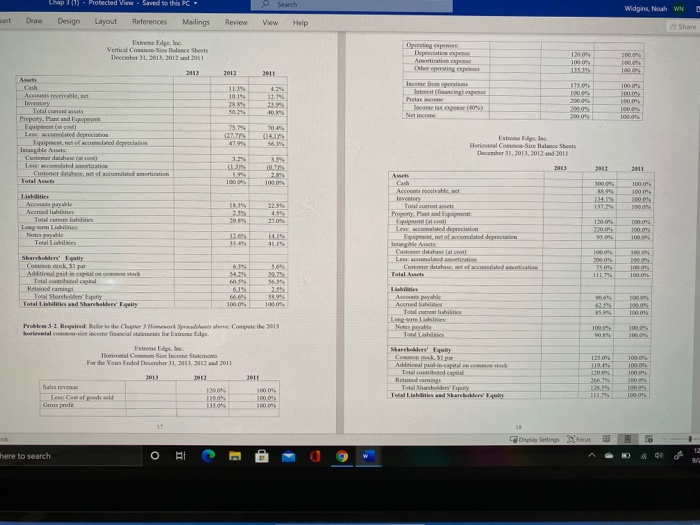

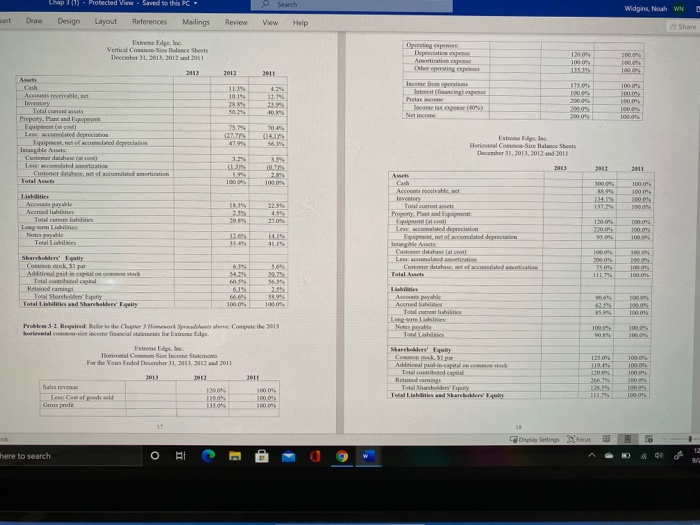

problem 3-2. please answer inside a chart

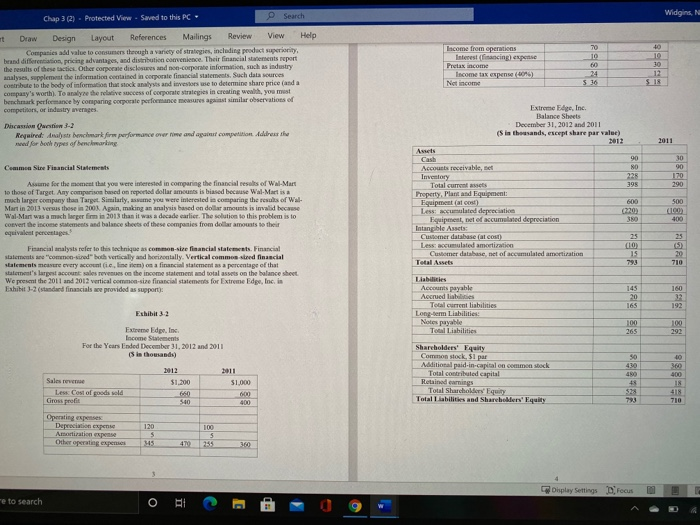

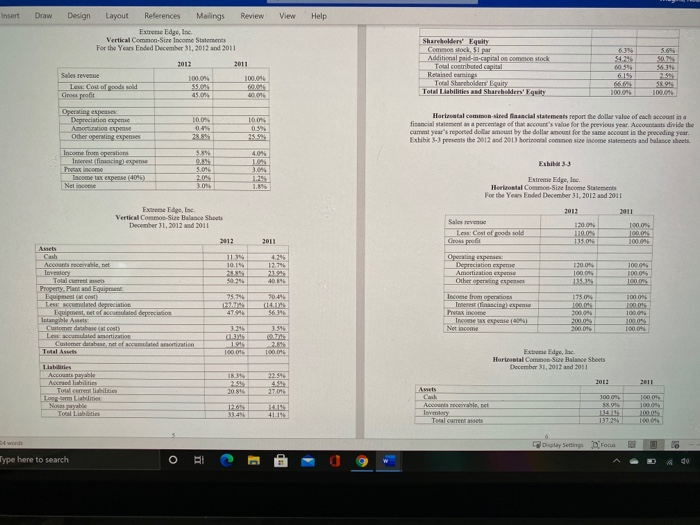

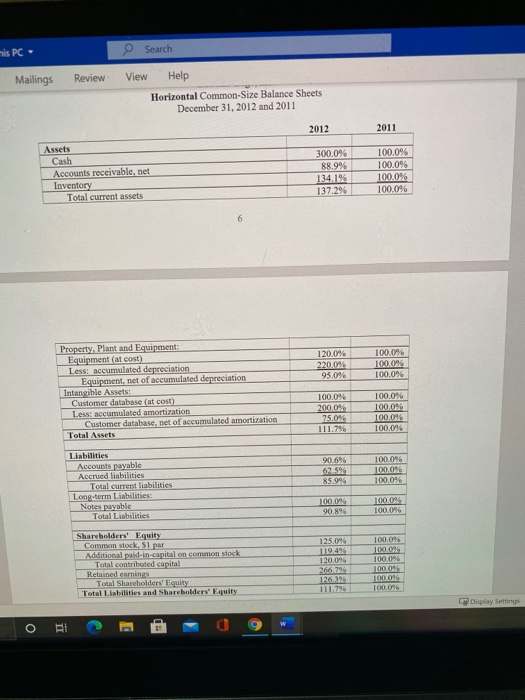

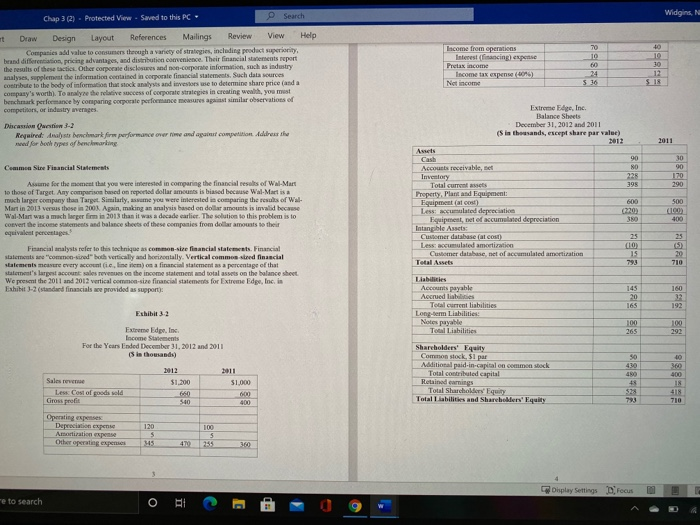

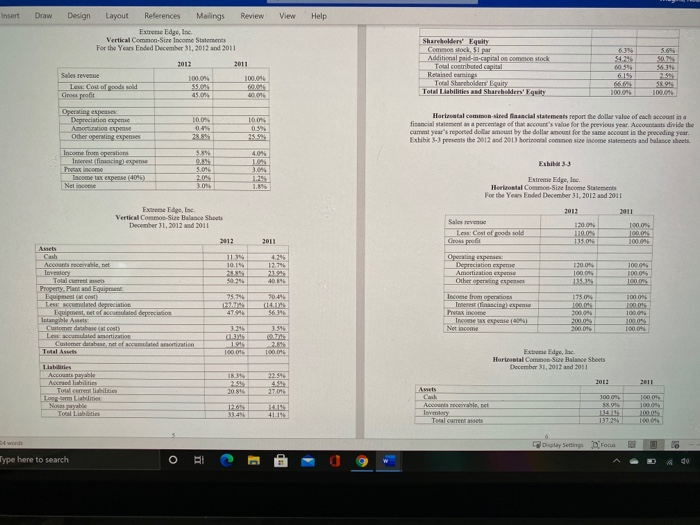

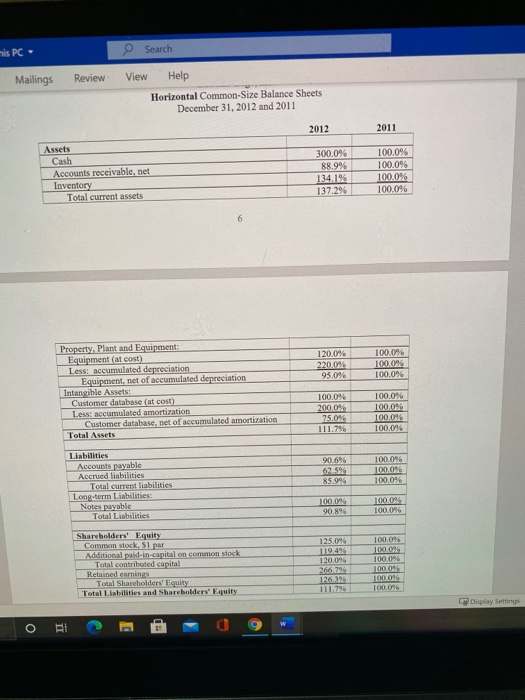

Chap 30) - Protected View - Saved to this PC Widgins, Noah WN sent Draw Design Layout References Mailings Review View Help Share Extreme Fine Vertical wire balance Sheets December 31, 2013 2012 2011 Depois expense Amortation expert DOOR 1000 1000 13519 2013 2012 ITS 100 1000 4.2% 12. 10.19 Incontro sporto Interest (financing expense Tore (809) Netice 1000 TODO 100.0% 10.89 30.2% 7047 Accounts receive act Invey Total Property Plantander Equipment Les clared deprecia Prince nel frated depresite Intangible Art Customer Les colori Cartes de calated amortiration Total Auto 56.3% Ext Horial Cosure Balance Shots December 11, 2011, 2012 and 2011 2011 100.0 100.0% Accounts receivable, et 1000 1000 1000 1000 22:55 1372 20.8% 27.09 1200 Total.com Property. Pland Equipment: E. Les med den Equipment, et cumulated deprecation Intangi Art 100.0% 100 UN Account Accred liabilities Total current abilities Long-Las Notes able Total Lilies Shareholders' quity Convock, 31 par Arial pagal Total cap Reincaming Teal Share Totalled Shareholders' Equity Lewed Customer database, not of accumulated mic Total Awards TON 2000 25.01 TIL 100 50 06 1000 1000 1000 Accounts payable Accredi Taalamat liabilities Nosyal Talabilities Problem 3-2. Required: Refer to the Chapter 3 Nombork Spreadsheets above. Compute the 2013 1000 O. 1000 Extreme Horizontal Commen Sie incene su For the Year Ended Dewji, 2003, 2013 and 2011 1250 100 Comes Additional pidin capitales comune Totalcore capital Reid aming Total Sharquity Total Lased barebbers Fuity 1200 1467 100 MO 1200 111.7% 1000's Les Could Grouprot 135.0 1000% 100034 17 Display Settings focus BE here to search o E . 9 12 972 Widgins, N Chap 32). Protected ViewSaved to this PC- Search at Draw Design Layout References Mailings Review View Help Companies and value to consumers through a variety of strategies, including product superiority, brand differentiation, pricing advantages, and distribution cervenience. Their financial statements report the results of these acties. Other corporate discloses and non-corporate information, such as industry analyses, supplement the informatica contained in corporate financial statements such data sources contribute to the body of information that stock analysts and investors use to determine share price and a company's worth). To analyze the relative success of corporate vir tegies in creating wealth, you must benchmark performance by comparing corporate performance measures against similar observations of competitors, or industry