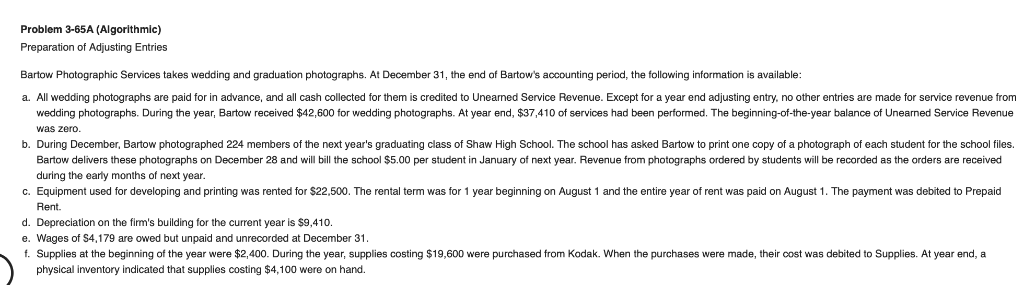

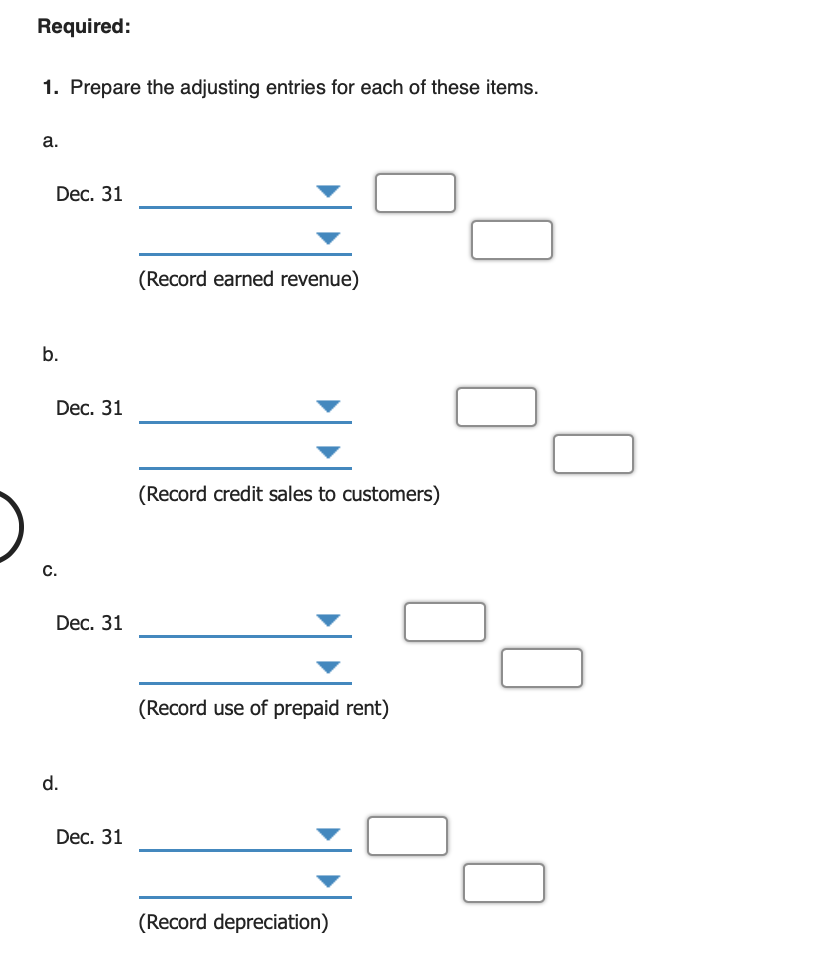

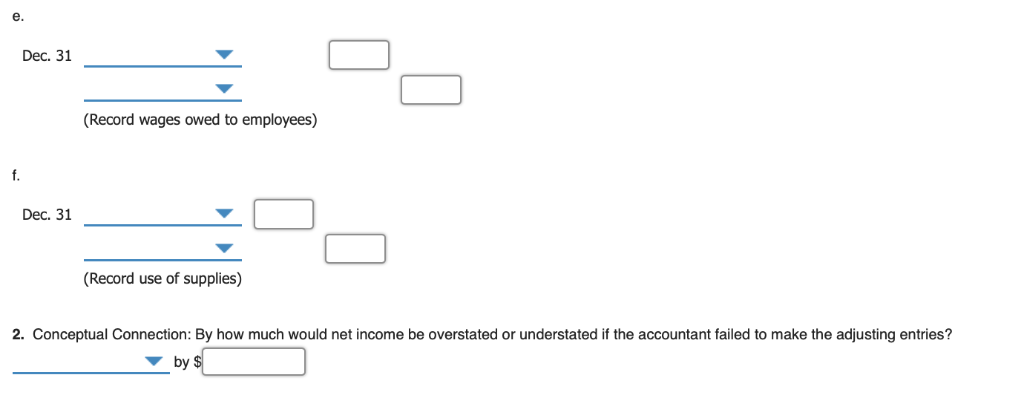

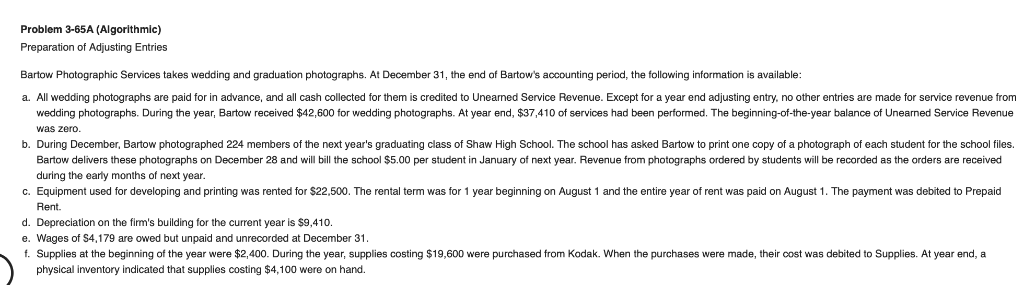

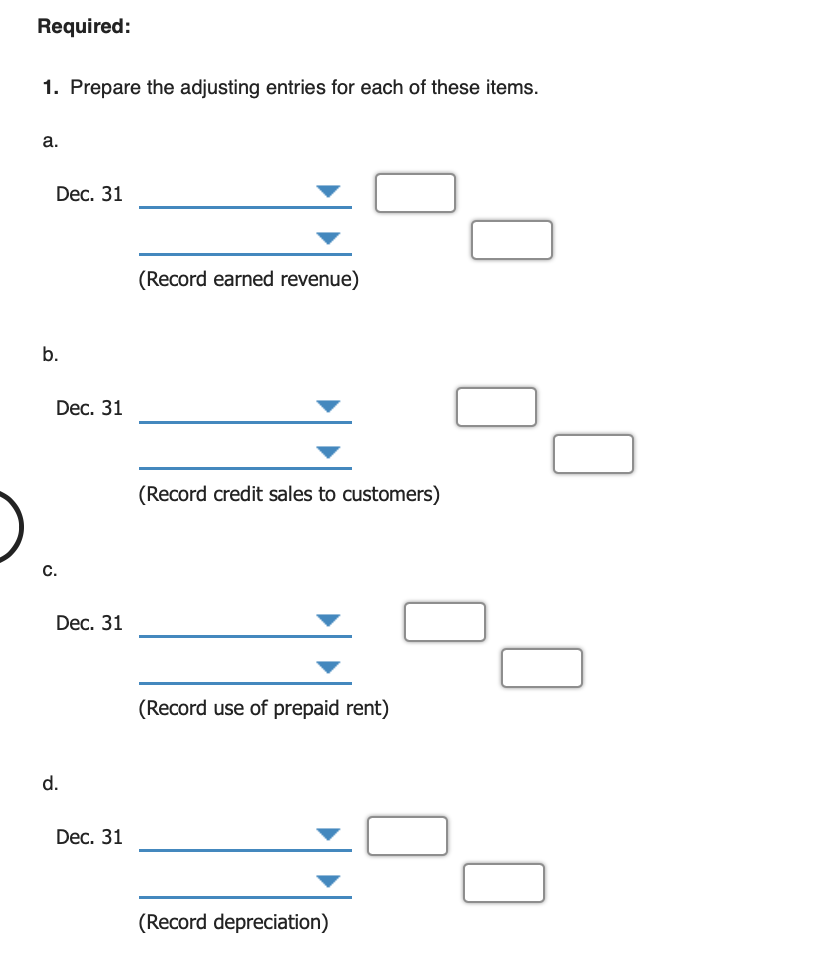

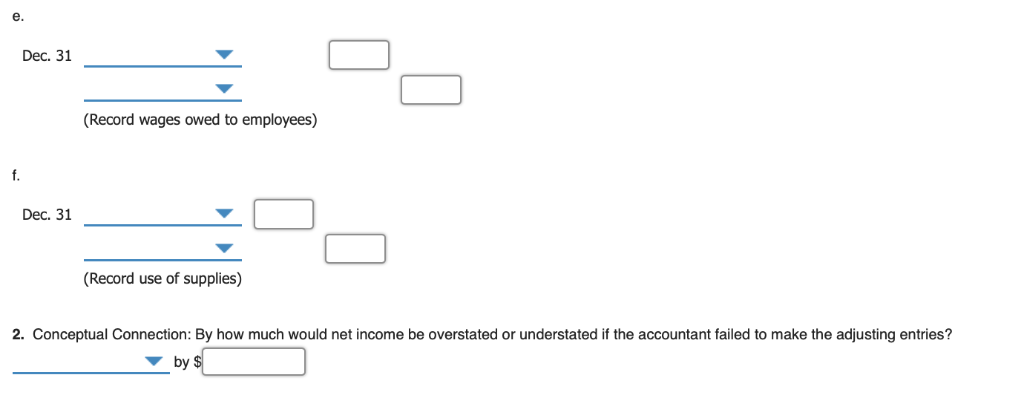

Problem 3-65A (Algorithmic) Preparation of Adjusting Entries Bartow Photographic Services takes wedding and graduation photographs. At December 31, the end of Bartow's accounting period, the following information is available: All wedding photographs are paid for in advance, and all cash collected for them is credited to Unearned Service Revenue. Except for a year end adjusting entry, no other entries are made for service revenue from wedding photographs. During the year, Bartow received $42,600 for wedding photographs. At year end, $37,410 of services