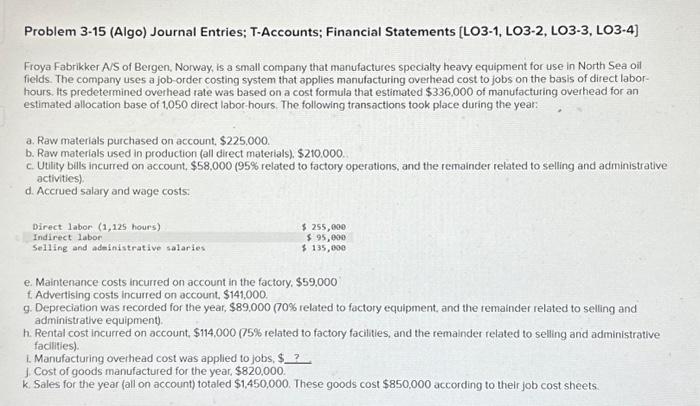

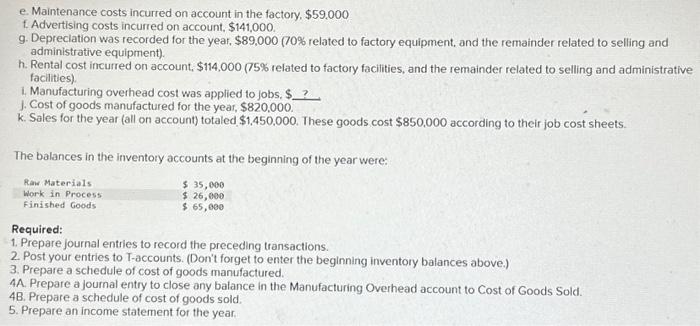

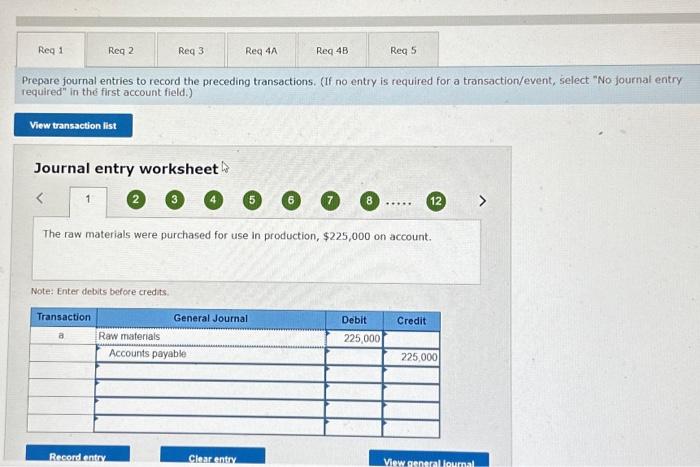

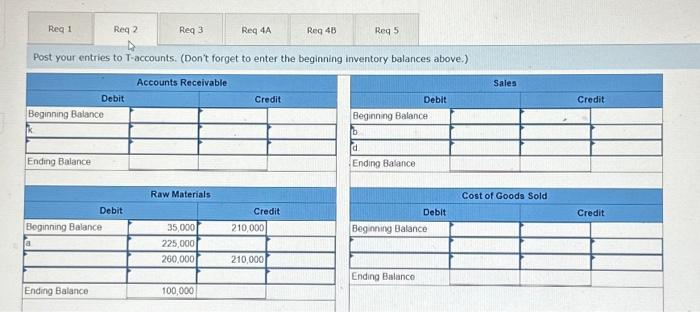

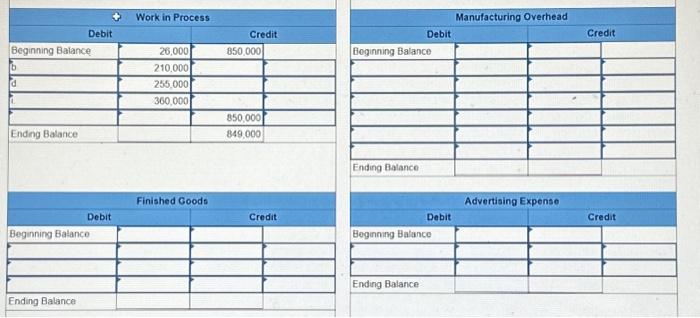

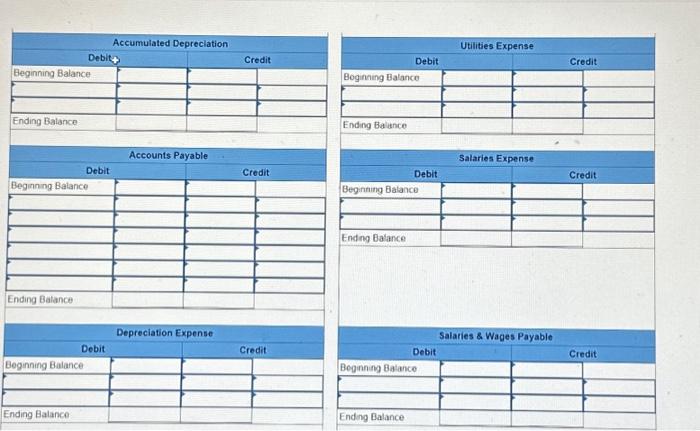

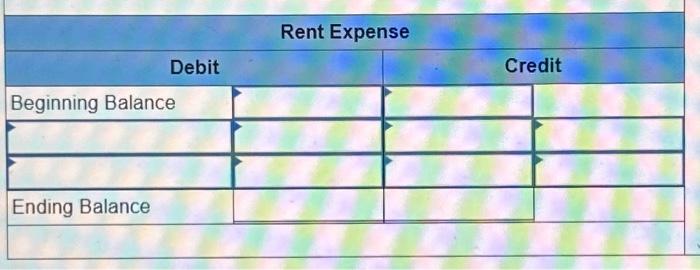

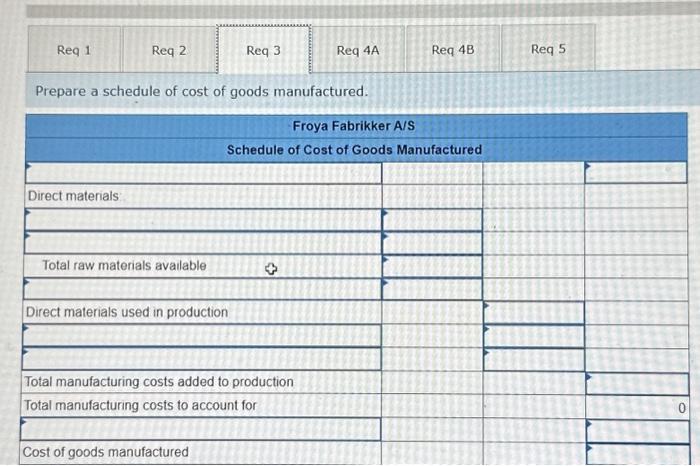

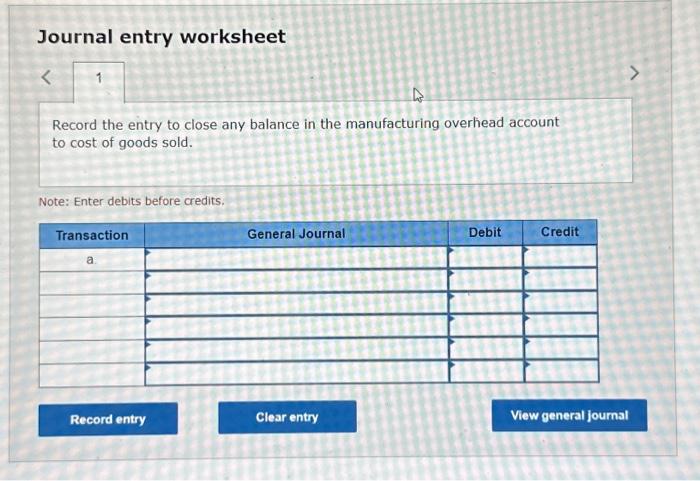

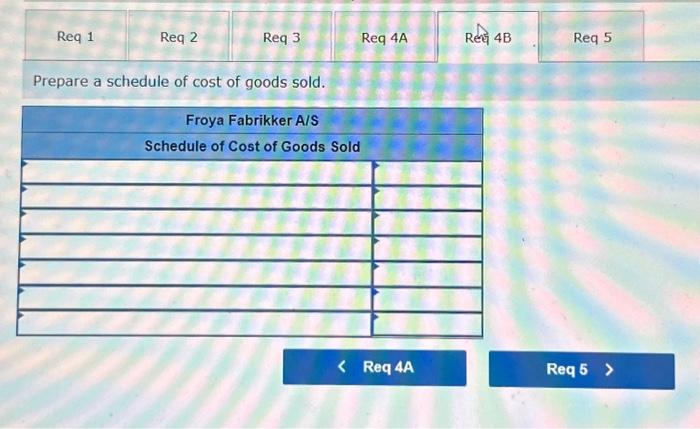

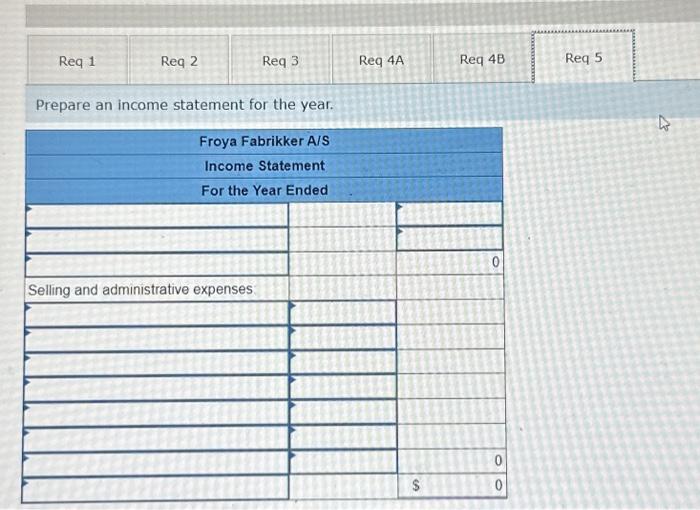

Problem 3-15 (Algo) Journal Entries; T-Accounts; Financial Statements [LO3-1, LO3-2, LO3-3, LO3-4] Froya Fabrikker A/S of Bergen, Norway, is a small company that manufactures specialty heavy equipment for use in North Sea oil fields. The company uses a job-order costing system that applies manufacturing overhead cost to jobs on the basis of direct laborhours. Its predetermined overhead rate was based on a cost formula that estimated $336,000 of manufacturing overhead for an estimated allocation base of 1.050 direct labor-hours. The following transactions took place during the year: a. Raw materials purchased on account, $225,000. b. Raw materials used in production (all direct materials), $210.000. c. Utility bills incurred on account, $58,000 (95\% related to factory operations, and the remainder related to selling and administrative activities) d. Accrued salary and wage costs. e. Maintenance costs incurred on account in the factory. $59,000 t. Advertising costs incurred on account, $141,000. 