averages Discussion west 3-2 Required: Anastachmark for performance over and agaut compution Address wed for den per obenemarking Income from operations Interesting) expose Pretax income Income tax expense (2016) Nist income 70 10 60 14 5 36 40 10 10 12 2011 Commen Sie Financial Statements Extreme Edge, Inc Balance Sheets December 31, 2012 and 2011 (S in thousands, except share par value) 2012 Ants Cash 90 Accounts receivable, et NO Inventory 228 Total current assets 395 Property, plant and Iquipment: Equipment (ast) 600 Less: accumulated depreciation (220) Equipment, not of acumulated depreciation Intangible Assets Customer database (acou Less: accumulated amortization (10) Customer database, net of accumulated amortization 15 Total Assets 793 30 90 170 290 Asume for the moment that you were interested in comparing the financial results of WW-Mart to those of Target. Any comparison based on reported dollar amounts is biased because Wal-Mart is a much larger company than Target. Similarly, assume you were interested in comparing the results of Wal- Martin 2013 versus these in 2003. Again, making an analysis based on dollar amounts is invalid because Wal-Mart was a much larger firm in 2013 than it was a decade earlier. The solution to this problem is to convert the income statements and balance sheets of these companies from dollar amounts to their equivalent percentages Financial analysts refer to this technique as common-size financial statements Financial statements are common-sired" both vertically and horizontally. Vertical common stred financial statements mare every account (ic, line item) a financial statement as a percentage of that statement's largest account sales revenues on the income statement and total assets on the balance sheet We present the 2011 and 2012 vertical common-size financial statements for Extreme Edge, Inc. in Exhibit-2 (standard financials are provided as support: 500 (100) 400 (15 710 Liabilities Accounts payable Accrued its Total current liabilities Long-term Liabilities Notes payable Total Liabilities 145 20 165 180 22 192 Exhibit 32 Extreme Edge, Inc Income Statements For the Year Ended December 31, 2012 and 2011 is a thousands) 100 265 100 292 30 2011 $1.000 Shareholders' Equity Common stock, 51 par Additional paid-in-capital on emmen ock Total contributed capital Retained earnings Total Shareholders' Equity Total Ilabilities and Sharehors' quity 2012 $1.200 660 500 480 +8 Sales reve Less Cost of goods sold Gross profis 400 IS 418 710 400 793 Depreciation expense Amortization expense Other operating expenses 120 5 345 100 5 25 470 300 Display Settings Focus me to search O Ali E Insert Draw View Help Design Layout References Mailings Review Extreme Edge, Inc Vertical Commo-Size Income Statements For the Years Ended December 31, 2012 and 2011 2012 2011 Sales revence 100.0% 100.016 Less: Cost of goods sold 55.4 45.0 30016 