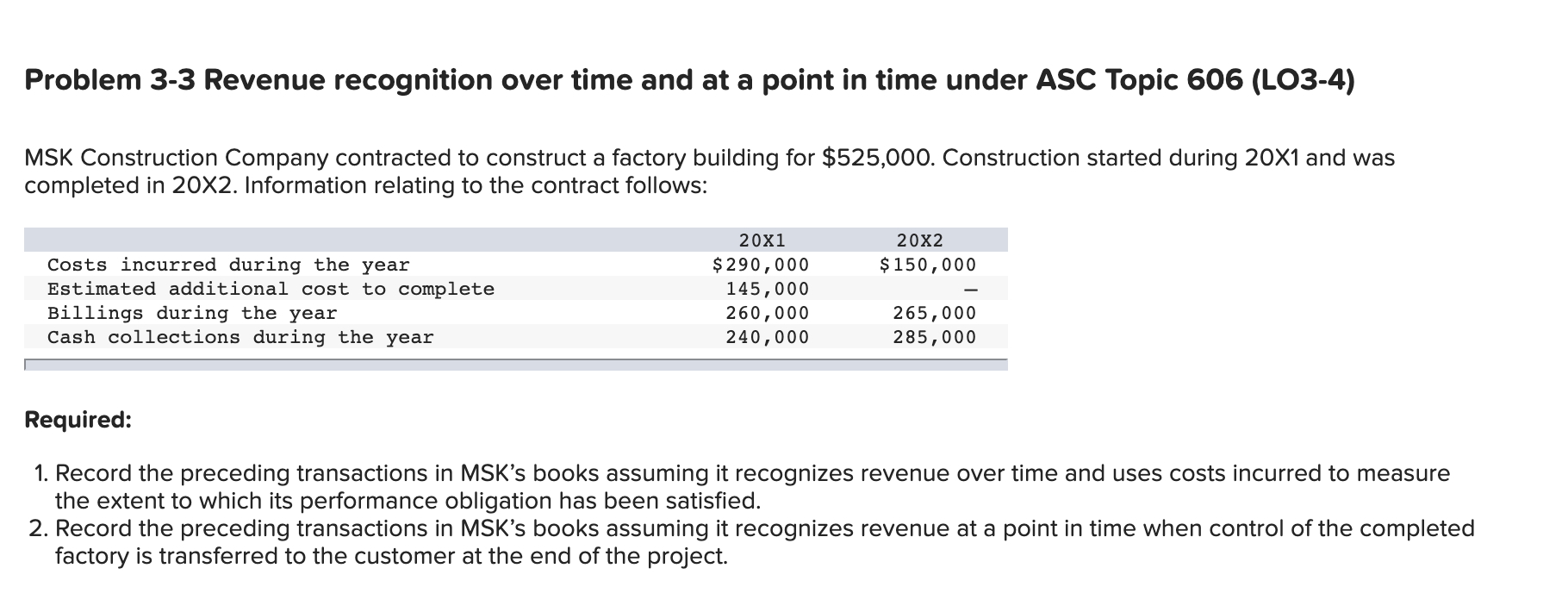

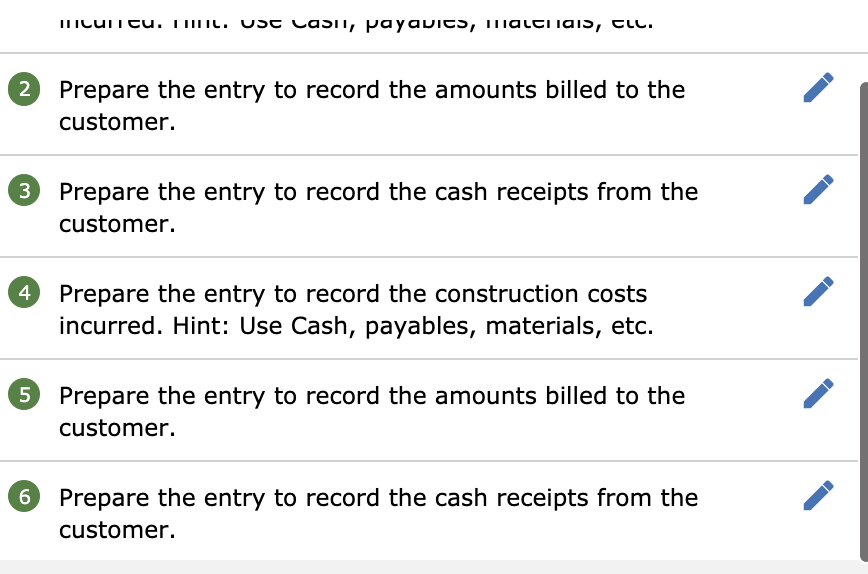

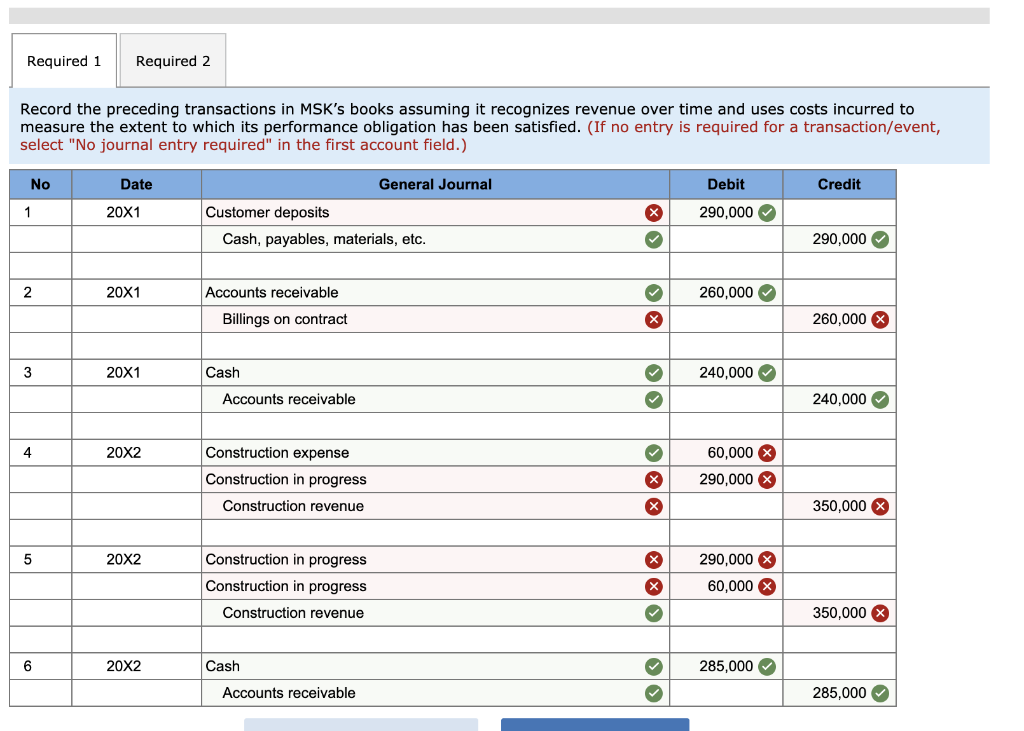

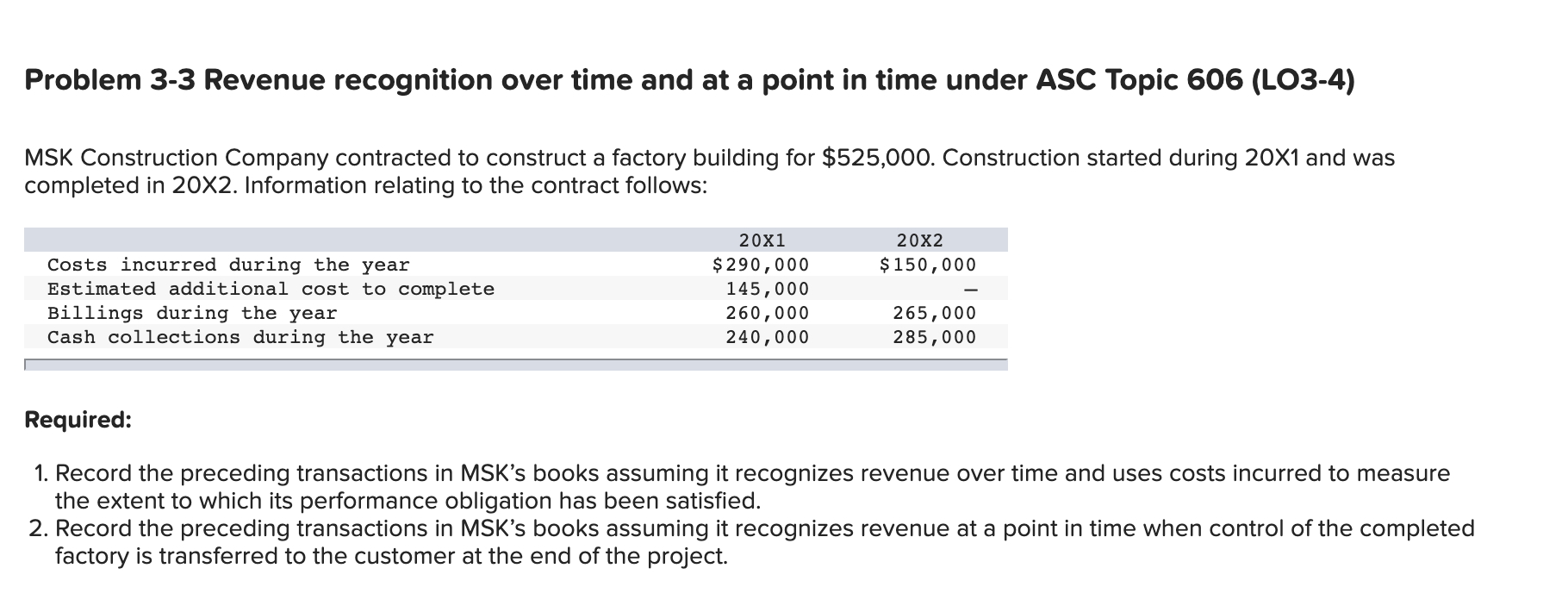

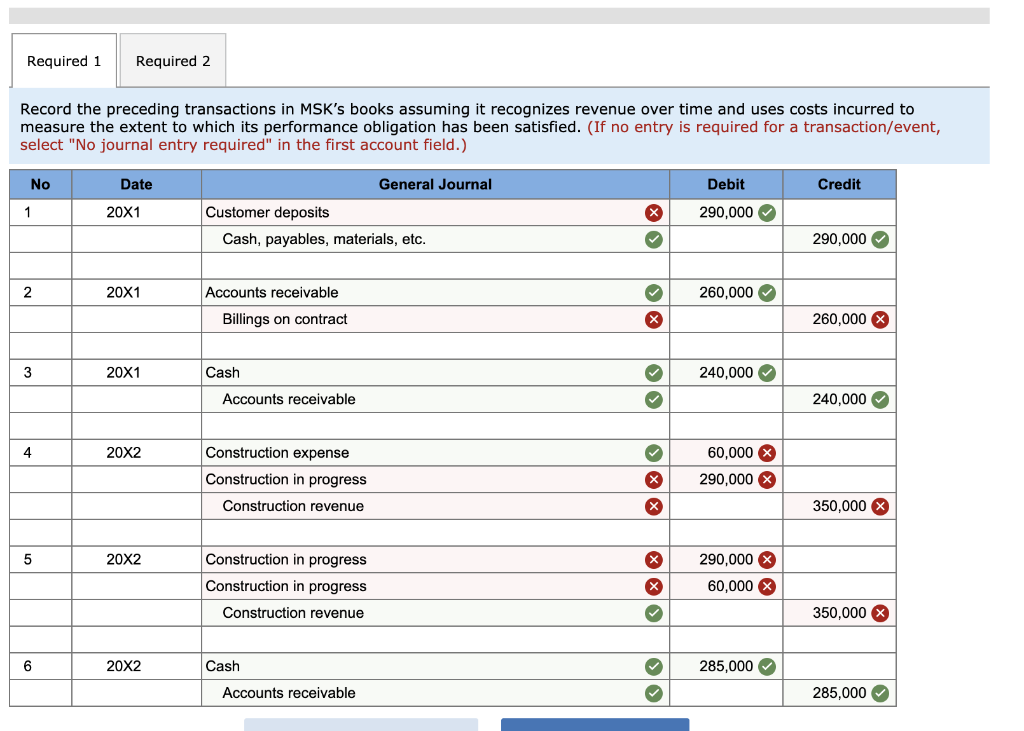

Problem 3-3 Revenue recognition over time and at a point in time under ASC Topic 606 (LO3-4) MSK Construction Company contracted to construct a factory building for $525,000. Construction started during 20X1 and was completed in 20X2. Information relating to the contract follows: 20x2 $ 150,000 Costs incurred during the year Estimated additional cost to complete Billings during the year Cash collections during the year 20x1 $ 290,000 145,000 260,000 240,000 265,000 285,000 Required: 1. Record the preceding transactions in MSK's books assuming