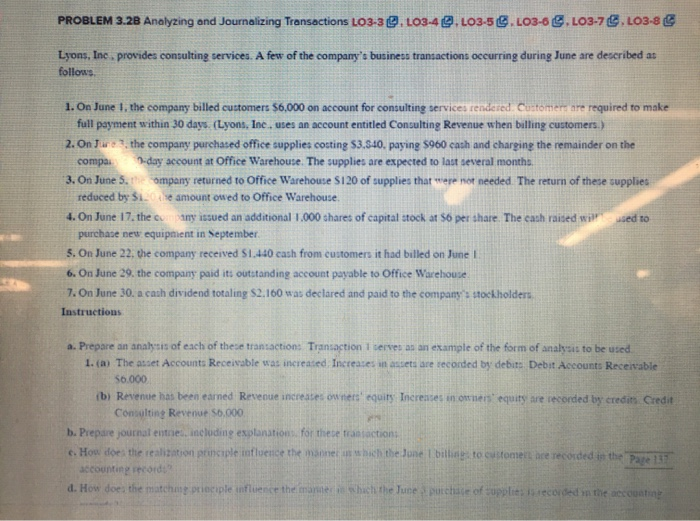

PROBLEM 3.28 Analyzing and Journalizing Transactions L03-3. 103-42.103.5 . L03-6 . LO3-7.L03-8 Lyons, Inc. provides consulting services. A few of the company's business transactions occurring during June are described as follows 1. On June 1, the company billed customers 56,000 on account for consulting services rendered. Customer are required to make full payment within 30 days. (Lyons, Inc. uses an account entitled Consulting Revenue when billing customers.) 2. On Jure the company purchased office supplies costing 53.540. paying 5960 cash and charging the remainder on the compai d ay account at Office Warehouse. The supplies are expected to last several months. 3. On June 5.: ompany returned to Office Warehouse S120 of supplies that were not needed. The return of these supplies reduced by Sie amount owed to Office Warehouse 4. On June 17, the any issued an additional 1.000 shares of capital stock at 56 per share. The cash raided will used to purchase new equipment in September 5. On June 22, the company received $1.440 cash from customers it had billed on June 6. On June 29. the company paid its outstanding account payable to Office Warehouse 7. On June 30, a cash dividend totaling $2.160 was declared and paid to the company's stockholders Instructions a. Prepare an analysis of each of these transactions Transaction terve as an example of the form of analysis to be used 1. ( The asset Accounts Receivable was increased. Increases in assets are recorded by debito Debit Accounts Receivable 56.000 b) Revenue has been earned Revenue increases ownerseguits Increases in one equity are recorded by credits Credit Convolting Revenue 50.000 b. Prepare journal entries, including explanation for these transactions c. How does the realization principle influence the one thich the one billing to customer are recorded in the Past accounting record d. How does the match principle influence the m edischichte une pr o f supplies to recorded in the counting PROBLEM 3.28 Analyzing and Journalizing Transactions L03-3. 103-42.103.5 . L03-6 . LO3-7.L03-8 Lyons, Inc. provides consulting services. A few of the company's business transactions occurring during June are described as follows 1. On June 1, the company billed customers 56,000 on account for consulting services rendered. Customer are required to make full payment within 30 days. (Lyons, Inc. uses an account entitled Consulting Revenue when billing customers.) 2. On Jure the company purchased office supplies costing 53.540. paying 5960 cash and charging the remainder on the compai d ay account at Office Warehouse. The supplies are expected to last several months. 3. On June 5.: ompany returned to Office Warehouse S120 of supplies that were not needed. The return of these supplies reduced by Sie amount owed to Office Warehouse 4. On June 17, the any issued an additional 1.000 shares of capital stock at 56 per share. The cash raided will used to purchase new equipment in September 5. On June 22, the company received $1.440 cash from customers it had billed on June 6. On June 29. the company paid its outstanding account payable to Office Warehouse 7. On June 30, a cash dividend totaling $2.160 was declared and paid to the company's stockholders Instructions a. Prepare an analysis of each of these transactions Transaction terve as an example of the form of analysis to be used 1. ( The asset Accounts Receivable was increased. Increases in assets are recorded by debito Debit Accounts Receivable 56.000 b) Revenue has been earned Revenue increases ownerseguits Increases in one equity are recorded by credits Credit Convolting Revenue 50.000 b. Prepare journal entries, including explanation for these transactions c. How does the realization principle influence the one thich the one billing to customer are recorded in the Past accounting record d. How does the match principle influence the m edischichte une pr o f supplies to recorded in the counting