Shareholders' Equity Como stock, par Additional paid in-capital on common stock Total contributed capital Reedings To Shareholders' Equity Total Liabilities and Shareholders' quity 5.65 50,79 54.46 6055 2.595 5894 1000 100% 049 Horizontal common indfancial statements report the dollar value of each accountina financial statement as a percentage of that account's value for the previous year. Accountants divide the current year's reported dollar amount by the dollar amount for the same account in the preceding year. Exhibit 3-3 presents the 2012 and 2013 horizontal common size income statements and balance sheets Operating expenses . Depreciation experie Amortion expense Other operating expenses Income from per Instancingo me Pretax income come lux, expense (406) Netice 3.046 2.046 3.0 4.0% 1. 3.06 1.29 1.896 Eshik 3.3 Extreme Edge, la Horizontal Commire Income Statements For the Year Ended December 31, 2012 and 2011 2012 2011 Extreme Inc Vertical Commoe Sue Balance Sheets December 31, 2012 and 2011 1000 Sales TV Le Cost of goods sold Cross profit HOON 135.00 100.096 Assets Cash Accounts receivable et 10.15 1000 Tester 12.7% 2191 40.6 1300 1000 135 50.246 100 ore 95.7% Operating expenses Depreciation experte Amortization Other operating expenses Income from operations Tofinancing op Pretax income Income tax exponi (0) Net income 175 1000 20.4% (14.17 56.346 Total current Property. Plant and Equipment: Equipes (al cost Less Cated depreciation Equipment set of counted depreciation Intangible Assets Customer carbonecos Les accumulated artition Customer databasenit of mediation Total Asus 47.94 2000 2000 200.046 100.0 1000% 1000 TAS 191 100.016 1000 ExtEdge, Horizontal Commen Size Balance Sheets December 31, 2012 and 2011 IR 34 23.16 Liabilities Accounts payable Accreditatis Total current liabilities Langarm La Notes yale Tool Lisbites 27.016 100 1000 Accountable 12.05 33.4% Total Tests 1372 24 words Display Settings Drocul Type here to search O BI de his PC- Search Mailings Review View Help Horizontal Common-Size Balance Sheets December 31, 2012 and 2011 2012 2011 Assets Cash Accounts receivable, net Inventory Total current assets 300,0% 88.9% 134.1% 137.29 100.0% 100.0% 100.0% 100.0% 6 120.096 220.0% 95.0% 100.096 100.00 100.0% Property. Plant and Equipment: Equipment (at cost) Less: accumulated depreciation Equipment, net of accumulated depreciation Intangible Assets: Customer database (at cost) Less: accumulated amortization Customer database, net of accumulated amortization Total Assets 100.0% 200.0% 75.0% 111.7% 100.0% 100.0% 100.0% 100.096 90.6 62.5% 85.996 Liabilities Accounts payable Accrued liabilities Total current liabilities Long-term Liabilities: Notes payable Total Liabilities 100.096 100.0% 100.0% 100.00 90.8% 100.0% 100.096 Shareholders' Equity Common stock, S1 par Additional paid-in-capital on common stock Total contributed capital