9. Depreciation was recorded for the year, $89,000,70% related to factory equipment, and the remainder related to selling and administrative equipment) h. Rental cost incurred on account, $114,000 (75\% related to factory facilities, and the remainder related to selling and administrative facilities). L. Manufacturing overhead cost was applied to jobs, $ ? 1. Cost of goods manufactured for the year, $820,000. k. Sales for the year (all on account) totaled $1,450,000. These goods cost $850,000 according to their job cost sheets e. Maintenance costs incurred on account in the factory, $59.000 t. Advertising costs incurred on account, $141,000. 9 . Depreclation was recorded for the year, $89,000 (70\% related to factory equipment, and the remainder related to selling and administrative equipment). h. Rental cost incurred on account, $114,000 (75\% related to factory facilities, and the remainder related to selling and administrative facilities). 1. Manufacturing overhead cost was applied to jobs, $ ? 1. Cost of goods manufactured for the year, $820,000. k. Sales for the year (all on account) totaled $1,450,000. These goods cost $850,000 according to their job cost sheets. The balances in the inventory accounts at the beginning of the year were: Required: 1. Prepare journal entries to record the preceding transactions. 2. Post your entries to T-accounts. (Don't forget to enter the beginning inventory balances above.) 3. Prepare a schedule of cost of goods manufactured. 4A. Prepare a journal entry to close any balance in the Manufacturing Overhead account to Cost of Goods Sold. 4B. Prepare a schedule of cost of goods sold. 5. Prepare an income statement for the year. Prepare journal entries to record the preceding transactions. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet The raw materials were purchased for use in production, $225,000 on account. Note: Enter debits before credits. Post your entries to T-accounts. (Don't forget to enter the beginning inventory balances above.) Rent Expense \begin{tabular}{|l|l|l|l|} \hline \multicolumn{2}{|c|}{ Debit } & \multicolumn{2}{c|}{ Credit } \\ \hline Beginning Balance & & & \\ \hline & & & \\ \hline & & & \\ \hline Ending Balance & & & \\ \hline & & \\ \hline \end{tabular} Prepare a schedule of cost of goods manufactured. Journal entry worksheet Record the entry to close any balance in the manufacturing overhead account to cost of goods sold. Note: Enter debits before credits. Prepare a schedule of cost of goods sold. Prepare an income statement for the year