it recognizes revenue over time and uses costs incurred to measure the extent to which its performance obligation has been satisfied. 2. Record the preceding transactions in MSK's books assuming it recognizes revenue at a point in time when control of the completed factory is transferred to the customer at the end of the project. InCunicu. LILIL. Usc casi, payavics, Haltiais, cll. 2 Prepare the entry to record the amounts billed to the customer. 3 Prepare the entry to record the cash receipts from the customer. 4 Prepare the entry to record the construction costs incurred. Hint: Use Cash, payables, materials, etc. 5 Prepare the entry to record the amounts billed to the customer. 6 Prepare the entry to record the cash receipts from the customer. Required 1 Required 2 Record the preceding transactions in MSK's books assuming it recognizes revenue over time and uses costs incurred to measure the extent to which its performance obligation has been satisfied. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) No Date General Journal Debit Credit 1 20X1 x 290,000 Customer deposits Cash, payables, materials, etc. 290,000 2 20X1 260,000 Accounts receivable Billings on contract X 260,000 X 3 20X1 Cash 240,000 Accounts receivable 240,000 4 20X2 Construction expense Construction in progress Construction revenue 60,000 X 290,000 X x x 350,000 $ 5 20X2 Construction in progress X 290,000 X Construction in progress X 60,000 X Construction revenue 350,000 6 20X2 Cash 285,000 Accounts receivable 285,000