Retained earnings Total Shareholders' Equity Total Liabilities and Shareholders' Equity 125.096 11949 120,096 266.796 126.95 111 796 100.096 100.0 100.046 10004 1000 100.0 Display Settings ELI Chap 30) - Protected View - Saved to this PC Widgins, Noah WN sent Draw Design Layout References Mailings Review View Help Share Extreme Fine Vertical wire balance Sheets December 31, 2013 2012 2011 Depois expense Amortation expert DOOR 1000 1000 13519 2013 2012 ITS 100 1000 4.2% 12. 10.19 Incontro sporto Interest (financing expense Tore (809) Netice 1000 TODO 100.0% 10.89 30.2% 7047 Accounts receive act Invey Total Property Plantander Equipment Les clared deprecia Prince nel frated depresite Intangible Art Customer Les colori Cartes de calated amortiration Total Auto 56.3% Ext Horial Cosure Balance Shots December 11, 2011, 2012 and 2011 2011 100.0 100.0% Accounts receivable, et 1000 1000 1000 1000 22:55 1372 20.8% 27.09 1200 Total.com Property. Pland Equipment: E. Les med den Equipment, et cumulated deprecation Intangi Art 100.0% 100 UN Account Accred liabilities Total current abilities Long-Las Notes able Total Lilies Shareholders' quity Convock, 31 par Arial pagal Total cap Reincaming Teal Share Totalled Shareholders' Equity Lewed Customer database, not of accumulated mic Total Awards TON 2000 25.01 TIL 100 50 06 1000 1000 1000 Accounts payable Accredi Taalamat liabilities Nosyal Talabilities Problem 3-2. Required: Refer to the Chapter 3 Nombork Spreadsheets above. Compute the 2013 1000 O. 1000 Extreme Horizontal Commen Sie incene su For the Year Ended Dewji, 2003, 2013 and 2011 1250 100 Comes Additional pidin capitales comune Totalcore capital Reid aming Total Sharquity Total Lased barebbers Fuity 1200 1467 100 MO 1200 111.7% 1000's Les Could Grouprot 135.0 1000% 100034 17 Display Settings focus BE here to search o E . 9 12 972 Widgins, N Chap 32). Protected ViewSaved to this PC- Search at Draw Design Layout References Mailings Review View Help Companies and value to consumers through a variety of strategies, including product superiority, brand differentiation, pricing advantages, and distribution cervenience. Their financial statements report the results of these acties. Other corporate discloses and non-corporate information, such as industry analyses, supplement the informatica contained in corporate financial statements such data sources contribute to the body of information that stock analysts and investors use to determine share price and a company's worth). To analyze the relative success of corporate vir tegies in creating wealth, you must benchmark performance by comparing corporate performance measures against similar observations of competitors, or industry averages Discussion west 3-2 Required: Anastachmark for performance over and agaut compution Address wed for den per obenemarking Income from operations Interesting) expose Pretax income Income