debit Credit Cash 40240 21,440 Supplies Prepaid Insurance 31,900 Land 88,680 88,680 128,680 128,680 44,850 17,440 Equipment Accumulated Depreciation Equipment Accounts Payable Unearned Service Revenue Mortgage Payable Common Stock Dividends 705 55,680 118,380 14,000 39,040 17,440 3,490 55,680 118,380 14,000 2,000 285,180 108,210 33,340 9,400 19,740 Retained Earnings 2,000 287,965 Service Revenue Salaries and Wages Expense 108,210 Maintenance and Repairs Expense 33,340 Advertising Expense 9,400 Utilities Expenses 19,740 Property Tax Expense 18,790 23,030 12,630 Interest Expense Totals Insurance Expense 6,790 521,210 519,210 28,197 16,857 Supplies Expense 5,840 5,810 Interest Payable Depreciation Expense Property Tax Payable Totals 4,240 537,100 537,100 Net Income Totals Problem 3-12 Accounts Payable Accounts Receivable Accumulated Depreciation-Building Accumulated Depreciation-Equipment Administrative Expenses Admissions Revenue Advertising Expense Allowance for Doubtful Accounts Bad Debt Expense Buildings Cash Common Stock Cost of Goods Sold Current Maturity of Long-Term Debt Delivery Expense Depreciation Expense Dividends Dues Revenue Equipment Green Fees Revenue Income Summary Income Tax Expense Insurance Expense Interest Expense Interest Payable Interest Receivable Interest Revenue Inventory Land Maintenance and Repairs Expense Mortgage Payable No Entry Notes Payable Notes Receivable Office Expense Owner's Capital Owner's Drawings Prepaid Advertising Prepaid Insurance Prepaid Rent Property Tax Expense Property Tax Payable Rent Expense Rent Receivable Rent Revenue Retained Earnings Salaries and Wages Expense Salaries and Wages Payable Sales Discounts Sales Returns and Allowances Sales Revenue Selling Expenses Service Revenue Supplies Supplies Expenses Telephone and Internet Expense Utilities Expenses Unearned Admissions Revenue Unearned Dues Revenue Unearned Service Revenue Unearned Rent Revenue