had been performed. The beginning-of-the-year balance of Unearned Service Revenue was zero b. During December, Bartow photographed 224 members of the next year's graduating class of Shaw High School. The school has asked Bartow to print one copy of a photograph of each student for the school files. Bartow delivers these photographs on December 28 and will bill the school $5.00 per student in January of next year. Revenue from photographs ordered by students will be recorded as the orders are received during the early months of next year. c. Equipment used for developing and printing was rented for $22,500. The rental term was for 1 year beginning on August 1 and the entire year of rent was paid Rent d. Depreciation on the firm's building for the current year is $9,410, August 1. The payment was debited to Prepaid Wages of $4,179 are owed but unpaid and unrecorded at December 31. Supplies at the beginning of the year were $2,400. During the year, supplies costing $19,600 were purchased from Kodak. When the purchases were made,, their cost was debited Supplies. At year end, a physical inventory indicated that supplies costing $4,100 were on hand. Required: 1. Prepare the adjusting entries for each of these items. a. Dec. 31 (Record earned revenue) b. Dec. 31 (Record credit sales to customers) C. Dec. 31 (Record use of prepaid rent) d. Dec. 31 (Record depreciation) e. Dec. 31 (Record wages owed to employees) f. Dec. 31 (Record use of supplies) 2. Conceptual Connection: By how much would net income be overstated or understated if the accountant failed to make the adjusting entries? by $