tax expense (2016) Nist income 70 10 60 14 5 36 40 10 10 12 2011 Commen Sie Financial Statements Extreme Edge, Inc Balance Sheets December 31, 2012 and 2011 (S in thousands, except share par value) 2012 Ants Cash 90 Accounts receivable, et NO Inventory 228 Total current assets 395 Property, plant and Iquipment: Equipment (ast) 600 Less: accumulated depreciation (220) Equipment, not of acumulated depreciation Intangible Assets Customer database (acou Less: accumulated amortization (10) Customer database, net of accumulated amortization 15 Total Assets 793 30 90 170 290 Asume for the moment that you were interested in comparing the financial results of WW-Mart to those of Target. Any comparison based on reported dollar amounts is biased because Wal-Mart is a much larger company than Target. Similarly, assume you were interested in comparing the results of Wal- Martin 2013 versus these in 2003. Again, making an analysis based on dollar amounts is invalid because Wal-Mart was a much larger firm in 2013 than it was a decade earlier. The solution to this problem is to convert the income statements and balance sheets of these companies from dollar amounts to their equivalent percentages Financial analysts refer to this technique as common-size financial statements Financial statements are common-sired" both vertically and horizontally. Vertical common stred financial statements mare every account (ic, line item) a financial statement as a percentage of that statement's largest account sales revenues on the income statement and total assets on the balance sheet We present the 2011 and 2012 vertical common-size financial statements for Extreme Edge, Inc. in Exhibit-2 (standard financials are provided as support: 500 (100) 400 (15 710 Liabilities Accounts payable Accrued its Total current liabilities Long-term Liabilities Notes payable Total Liabilities 145 20 165 180 22 192 Exhibit 32 Extreme Edge, Inc Income Statements For the Year Ended December 31, 2012 and 2011 is a thousands) 100 265 100 292 30 2011 $1.000 Shareholders' Equity Common stock, 51 par Additional paid-in-capital on emmen ock Total contributed capital Retained earnings Total Shareholders' Equity Total Ilabilities and Sharehors' quity 2012 $1.200 660 500 480 +8 Sales reve Less Cost of goods sold Gross profis 400 IS 418 710 400 793 Depreciation expense Amortization expense Other operating expenses 120 5 345 100 5 25 470 300 Display Settings Focus me to search O Ali E Insert Draw View Help Design Layout References Mailings Review Extreme Edge, Inc Vertical Commo-Size Income Statements For the Years Ended December 31, 2012 and 2011 2012 2011 Sales revence 100.0% 100.016 Less: Cost of goods sold 55.4 45.0 30016 Shareholders' Equity Como stock, par Additional paid in-capital on common stock Total contributed capital Reedings To Shareholders' Equity Total Liabilities and Shareholders' quity 5.65 