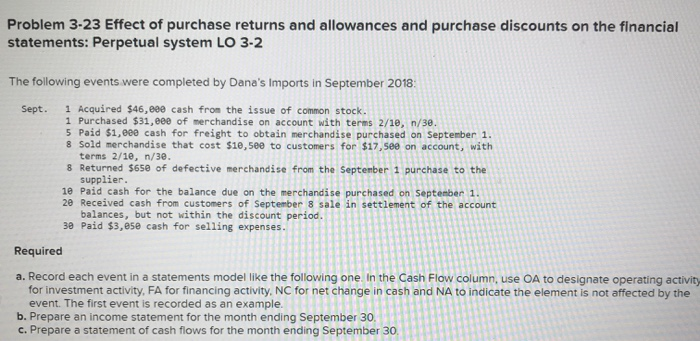

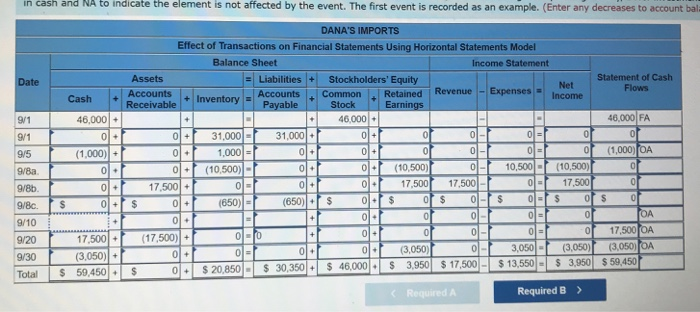

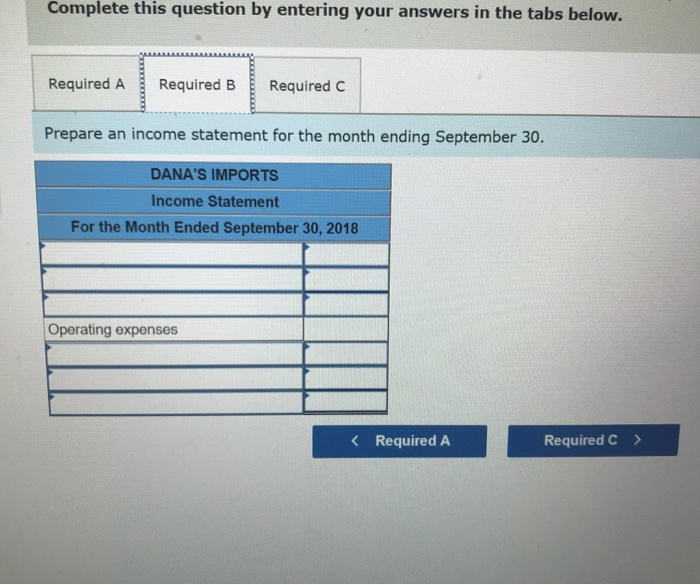

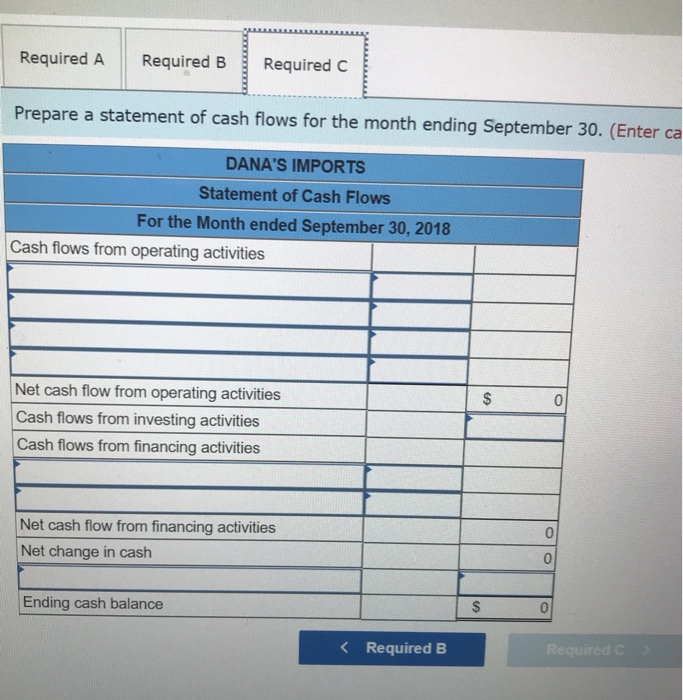

Problem 3-23 Effect of purchase returns and allowances and purchase discounts on the financial statements: Perpetual system LO 3-2 The following events were completed by Dana's Imports in September 2018: Sept. 1 Acquired $46,80e cash from the issue of common stock. 1 Purchased $31,000 of merchandise on account with terms 2/10, n/3e. 5 Paid $1,000 cash for freight to obtain merchandise purchased on September 1. 8 Sold merchandise that cost $1,500 to customers for $17,500 on account, with terms 2/10, n/30. 8 Returned $650 of defective merchandise from the September 1 purchase to the supplier. 1e Paid cash for the balance due on the merchandise purchased on September 1. 20 Received cash from customers of September 8 sale in settlement of the account balances, but not within the discount period. 30 Paid $3,ese cash for selling expenses. Required a. Record each event in a statements model like the following one in the Cash Flow column, use OA to designate operating activity for investment activity, FA for financing activity, NC for net change in cash and NA to indicate the element is not affected by the event. The first event is recorded as an example. b. Prepare an income statement for the month ending September 30. c. Prepare a statement of cash flows for the month ending September 30. Lasaru Maleate the element is not affected by the event. The first event is recorded as an example. (Enter any decreases to account bal Date Statement of Cash Flows Cash 9/1 46,000 FA 9/1 46,000+ 0+ (1,000) + 9/5 DANA'S IMPORTS Effect of Transactions on Financial Statements Using Horizontal Statements Model Balance Sheet Income Statement Assets = Liabilities - Stockholders' Equity Net Accounts le vent Accounts Common Retained Revenue - Expenses Receivable Income Payable Stock Earnings 46.000 0 0 0 - 0 0+ 0 0 - (10.500) 0+ (10,500)| 0- 17.500 0 17,500 17.500 - 0 16501 (650) 0$ 0f $ - $ 0 of ol (17,500) 0 0 o 0:1 (3,050) 0-1 3,050 - (3,050) $ 0 + $ 20,850 - $ 30,350 + $ 46,000 $ 3,950 $ 17,500 - $ 13,550 $ 3,950 9/B 10.500 9/8b 9/Bc. 9/10 17.500 9/20 9/30 Total 17,500 (3,050) + 59,450 + (3,050) $ 59,450 $ Required A Required B > Complete this question by entering your answers in the tabs below. Required A Required B Required Prepare an income statement for the month ending September 30. DANA'S IMPORTS Income Statement For the Month Ended September 30, 2018 Operating expenses Required A Required B Required C Prepare a statement of cash flows for the month ending September 30. (Enter ca DANA'S IMPORTS Statement of Cash Flows For the Month ended September 30, 2018 Cash flows from operating activities Net cash flow from operating activities Cash flows from investing activities Cash flows from financing activities Net cash flow from financing activities Net change in cash o Ending cash balance $ 0