50,79 54.46 6055 2.595 5894 1000 100% 049 Horizontal common indfancial statements report the dollar value of each accountina financial statement as a percentage of that account's value for the previous year. Accountants divide the current year's reported dollar amount by the dollar amount for the same account in the preceding year. Exhibit 3-3 presents the 2012 and 2013 horizontal common size income statements and balance sheets Operating expenses . Depreciation experie Amortion expense Other operating expenses Income from per Instancingo me Pretax income come lux, expense (406) Netice 3.046 2.046 3.0 4.0% 1. 3.06 1.29 1.896 Eshik 3.3 Extreme Edge, la Horizontal Commire Income Statements For the Year Ended December 31, 2012 and 2011 2012 2011 Extreme Inc Vertical Commoe Sue Balance Sheets December 31, 2012 and 2011 1000 Sales TV Le Cost of goods sold Cross profit HOON 135.00 100.096 Assets Cash Accounts receivable et 10.15 1000 Tester 12.7% 2191 40.6 1300 1000 135 50.246 100 ore 95.7% Operating expenses Depreciation experte Amortization Other operating expenses Income from operations Tofinancing op Pretax income Income tax exponi (0) Net income 175 1000 20.4% (14.17 56.346 Total current Property. Plant and Equipment: Equipes (al cost Less Cated depreciation Equipment set of counted depreciation Intangible Assets Customer carbonecos Les accumulated artition Customer databasenit of mediation Total Asus 47.94 2000 2000 200.046 100.0 1000% 1000 TAS 191 100.016 1000 ExtEdge, Horizontal Commen Size Balance Sheets December 31, 2012 and 2011 IR 34 23.16 Liabilities Accounts payable Accreditatis Total current liabilities Langarm La Notes yale Tool Lisbites 27.016 100 1000 Accountable 12.05 33.4% Total Tests 1372 24 words Display Settings Drocul Type here to search O BI de his PC- Search Mailings Review View Help Horizontal Common-Size Balance Sheets December 31, 2012 and 2011 2012 2011 Assets Cash Accounts receivable, net Inventory Total current assets 300,0% 88.9% 134.1% 137.29 100.0% 100.0% 100.0% 100.0% 6 120.096 220.0% 95.0% 100.096 100.00 100.0% Property. Plant and Equipment: Equipment (at cost) Less: accumulated depreciation Equipment, net of accumulated depreciation Intangible Assets: Customer database (at cost) Less: accumulated amortization Customer database, net of accumulated amortization Total Assets 100.0% 200.0% 75.0% 111.7% 100.0% 100.0% 100.0% 100.096 90.6 62.5% 85.996 Liabilities Accounts payable Accrued liabilities Total current liabilities Long-term Liabilities: Notes payable Total Liabilities 100.096 100.0% 100.0% 100.00 90.8% 100.0% 100.096 Shareholders' Equity Common stock, S1 par Additional paid-in-capital on common stock Total contributed capital Retained earnings Total Shareholders' Equity Total Liabilities and Shareholders' Equity 125.096 11949 120,096 266.796 126.95 111 796 100.096 100.0 100.046 10004 1000 100.0 Display Settings ELI